From Job Loss to New Leadership: A Financial Roadmap for Executives in Transition

You never see it coming.

One moment, you’re leading meetings, finalizing strategic plans, preparing for next quarter. The next, you’re sitting in a conference room—or worse, on a video call—hearing words you’ll never forget: “Your role has been eliminated.”

You wonder, “How could this happen to me?”

The first wave is disbelief. The shock is immediate. Then fear. Then the sinking realization: you now have to explain this to your spouse, face your children, and figure out what’s next in a world that suddenly feels unrecognizable.

Take a deep breath.

Job loss—especially at the executive level—can feel like the floor has disappeared beneath you. But it’s also a powerful opportunity to reset, regroup, and rebuild something stronger. With the right plan, this disruption can become a catalyst for transformation – a launchpad for something better.

This roadmap is here to guide you through that process—step by step.

From Free Fall to Flight Plan: An Analogy for the Journey Ahead

Losing a job—especially as an executive—can feel like being suddenly ejected from a jet mid-flight. One moment, you’re moving fast and in control. The next, you’re spiraling through the air with no map, no warning, and no sense of where you’ll land.

It’s disorienting. It’s overwhelming. But just as a pilot turns to their training and mission control during a crisis, you need the right support team to help you stabilize, regain altitude, and chart a new course.

That’s what smart financial planning does during a career transition. It brings structure to the chaos, replaces fear with strategy, and transforms uncertainty into clear next steps.

At Gatewood, we serve as your mission control. We guide you through the turbulence, help you evaluate your options, and design a flight plan for the future. Instead of just surviving the transition, you rise from it—with clarity, lift, and forward momentum.

Avoid Common Mistakes: Lessons From the Field

We’ve worked with many executives through transitions. Here are some of the most common (and costly) missteps we’ve seen:

- Exercising stock options without tax modeling – leading to large, unexpected tax bills.

- Missing plan deadlines – forfeiting non-qualified benefits or accelerated RSU payouts.

- Underestimating liquidity needs – forcing early withdrawals or high-interest borrowing.

- Failing to secure interim insurance – resulting in gaps in medical or life coverage.

- Accepting a new offer based on salary alone – overlooking equity, benefits, or tax structure.

Navigating job loss as an executive isn’t just about making a few quick decisions—it’s about managing a complex web of financial, professional, and personal changes, often under pressure.

The Four Phase Process

That’s why we break the process into four structured phases:

- Triage

- Exploration

- Evaluation

- Integration

Each step is designed to bring order to the chaos, helping you move from immediate uncertainty to long-term clarity. This isn’t just theory—it’s a practical framework that puts you back in control and positions you for what’s next.

This roadmap exists to help you avoid those traps—and make each decision with confidence.

Phase One: Financial Triage & Stabilization

This is your moment of pause—your chance to stabilize and breathe.

Emotions are high, and there are real financial decisions that must be made quickly and carefully. The goal here is control, clarity, and cash flow.

Gatewood’s Role:

Think of Gatewood as your Financial First Responder, bringing calm, clarity, and order when things feel uncertain. We then stay by your side, as your personal CFO, turning crisis into strategy.

We help you prioritize, analyze, and act with purpose—so you’re not making rushed or emotional decisions with long-term consequences. The key steps are as follow:

Evaluate Your Severance Package Thoroughly:

Unpacking your separation agreement helps you avoid missed opportunities and surprises: Is compensation a lump sum or salary continuation?

- What’s the timeline on COBRA, life, and disability insurance?

- Are bonuses, RSUs, or equity awards still payable or forfeited?

- What are your response deadlines—some are within 60–90 days?

Handle Your Retirement Accounts with Intention:

Avoid triggering taxes or penalties by proactively managing your retirement accounts:

- Explore 401(k) rollover options for greater control and investment flexibility.

- Strategically time non-qualified deferred comp distributions.

- Consolidate legacy IRAs or pensions for simplicity and oversight.

Stock Options & Equity Compensation Decisions:

Stock options can become worthless—or cost you more than you gain—if mismanaged:

- Review vesting schedules and expiration dates to avoid forfeiting unexercised stock options.

- Understand the tax treatment differences between ISOs and NSOs, including exposure to AMT and ordinary income tax.

- Model exercise strategies—including early exercise or deferral options—to optimize timing and minimize tax liability.

Cash Flow & Liquidity Management:

Make sure your financial runway is long enough to give you breathing room:

- Inventory current savings, cash reserves, and near-term liabilities.

- Adjust household budget realistically—avoid panic cuts.

- Reassess and align your investment allocation with your new risk profile.

Close the Insurance Gaps:

Losing employer coverage can leave you exposed:

- Compare COBRA, private marketplace, or spousal medical insurance coverage.

- Replace life and disability coverage if lost with employment.

- Consider supplemental coverage if you’re transitioning to self-employment or entrepreneurial efforts.

This phase is about building a financial runway. When done right, it gives you the time and space to thoughtfully plan your next chapter.

Gatewood helps you triage decisions, organize your financial picture, and build a plan that keeps your options open. You’ll walk away from Phase One with a roadmap, not just a list of to-dos.

Phase Two: Exploring What’s Next

Stabilized? Good. Now let’s look forward.

You may not know your next role yet—but that doesn’t mean you can’t plan. In fact, this is the perfect time to explore options and model scenarios that inform your future path.

Whether you plan to rejoin the corporate world, launch your own venture, or pursue consulting, each path requires its own set of decisions and financial assumptions.

What Path Are You Considering?

Each of the following directions carries distinct income variability, tax consequences, and risk dynamics. We help you pressure-test what each would mean for your financial future:

- Traditional Executive Role – Return to a leadership role within a company, often with relocation, equity, or bonus incentives to evaluate.

- Consulting or Contract Work – Offers flexibility and control, but requires planning for fluctuating income, estimated taxes, and benefit self-funding.

- Entrepreneurship or Business Ownership – May offer long-term upside, but involves upfront capital, startup costs, and delayed income potential.

Gatewood Helps You Model and Compare:

- Cash flow under each scenario, including personal runway needs and business funding

- Start-up cost assumptions, including legal setup, equipment, staffing, and marketing

- Self-employment tax implications and retirement plan options (e.g., SEP IRA, Solo 401(k))

- Investment portfolio adjustments to align with your new timeline, risk profile, and liquidity needs

- Tax Strategies for a Lower-Income Year

- A year of reduced income—especially one following high-earning years—can open unique windows for tax planning. Gatewood helps you capitalize on these opportunities with the goal of long-term tax efficiency:

- Roth IRA Conversions

- Move pre-tax assets into Roth accounts at lower marginal rates, creating future tax-free income.

- Capital Gain Realization

- Harvest gains from taxable investments while you’re in a temporarily lower bracket.

- Tax-Loss Harvesting

- Offset gains with losses to reduce current-year taxable income.

- Donor-Advised Fund (DAF) Contributions

- Front-load charitable giving while reducing taxable income, especially helpful if severance or bonuses are pushing you into higher brackets.

You don’t need all the answers today. What you need is a partner who can help you navigate uncertainty with confidence— someone to help you weigh the tradeoffs, test your assumptions, and build optionality into your plan.

Gatewood’s Role:

We serve as your strategic thought partner, modeling what-if scenarios and helping you understand how today’s decisions shape your long-term success. You’ll leave Phase Two with a clear understanding of your options—and a plan that grows with your evolving vision.

Phase Three: Evaluating the Next Opportunity

The offers arrives. Now what?

When the right opportunity and new offer come in, it’s time to switch from stabilization to evaluation. This is more than a salary negotiation.

This phase is not just about understanding what’s being offered. It’s about how it fits into your broader financial, professional, and family life goals.

You’ve already created a baseline financial plan during your transition. Now, we integrate the new compensation and benefits package into that plan to evaluate its impact—and identify any gaps, risks, or opportunities.

Evaluating the Offer:

A job offer is more than just salary. We help you analyze:

- Base compensation, bonuses, and performance incentives

- Equity components – RSUs, stock options, and restricted stock

- 401(k) and retirement plan options, including employer match or deferred comp

- Executive benefit packages, such as SERPs, split-dollar life insurance, or fringe benefits

- Relocation packages – including potential tax treatment and reimbursement caps

Key Questions to Consider:

- How does this new package support or fall short of your long-term financial goals?

- What are the tax implications of signing bonuses, equity grants, or deferred comp?

- Is there opportunity for future growth, ownership, or strategic exit?

Gatewood’s Role:

We translate complex offer terms into clear financial implications. By layering the offer into your existing plan, we show you:

- How this offer affects your retirement trajectory

- Whether your liquidity needs are met

- What adjustments may be needed in your investment or tax strategy

Insurance & Risk Considerations:

Many executives overlook the insurance shifts that come with a new role or company. We help you evaluate:

- Medical insurance options – employer plan vs. private coverage

- Life and disability insurance – are your new policies sufficient for your needs?

- Long-term care or supplemental coverages – based on age, wealth, and family considerations

This is about more than accepting a job—it’s about aligning your next chapter with your life vision.

The right role should advance your career and your financial goals. We help make sure it does both.

Phase Four: Long-term Planning & Integration

This is where clarity becomes momentum.

Once you’ve accepted your next role, the real work begins – integrating your new financial life into a long-term strategy that supports your goals, protects your family, and grows your wealth intentionally.

This phase is about moving beyond the transition— it’s time to align every aspect of your financial life with your goals—across investments, tax strategy, risk management, and legacy planning.

Update Your Financial Plan:

Now that compensation is more predictable, we revisit your plan to ensure:

- Cash flow modeling reflects your new income and expenses

- Savings goals are recalibrated for retirement, education, or lifestyle needs

- Tax strategies are aligned with your updated income and equity

- Philanthropic goals are folded into the plan if applicable

Optimize Retirement & Investment Strategies:

Your investment plan must evolve with your life stage and risk profile. We help you:

- Consolidate retirement assets and align allocations with future cash needs

- Evaluate backdoor Roth IRA or mega backdoor 401(k) opportunities

- Coordinate non-qualified plan deferrals with expected distribution years

- Prepare exit strategies for any equity compensation you still hold

Estate, Risk & Legacy Planning:

With a new financial foundation, it’s time to reassess your long-term preservation and legacy goals:

- Review and update your estate documents

- Establish or revise trust structures if needed

- Ensure beneficiary designations match your wishes

- Consider asset preservation strategies for executive-level exposure

Ongoing Review and Accountability:

Life, tax laws, and the economy evolve. We provide:

- Annual reviews to monitor progress toward your goals

- Proactive communication around tax and legislative changes

- Strategic planning around career milestones, liquidity events, or business ventures

This is not the end of your transition—it’s the beginning of a new financial trajectory with clarity and intention.

Bringing It All Together

Losing a job at the executive level isn’t just a career event—it’s a life event. It can feel like free fall, like chaos. But with the right process, it becomes a chance to take stock, pivot wisely, and launch your next chapter from a position of strength.

These four phases—triage, exploration, evaluation, and integration—are designed to bring structure to what feels unstructured. To bring clarity to the chaos. To move you from reaction to strategy.

While this guide offers a framework, it’s not just about having a checklist—it’s about having a partner who helps you make the right decisions, at the right time, for the right reasons.

We’ve helped executives in this moment before. And we can help you, too.

Important Disclosures:

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

This information is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

Traditional IRA account owners have considerations to make before performing a Roth IRA conversion. These primarily include income tax consequences on the converted amount in the year of conversion, withdrawal limitations from a Roth IRA, and income limitations for future contributions to a Roth IRA. In addition, if you are required to take a required minimum distribution (RMD) in the year you convert, you must do so before converting to a Roth IRA.

A plan participant leaving an employer typically has four options (and may engage in a combination of these options): 1. Leave the money in their former employer’s plan, if permitted; 2. Roll over the assets to their new employer’s plan, if one is available and rollovers are permitted; 3. Roll over to an IRA; or 4. Cash out the account value

Financial Planning Before & After a Divorce: A Guide for Women Navigating Life’s Transition

Divorce is one of life’s most emotionally charged and financially complex transitions. Whether you are just beginning to consider it, actively going through the process, or finding your footing after it’s finalized, your financial life will inevitably change. For many women—whether a successful professional or a full-time caregiver to children—this can feel overwhelming, isolating, and uncertain.

At Gatewood Wealth Solutions, we recognize that divorce is not just a financial event—it’s an emotional journey filled with grief, fear, uncertainty, and sometimes betrayal. It affects more than just the couple—it ripples into relationships with children, in-laws, mutual friends, and shared professionals who may now be forced to choose sides.

Trust can be deeply shaken. That’s why our approach is grounded in empathy, discretion, and partnership. We walk with our clients through every stage—supporting them not just as financial advisors, but as steady, compassionate allies in a time of profound change.

This guide outlines the key considerations you need to think through—and the actions you should take—as you navigate this pivotal chapter.

When You’re Considering a Divorce

Before any paperwork is filed, it’s essential to take stock of your situation:

- Understand your financial position: Begin gathering all relevant documents—tax returns, bank and investment statements, insurance policies, loan documents, retirement accounts, and household expenses.

- Assess your lifestyle and spending: What does it cost to live your current life? What expenses may remain or change post-divorce?

- Consider future housing and income needs: Will you stay in the home? Will you need to re-enter the workforce?

- Meet with a financial advisor and attorney confidentially: Even if you aren’t sure you’ll move forward, early professional advice can help you understand your rights, risks, and options.

This stage is about preparation. Quietly gathering information and creating a plan helps protect your interests and gives you space to process what’s ahead emotionally.

Types of Divorces and Their Implications

Understanding the process can help you choose the right path:

- Mediated Divorce: A neutral third-party mediator helps spouses negotiate terms. Often lower in cost and less adversarial.

- Collaborative Divorce: Each spouse has their own attorney, but all commit to resolving without litigation. Additional experts, like financial advisors or therapists, may be involved.

- Litigated Divorce: If cooperation breaks down, the case proceeds to court. This is often the most contentious and expensive route.

The choice impacts your financial, emotional, and relational outcomes. Working with a financial advisor early can help you evaluate settlement options from a long-term planning lens and ensure you’re emotionally supported throughout the process.

Financial, Legal & Emotional Challenges for Women

Whether you’re a professional earning a significant income or a stay-at-home parent managing the household, divorce introduces several issues:

For Working Professionals:

- Dividing complex assets like equity compensation, business interests, and retirement plans

- Adjusting to new tax liabilities and loss of household income

- Protecting future earnings from excessive support obligations

For Stay-at-Home Mothers:

- Understanding entitlements to spousal or child support

- Re-entering the workforce or seeking training

- Securing long-term financial independence post-divorce

For All Women:

- Creating a new personal budget and financial plan

- Updating wills, trusts, beneficiary designations, and account titling

- Managing emotional trauma, decision fatigue, and shifts in family and social circles

- Navigating loss of shared friendships and community

We understand that many women feel lost in this transition. Trust in others—even professionals—can feel fragile. That’s why working with a firm like Gatewood, where we prioritize empathy, clarity, and transparency, can be a stabilizing force. Our goal is to rebuild your sense of control and confidence in your future.

A financial advisor can act as a steady hand through these transitions, helping ensure nothing falls through the cracks.

The Role of the Financial Advisor in a Divorce

A qualified financial advisor does more than analyze numbers—they provide clarity, structure, and emotional steadiness. They:

- Create financial models to evaluate settlement options

- Project cash flow and retirement viability post-divorce

- Inventory and organize assets and liabilities

- Assist in updating legal documents and insurance policies

- Coordinate with your attorney, CPA, and other relevant professional advisors

- Provide clarity when emotions are high and decisions feel overwhelming

At Gatewood, we are skilled at guiding clients through emotionally sensitive transitions with the care and confidentiality they deserve.

We build comprehensive plans tailored to your new life—empowering you to move forward with confidence.

What Documents Should You Have

- Tax returns (3 years)

- Bank, investment, and retirement account statements

- Pay stubs and income documentation

- Mortgage and debt documents

- Insurance policies (health, life, disability)

- Prenuptial or postnuptial agreements

- Estate planning documents

These help define marital vs. separate property and inform negotiation strategy. Having them prepared gives you a stronger voice in conversations that may feel emotionally loaded.

Evaluating Employee Benefits

Benefits can be an overlooked asset. Make sure to:

- Review health insurance options (COBRA, marketplace, employer coverage)

- Assess pensions, 401(k)’s, RSUs, or stock options

- Understand dependent care benefits or FSA’s

- Clarify ownership or division of group life insurance policies

If you’re covered under your spouse’s benefits, have a plan for transitioning off.

Practical Steps to Take During a Divorce

- Assemble a professional team: attorney, financial advisor, therapist

- Open individual bank and credit accounts

- Track your income and spending

- Freeze or monitor credit

- Establish a post-divorce budget

- Update passwords and secure personal information

- Review estate plan and insurance needs

We guide clients through each of these so they feel supported and informed—not alone.

Two Examples of Planning in Action

Case Study 1: Sarah, Corporate Executive

Sarah was a high-earning executive who handled investments but never paid much attention to cash flow. During her divorce, we:

- Modeled child support and alimony scenarios

- Analyzed division of deferred compensation and RSU’s

- Built a post-divorce financial plan that ensured she could maintain her lifestyle and retire on time

- Worked with her attorney to structure settlement payments in a tax-efficient way

Sarah walked away empowered, informed, and with a clear roadmap for her financial future.

Case Study 2: Emily, Stay-at-Home Mom

Emily had been out of the workforce for 15 years, raising her three children. We:

- Helped her inventory marital assets

- Coordinated with her attorney to secure support and long-term housing

- Built a cash flow plan with gradual return-to-work assumptions

- Worked with an estate attorney to update her will and establish a trust for the children

Emily gained financial confidence and clarity, with a plan that gave her options.

A Final Word and Where You Can Turn

Divorce doesn’t have to mean financial confusion or fear. With the right team and the right plan, you can take control of your future, protect what matters, and make empowered decisions.

At Gatewood Wealth Solutions, we specialize in helping women plan through and beyond divorce. Whether you’re just starting to consider it or have finalized it and need help rebuilding, we’re here for you.

Let’s talk. Your next chapter deserves a solid plan.

Important Disclosures

This material was created for educational and informational purposes only and is not intended as tax, legal or investment advice. For a comprehensive review of your personal situation, always consult with a tax or legal advisor. Neither LPL Financial nor any of its representatives may give legal or tax advice.

This is a hypothetical situation based on real life examples. Names and circumstances have been changed. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investments or strategies may be appropriate for you, consult your advisor prior to investing.

Major Tax Bill Clears the House {Updated 07/09/2025}

[Updated as of 07/09/2025]

On July 7, 2025, the “One Big Beautiful Bill,” a major tax and spending package we’ve been closely tracking, was officially signed into law by the President. We’ve broken down the new changes to help you easily understand how this might affect you, your family, and your financial plans.

What’s in the Final Law?

Permanent Lower Taxes for Individuals

Good news! Lower tax rates and the bigger standard deduction that came from the 2017 tax law (often called the TCJA) are now permanent. This means most people will continue paying less in taxes long-term.

Increased SALT Deduction Cap

If you live in a state with higher taxes, you’ll appreciate this one: The deduction limit for state and local taxes (SALT) has increased from $10,000 to $40,000. However, this benefit phases out if your income is above $500,000.

Special Deductions for Workers and Seniors

- No Federal Tax on Tips and Overtime: Workers who rely on tips or overtime pay won’t pay federal taxes on these earnings between 2025 and 2028, as long as income stays under certain limits ($150K individual/$300K family).

- Extra Deduction for Seniors: If you’re 65 or older, you’ll get an extra deduction ($6,000 if single, $12,000 if married), helping reduce or eliminate taxes on Social Security and other income. This deduction phases out at higher income levels.

Estate Tax Exemption Increase

The exemption for estate taxes is now permanently set at $15 million per person, helping families pass more of their wealth to their heirs without tax penalties.

Good News for Business Owners

- Bonus Depreciation: If you’re investing in your business, you’ll be able to write off 100% of qualifying expenses immediately (from 2025–2029).

- Section 179: Small business owners can now immediately expense up to $2.5 million of equipment, helping with cash flow.

- Research and Development: If your business invests in research, new rules let you write off these expenses more easily through 2029.

- QBI Deduction: The 20% deduction for pass-through business income is now permanent, and it phases out gradually for high earners, rather than disappearing all at once.

Energy and Community Investments

- Clean-energy tax credits are being reduced, but you can still access some incentives for solar and electric vehicles under stricter rules.

- Opportunity Zone investments continue, especially encouraging investment in rural and underserved communities.

Families and Children Benefit Too

- A new “Trump Savings Account” allows families to contribute up to $1,000 per year per child born after 2024, offering tax-friendly growth potential.

- Child tax credits have increased, providing additional support for families.

Social Program Changes

- There are new, stricter work requirements for Medicaid and SNAP (food stamps). While this is intended to encourage employment, it may affect some families negatively.

What Did NOT Pass?

- The corporate tax rate stays at 21%. It was not reduced to 15% as previously proposed.

- The estate tax was not eliminated, just increased significantly.

- Taxes on Social Security benefits were not completely removed, although many seniors will effectively see little to no tax on their benefits due to the senior deduction.

Who Benefits, and Who Might Face Challenges?

Winners:

- Middle-income households due to lower taxes and increased deductions.

- Small and medium-sized business owners with more tax incentives.

- Families who can use the higher estate exemptions.

- Seniors benefiting from additional deductions.

- Families with young children through new savings opportunities.

Those Facing Challenges:

- Higher earners in high-tax states due to limited SALT benefits.

- Consumers and businesses involved in renewable energy due to fewer incentives.

- Lower-income households impacted by stricter Medicaid and SNAP requirements.

We understand that these changes might have mixed impacts depending on your situation. Our priority is making sure you have a clear, easy-to-follow plan.

How Gatewood Wealth Solutions is Here for You

We’re already working to help our clients:

- Understand exactly how these changes impact your unique situation.

- Adjust your strategies to make the most of new opportunities.

- Seek to ensure you’re well-prepared and protected from unintended consequences.

As always, please reach out to us if you have questions or would like personalized advice on navigating these new changes. We’re here to guide you every step of the way.

[Original Article from 06/03/2025]

On May 22, 2025, the U.S. House of Representatives narrowly passed a nearly $4 trillion tax bill known as the “One Big Beautiful Bill” by a 215-214 vote. The legislation includes the most significant tax changes proposed since 2017, including permanent extensions of key provisions from the Tax Cuts and Jobs Act (TCJA), new deductions, and revised rules for both individuals and businesses.

While this is a major step, it is not yet law. The bill now heads to the Senate, where changes are likely. The administration has signaled an interest in seeing legislation finalized by July 4, though many expect the timeline may extend into August or beyond, depending on the pace of negotiations.

Here’s what you need to know — and what we’re doing to help you prepare.

Key Highlights from the House Bill

For Individuals:

- Permanent extension of TCJA provisions, including lower individual tax rates, an expanded standard deduction, and repeal of personal exemptions.

- Increased child tax credit to $2,500 per child for tax years 2025 through 2028.

- Higher SALT deduction cap, raising the limit from $10,000 to $40,000 for households earning under $500,000, with the cap and income threshold indexed by 1% annually through 2033.

- New above-the-line deductions for seniors ($4,000), tip income, overtime pay, and up to $10,000 in U.S. auto loan interest—each subject to income limits.

Estate Planning Updates:

- Increased lifetime exemption for estate, gift, and generation-skipping transfer taxes to $15 million starting in 2026, indexed for inflation. This builds on the existing TCJA levels, which reach nearly $14 million in 2025.

For Business Owners:

- Bonus depreciation restored at 100% for qualifying assets placed in service between 2025 and 2029.

- Section 179 expensing limits increased to $2.5 million, with a $4 million phaseout threshold.

- Domestic R&D expensing reinstated for 2025 through 2029 under a new Section 174A structure.

- Section 199A (Qualified Business Income Deduction):

- Deduction rate increased from 20% to 23% starting in 2026.

- Phaseout reform: For service businesses, it expands eligibility and the deduction phases out gradually—reducing by 75 cents for each dollar of income over the threshold—making planning more predictable and makes the deduction permanent. (I removed the comma in this sentence.)

- Expanded eligibility: Certain dividends from Business Development Companies now qualify for the deduction.

- Permanence: The deduction is made permanent, ending its previous 2025 sunset.

Other Notables:

- Energy credit repeals and phaseouts: The legislation rolls back tax credits from the Inflation Reduction Act, affecting wind, solar, and battery storage projects, and potentially increasing household energy costs.

- Opportunity Zone extension through 2028, with new incentives for rural investment.

- International and reciprocal taxes, including changes to GILTI, FDII, BEAT, and new retaliatory taxes for countries imposing “unfair” taxes on U.S. firms.

- Medicaid & SNAP Changes: The bill imposes stricter work requirements for Medicaid and the Supplemental Nutrition Assistance Program (SNAP), potentially affecting millions of low-income Americans.

- Introduction of “Trump Savings Accounts”: The bill creates $1,000 “Trump savings accounts” for children born after 2024, offering tax-deferred savings with capital gains tax rates on withdrawals.

- Student Loan Forgiveness Repeal: The legislation repeals student loan forgiveness options under President Biden’s SAVE plan and introduces new repayment plans.

- Defense & Border Security Funding: The bill allocates $150 billion to defense spending and $70 billion to border security, including funding for mass deportations and border infrastructure.

What Happens Next?

The Senate is expected to take up the bill in June, possibly bypassing committee review in favor of direct negotiations. Any significant changes made by the Senate would require another vote in the House before the bill can be enacted. While many core elements of the bill enjoy broad Republican support, there are competing priorities among Senate members — particularly around energy credits, international taxation, and the scope of permanent provisions.

How Gatewood Is Preparing Our Clients

With major tax changes on the horizon and year-end planning season approaching, timing and strategy will be critical. At Gatewood Wealth Solutions, we’re preparing our clients for all possible outcomes — and we’re starting now.

Here’s how we’re helping:

- Running personalized tax scenarios under both current law and the proposed changes, so you can make informed decisions now — not after the fact.

- Identifying strategic opportunities to leverage new deductions, avoid phaseouts, and optimize entity structures and income timing.

- Reviewing estate and business plans to take advantage of proposed changes, including the increased estate exemption and favorable treatment of business investments and income.

You don’t need to wait for the final vote to start planning. Strategic action today can create lasting benefits regardless of how the final bill takes shape.

If you’re ready to review your plan or want to understand how this legislation could impact your financial goals, let’s talk. We’re here to guide you through it — with clarity, strategy, and purpose.

Important Disclosures:

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

This information is not intended to be a substitute for individualized tax advice. We suggest that you discuss your specific tax situation with a qualified tax advisor.

Money Considerations When Becoming a Caregiver for Aging Parents

As Americans live longer, more adult children are stepping into a new and emotionally complex role: caregiver for aging parents. While this caregiving journey is often rooted in love and duty, it comes with significant financial, legal, and emotional challenges—many of which families are unprepared to navigate.

At Gatewood Wealth Solutions, we help families prepare for life’s key moments. Becoming a caregiver is one of those moments, and having the right plan in place can help you support your parents without jeopardizing your own financial well-being or confidence.

The Situation Many Couples Face

The typical scenario starts subtly. One parent begins needing help with errands, then medications, then transportation. Eventually, the need grows to include daily support—bathing, dressing, managing bills—or even full-time care.

For couples in their 40s, 50s, or 60s, this can be a difficult balancing act. They may still be working full-time, saving for retirement, or even supporting children in college. When caregiving duties grow, it creates stress, financial strain, and difficult decisions:

- Should one spouse reduce hours or leave work entirely?

- How do we pay for in-home care or assisted living?

- Are we prepared for the legal and medical decisions ahead?

- Will this derail our own retirement?

These are deeply personal—and deeply financial—questions.

Financial Considerations for Caregiving

Caring for a parent can quickly become a financial responsibility. Common costs include:

- Home modifications (ramps, walk-in tubs)

- In-home caregivers or visiting nurses

- Adult daycare programs or respite care

- Transportation services

- Medications, co-pays, or specialized therapies

- Long-term care or assisted living facilities

Medicare Vs. Medicaid: What They Cover (and what they don’t)

Medicare is health insurance primarily for those 65 and older. It covers hospital care, doctor visits, and short-term rehabilitation—but NOT long-term custodial care such as help with bathing, dressing, or eating.

Medicaid, on the other hand, is a needs-based program that can cover long-term care in a facility or at home—but only for individuals with very limited income and assets.

Coordination Between the Two:

In some cases, individuals can qualify for both Medicare and Medicaid (known as “dual eligibility”), but coordinating these benefits is complex and often requires professional guidance. Timing, asset structuring, and proper documentation are key to avoiding disqualification or delays in coverage.

Legal and Estate Planning Issues to Address

When you step into a caregiving role, you also step into a world of legal responsibilities. The following should be reviewed or created:

- Powers of Attorney (Financial & Medical): Ensure someone has legal authority to act on your parent’s behalf.

- Living Will/Advance Directive: Clarifies wishes regarding life-sustaining treatment.

- HIPAA Authorizations: Grants access to medical records.

- Updated Wills and Trusts: Review beneficiary designations, successor trustees, and asset titling.

- Asset Protection Planning: If long-term care may be needed, there are legal strategies to protect family assets within Medicaid’s lookback rules.

Gatewood can work alongside estate attorneys to help ensure the proper legal structures are in place and coordinate with elder law specialists when necessary.

Emotional and Lifestyle Strain

Many caregivers experience:

- Guilt over not doing enough

- Burnout from juggling work, children, and caregiving

- Conflict with siblings or spouses over roles and responsibilities

- Grief as they watch a parent’s health decline

We often remind families: you cannot pour from an empty cup. Planning ahead financially and legally can ease the stress and allow more energy for the emotional and relational aspects of caregiving.

Resources for Caregivers

You’re not alone in this journey. Here are a few reputable resources:

- Area Agencies on Aging (AAA): Local support and information services

n4a.org - Eldercare Locator: A free service to connect caregivers with local help

eldercare.acl.gov - Family Caregiver Alliance: Tools, education, and support groups

caregiver.org - Medicare.gov: Coverage information, providers, and cost estimators

www.medicare.gov - Medicaid Planning Resources: State-specific resources available through local elder law attorneys or planning professionals

How Gatewood Can Help

At Gatewood, we guide families through the complexities of caregiving—from financial planning to legal coordination to emotional support strategies. We:

- Model the impact of caregiving expenses on your own retirement plan

- Coordinate with estate attorneys and elder law professionals

- Identify insurance and long-term care funding options

- Help facilitate family conversations and clarify roles

- Help ensure planning stays aligned across generations

A Final Thought

You may never feel fully ready to become a caregiver—but with thoughtful preparation and the right support, you can approach it with confidence, clarity, and compassion.

If you’re facing—or anticipating—the responsibility of caring for an aging parent, let’s have a conversation. We’re here to help you prepare financially and emotionally for one of life’s most important roles.

Important Disclosures:

This material was created for educational and informational purposes only and is not intended as tax, legal or investment advice. For a comprehensive review of your personal situation, always consult with a tax or legal advisor. Neither LPL Financial nor any of its representatives may give legal or tax advice.

How One Business Owner Saved Over $12K by Electing S-Corp Status

When Mike started his consulting business, he did what many new entrepreneurs do—he operated as a sole proprietor. It was simple, required no formal setup, and allowed him to focus on building his client base.

But two years in, with business booming and $200,000 in net income on the books, Mike’s CPA asked a pivotal question:

“Have you thought about electing to be taxed as an S-corporation?”

Mike had heard the term before but didn’t quite understand how it worked—or why it mattered. What followed was an analysis that changed the way Mike ran his business and saved him thousands of dollars every year.

The Tax Breakdown: Sole Proprietor vs. S-Corp

As a sole proprietor, Mike was paying self-employment tax on every dollar of his $200,000 net income. That meant:

- Sole Proprietor Self-Employment Tax:

$200,000 × 15.3% (Social Security + Medicare) = $30,600

Ouch.

But under an S-Corp structure, things look different. Mike would pay himself a reasonable salary (let’s say $96,000) and take the rest of the profit ($104,000) as a distribution, which isn’t subject to self-employment taxes.

Here’s how the S-Corp scenario plays out:

- S-Corp Employment Tax on Salary:

$96,000 × 15.3% = $14,688 - Remaining $104,000 in profit is not subject to employment tax.

- Tax Savings:

$30,600 (Sole Proprietor) – $14,688 (S-Corp) = $15,912 saved

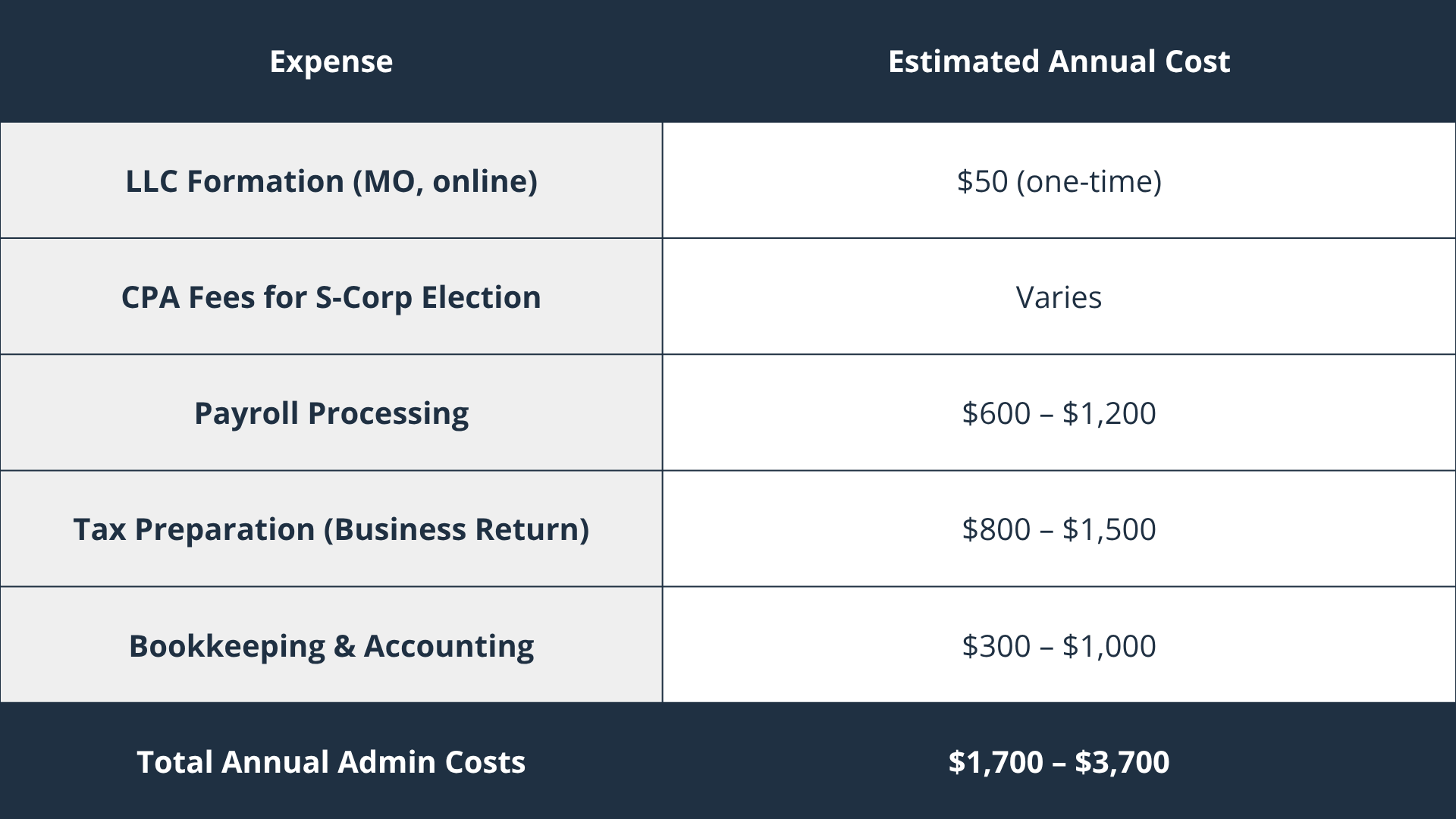

The Cost of Making the Switch

Of course, S-corporation status comes with a few additional administrative requirements:

Even after subtracting these estimated costs, Mike stood to save between $12,212 and $14,212 per year.

Bonus Tax Benefit: State Income Tax Deduction

But that’s not all. Because S-corps are pass-through entities, Mike also became eligible for Missouri’s pass-through entity tax election, allowing state taxes to be paid at the business level—rather than being limited to the $10,000 SALT deduction cap on his personal return.

This strategy gave Mike additional federal tax savings, since he could now fully deduct state taxes paid by the S-corp.

Other Advantages of Being an S-Corporation

Beyond tax savings, Mike discovered several practical and strategic benefits:

- Professionalism: Operating as an S-Corp signaled to clients and vendors that his business was established and credible.

- Liability Protection: As an LLC electing S-Corp status, he gained legal separation between personal and business assets.

- Retirement Contributions: With W-2 wages, Mike could contribute more to certain retirement plans (like a solo 401(k)).

- Ownership Flexibility: He could bring on other shareholders or investors without reworking the business structure.

- Improved Bookkeeping Discipline: Payroll, regular compensation, and distributions helped him create clearer financial records—critical for future growth or financing.

Additional Considerations When Converting to an S-Corporation

Fringe Benefits May Be Less Favorable

S-corporation owners who hold more than 2% of the company are treated differently than sole proprietors or C-corporation owners when it comes to fringe benefits.

- For example, health insurance premiums must be included in the shareholder’s W-2 wages and deducted on their individual return—not the business return.

- This approach does not reduce FICA taxes and can limit the overall tax benefit.

- The same applies to HSA contributions and certain other fringe benefits, which may not be deductible at the entity level.

Reasonable Compensation Is Required

The IRS requires that S-Corp shareholder-employees pay themselves a reasonable wage before taking distributions. This is a common IRS audit focus.

Tip: A reasonable salary should be based on industry standards, the services performed, and the time spent working in the business. In our earlier example, $96,000 appears reasonable—but this figure should be justified and documented.

State Tax Workaround – SALT Cap (PTE Election)

Some states, including Missouri, allow Pass-Through Entity (PTE) tax elections, which can help bypass the federal $10,000 cap on state and local tax (SALT) deductions.

However, this strategy comes with caveats:

- The election must be made annually and on time.

- It isn’t always beneficial, depending on whether you itemize deductions and your income level.

- Not all states allow this workaround, so consult your tax advisor to see if it applies.

Tracking Basis and Distribution Rules

S-Corp shareholders must carefully track their basis (i.e., their investment in the company).

- Distributions in excess of basis are taxable.

- Losses may be disallowed if the shareholder doesn’t have enough basis to absorb them. This becomes more complex if the business has significant debt, inventory, or variable income.

Timeline for Electing S-Corp Status

To be effective for the current tax year, you must file Form 2553 by March 15.

- If you miss the deadline, you may still qualify for late election relief, but you’ll need to follow IRS procedures.

Exit Strategy and Flexibility

S-Corp status is relatively easy to revoke if your situation changes. However, once revoked, you generally cannot re-elect S-Corp status for five years without IRS approval.

Bottom Line: Is It Time to Make the Switch?

For Mike, the math was simple: Save over $12,000 a year, protect personal assets, and run a more structured, scalable business.

If you’re earning over $50,000–$60,000 in annual net income, talk to your CPA or financial advisor about whether electing S-Corp status could be right for you. With the right structure and planning, you may save thousands each year in taxes—while building a more scalable and protected business. For many small business owners, this single decision can meaningfully boost profitability and financial efficiency—without changing the work you do.

Want to explore whether switching to an S-Corp could save you thousands too? Let’s talk.

Important Disclosures:

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

This information is not intended to be a substitute for individualized tax advice. We suggest that you discuss your specific tax situation with a qualified tax advisor.

This is a hypothetical example and is not representative of any specific situation. Your results will vary.

Still Working, Still Planning: Why In-Service Distributions Can Be a Game Changer

For high-earning professionals, retirement isn’t a date—it’s a strategy. And one of the most overlooked ways to take control of that strategy, even while you’re still working, is through an in-service distribution (ISD).

We’re often asked this question:

“Can I move my 401(k) into an IRA while I’m still working—so I can take full advantage of active, personalized portfolio management?”

In many cases, the answer is yes. And when done strategically, it can unlock greater control, tax advantages, and long-term flexibility.

Let’s explore how in-service distributions work—and when they make sense as part of a bigger-picture plan for your future.

What You Gain with an In-Service Distribution?

An in-service distribution allows you to move all or part of your 401(k), 403(b), or pension assets into an IRA—without leaving your job. As long as the transfer is done as a direct rollover, your funds retain their tax-deferred status and the transaction is not taxable.

The IRS permits in-service distributions from:

- 401(k) or 403(b) plans once the participant reaches age 59½

- Defined benefit pensions or profit-sharing plans, sometimes at earlier ages (e.g., age 55 or based on years of service), depending on the plan document

But just because you can, doesn’t always mean you should—yet for many executives, this move creates flexibility, personalization, and greater alignment with long-term goals.

A Tale of Two Executives

Consider the stories of Michael and Susan, both successful professionals at different stages in their careers:

MICHAEL, age 59½, is a senior vice president who has spent 25 years with his company. He’s still passionate about his work but is beginning to think about his long-term financial independence. His 401(k) has grown substantially, but he feels limited by the investment options in the plan.

Because his plan allows for in-service distributions at 59½, Michael transfers a portion of his account into an IRA, enabling Gatewood’s investment team to tailor his strategy, diversify his portfolio, and begin creating a tax-smart income plan for future retirement.

SUSAN, age 67, is a chief operating officer who planned to retire at 65 but has decided to continue working for a few more years. She wants to avoid unnecessary risk and better align her retirement assets with her estate plan.

Her company’s retirement plan permits in-service distributions after age 65, and she uses the opportunity to roll assets into a professionally managed IRA. This move gives her more flexibility in charitable giving, Required Minimum Distribution (RMD) planning, and tax-efficient withdrawals—while continuing to contribute to her 401(k).

Questions to Consider Before Making an In-Service Distribution

- Does your employer’s retirement plan allow in-service distributions?

Not all plans offer this option, so the first step is to confirm availability through your plan documents or HR department. - Are you old enough to qualify?

Most 401(k) and 403(b) plans require that you reach age 59½ to take an in-service distribution without penalty. Some profit-sharing or pension plans may allow earlier access based on years of service. - Would you benefit from broader investment flexibility?

Employer plans typically offer a limited set of investment options. Rolling assets into an IRA can provide access to a wider range of strategies aligned with your goals and risk tolerance. - Do you want more active portfolio management?

If your plan is passively managed or lacks personalization, an IRA under Gatewood’s management may offer more proactive oversight and strategic alignment with your financial plan. - Are you looking to incorporate advanced tax strategies?

IRAs can unlock planning opportunities like Roth conversions, tax-efficient withdrawals, and Qualified Charitable Distributions (QCDs), which are harder to implement inside a 401(k). - Are you preparing for retirement and want to build a withdrawal or legacy strategy?

Making the move early can simplify your transition into retirement and help ensure your assets are structured for income, estate planning, and long-term preservation.

If you answered “yes” to more than one of these questions, an in-service distribution may be a valuable next step.

The Strategic Advantages & Smart Tradeoffs

The Advantages

Rolling assets into a Gatewood-managed IRA opens the door to a more expansive investment toolkit. Gone are the one-size-fits-all fund menus. Instead, you gain access to custom portfolios built with individual securities, ETFs, and even alternative investments—crafted around your objectives.

You also unlock:

- More proactive risk management

- Integrated tax planning (Roth conversions, QCDs, and withdrawal sequencing)

- Simplified estate coordination and beneficiary alignment

- Continued creditor protection under federal bankruptcy law, if the IRA is classified as a rollover*

*Note: Gatewood helps ensure that rollovers retain their ERISA-level protections by correctly classifying and documenting IRA rollovers.

Important Considerations

While an in-service distribution provides significant advantages, there are tradeoffs to be aware of:

- You lose access to 401(k) loan features. For most executives over 59½, this is rarely a material concern.

- Rollover IRAs¹ do not fall under ERISA’s federal creditor protections (outside of bankruptcy), which could matter in high-liability professions. We’ll help you evaluate based on your state’s protections and profession.

- IRAs require RMDs at age 73—even if you’re still working. In contrast, some 401(k)s let you defer RMDs while employed.

When Your Current Plan May Be Good Enough (For Now)

If your employer’s plan offers strong investment options, low costs, and you’re not yet focused on tax strategy or estate planning, staying the course may be appropriate—at least for now.

But if you’ve outgrown the plan’s limits, and want more alignment with your total financial life, then an in-service rollover may offer the clarity, control, and customization you deserve.

Why Gatewood for In-Service Distribution Management?

At Gatewood Wealth Solutions, we don’t just manage investments—we guide families through life’s most important financial transitions. Our in-service distribution process reflects that philosophy.

With us, you gain:

- A firm-to-family relationship built on trust, care, and your long-term purpose

- Integrated planning through our Total Client Deliverable—investments, cash flow, tax, and estate strategy in one plan

- An investment philosophy that focuses on risk management and long-term confidence

- No longer stuck with one-size-fits-all fund menu

- Disciplined, proactive management that evolves with your life and the market

- Clarity and confidence to navigate IRS rules, retirement timing, and plan complexity

Final Thought: It’s Not About Leaving Your Job. It’s About Taking Control.

Taking an in-service distribution isn’t about leaving your employer—it’s about taking control of your financial future.

If you’re ready for more flexibility, more strategy, and more confidence in your retirement plan, let’s start the conversation.

Your future self will thank you.

Important Disclosures:

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investing involves risk including loss of principal. No strategy assures success or protects against loss.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

This information is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

Securities and advisory services offered through LPL Financial, a Registered Investment Advisor, Member FINRA/SIPC

¹A plan participant leaving an employer typically has four options (and may engage in a combination of these options): 1. Leave the money in their former employer’s plan, if permitted; 2. Roll over the assets to their new employer’s plan, if one is available and rollovers are permitted; 3. Roll over to an IRA; or 4. Cash out the account value (38-LPL) show less

A Roth IRA offers tax deferral on any earnings in the account. Qualified withdrawals of earnings from the account are tax-free. Withdrawals of earnings prior to age 59 ½ or prior to the account being opened for 5 years, whichever is later, may result in a 10% IRS penalty tax. Limitations and restrictions may apply. Traditional IRA account owners have considerations to make before performing a Roth IRA conversion. These primarily include income tax consequences on the converted amount in the year of conversion, withdrawal limitations from a Roth IRA, and income limitations for future contributions to a Roth IRA. In addition, if you are required to take a required minimum distribution (RMD) in the year you convert, you must do so before converting to a Roth IRA. Contributions to a traditional IRA may be tax deductible in the contribution year, with current income tax due at withdrawal. Withdrawals prior to age 59 ½ may result in a 10% IRS penalty tax in addition to current income tax.

The 9 Essentials Every Thoughtful Estate Plan Should Include

The Unfinished Plan

David and Michelle are in their early 50’s, juggling successful careers, two teenagers, and aging parents who are starting to need more care. Like many, they meant to revisit their estate plan, but life got in the way. Their will is nearly a decade old. Their home is titled only in Michelle’s name. And their IRA beneficiaries haven’t been reviewed since David switched jobs.

They know planning is important. But between work and family, it’s hard to make the time.

Then imagine a sudden accident. Would Michelle be able to access David’s accounts or make medical decisions? Would their kids be placed with the right guardians? Without updated documents, their family could be left in legal limbo during one of the most difficult times.

What Is Estate Planning Really About?

Estate planning isn’t just for the wealthy. It’s for anyone who wants to protect the people they love and leave behind clarity instead of chaos. It involves deciding who will manage your assets, how they’ll be distributed, and who will make decisions if you can’t.

More than anything, it’s an act of care.

-

Understand Probate and How to Avoid It

Probate is a public, court-supervised process for settling estates. It can be expensive and slow. Tools like revocable trusts, joint account titling, and beneficiary designations can reduce or eliminate the need for probate.

-

Create or Update Your Will

Your will names guardians for minor children and explains how you want your assets distributed. While it doesn’t avoid probate, it gives clear instructions and can help reduce family conflict.

-

Check Your Beneficiaries and Account Titles

IRAs, 401(k)s, insurance policies, and even bank accounts can have named beneficiaries or be set up as transfer-on-death (TOD). Review these regularly—especially after marriage, divorce, or the birth of a child.

Gatewood Guidance: These designations often override your will. We help ensure your titling and beneficiaries reflect your current wishes.

-

Consider a Revocable Living Trust

A living trust can help manage assets during life and transfer them privately after death, avoiding probate. It’s ideal for blended families, out-of-state property, or complex estates.

-

Establish Powers of Attorney and Healthcare Directives

Appoint someone you trust to make financial and medical decisions if you’re incapacitated. Documents include:

- Durable Power of Attorney (for finances)

- Healthcare Power of Attorney

- Living Will (end-of-life preferences)

Don’t forget your family: If you have aging parents or unmarried adult children, help them get these documents in place. Without them, you may not have legal authority in an emergency.

-

Have the Conversation

Talking about your estate plan with family can feel awkward. But it’s one of the most valuable things you can do. It sets expectations, reduces conflict, and ensures your intentions are understood.

Tips for a Better Conversation:

- Start with your values, not your valuables

- Choose a relaxed setting

- Be open and invite questions

Gatewood Wisdom: A well-prepared family is the best legacy you can leave.

-

Be Strategic About Taxes

Smart estate planning can help reduce taxes and preserve wealth:

- Step-Up in Basis: Appreciated assets get a new cost basis when inherited, which may reduce capital gains taxes.

- Inherited IRAs: Understand the 10-year withdrawal rule under the SECURE Act.

- Charitable Giving: QCDs, donor-advised funds, and gifting appreciated assets can all help.

We collaborate with your CPA and estate attorney to build an integrated, tax-efficient strategy.

-

Keep It Current

Review your plan every three years or when life changes. New job? Move? Grandchild born? These events should prompt an update.

-

Get Organized

Inheriting Money, Property, or Investments? Here’s What to Do Next

Receiving an inheritance can be a powerful and emotional moment. Whether it follows the loss of a parent, grandparent, or another loved one, it often comes with a mix of gratitude, responsibility, and uncertainty. In many cases, these inherited assets are not held in trust or managed by a trustee—they come to you directly through beneficiary designations, account titling, or the probate process.

At Gatewood Wealth Solutions, we guide clients through these transitions with the thoughtful planning and care they deserve.

Here’s what you need to know if you’ve recently been notified that you’re inheriting assets—and how to make confident, well-informed decisions that align with your long-term goals.

Types of Assets You Might Inherit

Depending on your loved one’s estate, you might inherit:

- A personal residence

- Bank accounts (checking, savings, CDs)

- Retirement accounts (traditional and Roth IRAs, 401(k)s)

- Investment accounts (brokerage, mutual funds, stocks)

- Stock certificates or bonds held outside an account

- Life insurance proceeds

- Annuities

- Vehicles or personal property

- Rental properties or land

- Business interests

Inherited Assets not Held in a Trust May Pass to Heirs in One of Two Primary Ways:

By Operation of Law:

This includes assets that transfer directly to a named individual through mechanisms like beneficiary designations, joint ownership with rights of survivorship, or titling such as Transfer on Death (TOD) or Payable on Death (POD).

Common examples include retirement accounts, life insurance policies, jointly owned bank or brokerage accounts, and certain real estate titles. These assets typically bypass probate and go directly to the named beneficiary.

Through the Probate Process:

If an asset was not titled properly or did not have a valid or current beneficiary designation, it becomes part of the decedent’s estate and must go through probate.

This legal process involves court oversight and can delay distribution while ensuring debts and taxes are settled. Probate assets often include solely owned property, untitled personal items, or accounts where no beneficiary was named.

Each type of inherited asset comes with its own set of rules—governing how it transfers, when it must be distributed, and what taxes may apply.

From the timing of IRA distributions to the tax treatment of inherited property or investment accounts, it’s essential to understand the unique requirements and implications of each asset you receive.

STORY #1: Inheriting a Home Through Probate

David, age 38, inherited his mother’s $300,000 home in St. Louis after her passing. The home had no beneficiary deed, so it did not transfer automatically upon death. Instead, it passed to David through probate, according to the terms of his mother’s will, which named him as the sole beneficiary of the property.

The house was fully paid off and had been her primary residence. David lived across the country and wasn’t interested in relocating. Emotionally attached but financially uncertain, he faced several key decisions: Should he keep the home? Rent it out? Or sell it?

Challenges:

- Navigating the probate process and retitling the home in his name

- Understanding the home’s stepped-up cost basis

- Assessing the local real estate market

- Handling repairs, property taxes, and maintenance from out of state

Solution:

With no beneficiary deed in place, the home passed through probate according to David’s mother’s will. As an out-of-state beneficiary, David needed help understanding his responsibilities and evaluating whether to keep, rent, or sell the property.

Gatewood helped David by:

- Coordinating with an estate attorney to navigate probate and retitle the home

- Clarifying the stepped-up cost basis to reduce potential capital gains taxes

- Analyzing the financial pros and cons of renting versus selling

- Connecting him with a local realtor to assess market conditions and listing strategies

Ultimately, David chose to sell the home and invest the proceeds in a diversified portfolio aligned with his long-term goals.

STORY #2: Inheriting Financial Accounts with Beneficiary Designations

Julie, age 52, inherited the bulk of her father’s estate through direct beneficiary designations. She was named on each account as the Payable on Death (POD) or Transfer on Death (TOD) recipient, allowing her to bypass probate and take direct ownership of the assets.

Her inheritance included:

- $150,000 in a traditional IRA

- $120,000 across multiple bank accounts

- $400,000 in a brokerage account

While the process of receiving the assets was relatively straightforward, Julie wasn’t sure where to begin—and she recognized that timing and tax decisions could have long-term implications for her wealth.

Challenges:

- Establishing an inherited IRA and understanding distribution rules

- Titling and consolidating bank and investment accounts

- Deciding which assets to spend, save, or invest

- Understanding potential tax implications on inherited investments

Solution:

Gatewood worked closely with Julie to help her gain clarity and confidence. We:

- Opened a properly titled Inherited IRA and built a 10-year RMD strategy to minimize taxes and preserve flexibility

- Helped consolidate her bank accounts to simplify cash management

- Reviewed the brokerage holdings for cost basis, reallocation needs, and alignment with her financial goals

- Coordinated with an estate attorney to ensure proper documentation and address future estate planning needs

With a clear, personalized plan in place, Julie could move forward with confidence—using the inheritance to strengthen her financial foundation and accelerate her path to independence.

Key Questions to Ask Yourself

Inheriting assets can be overwhelming—especially when you’re navigating grief, unfamiliar paperwork, and looming decisions. Asking the right questions early can help you stay focused, intentional, and in control:

- What exactly am I inheriting—and what is it worth?

- How were these assets titled or designated (beneficiary, TOD/POD, will, probate)?

- Are there time-sensitive steps or deadlines I need to meet?

- What are the tax rules for each type of asset?

- Do I need to revise my own estate plan now that my financial picture has changed?

- How should I balance short-term needs with long-term goals?

Common Issues & Smart Action Steps by Asset Type

Inherited Home

- Confirm the home’s value at date of death for tax purposes (step-up in basis)

- Decide whether to keep, rent, or sell—factoring in market, maintenance, and emotion

- Review property taxes, insurance, and potential legal costs

IRA or Retirement Plan

- Open an Inherited IRA (if eligible) and follow IRS distribution rules

- Most non-spouse heirs must distribute within 10 years—plan withdrawals accordingly

- Explore tax-efficient withdrawal strategies that align with your income and goals

Bank Accounts

- If TOD/POD, work directly with the bank to transfer funds

- If held in probate, follow court or executor instructions for release

- Consider whether to hold, invest, or pay down debt

Investment Accounts or Stock Certificates

- Retitle or transfer assets using the stepped-up cost basis

- Review for concentration risk or misalignment with your financial plan

- Be mindful of capital gains and future tax impact

Life Insurance & Annuities

- Contact the carrier to file a claim and review payout options

- Life insurance is typically tax-free; annuities may have taxable portions

- Decide between lump sum and installment payments based on needs and planning

Vehicles & Personal Property

- Transfer ownership through the DMV—requirements vary by state and may include probate documentation, title, and a death certificate

- Update insurance coverage to reflect the new owner and intended use

- Get a valuation for tax, sale, or estate recordkeeping

- Consider logistics and emotional attachment—decide whether to keep, sell, or donate

Other Real Estate

- Obtain a professional appraisal to establish the date-of-death value

- Review deed and title status to determine if probate is required

- Consult an attorney to assist with transfer, sale, or co-ownership issues

- Consider ongoing costs (property taxes, insurance, maintenance) when deciding whether to keep or sell

Business Interests

- May require a professional valuation or legal support for transfer or sale

- Involve an attorney early if ownership or succession is unclear

Why Work with Gatewood—and an Estate Attorney

Inheriting assets is rarely simple. There are legal steps to follow, tax traps to avoid, and emotional decisions to make. But you don’t have to navigate it alone.

At Gatewood Wealth Solutions, we offer the clarity and expertise to help you:

- Organize and prioritize next steps

- Make confident, informed financial decisions

- Align inherited assets with your personal plan

- Coordinate with attorneys and other professionals to help ensure nothing is missed

This is about more than just what you’ve received. It’s about honoring a legacy, avoiding missteps, and building a future that reflects your values.

Let’s start with a conversation.

Because Wealth with Purpose starts with wisdom in moments like these.

Important Disclosures:

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investing involves risk including loss of principal. No strategy assures success or protects against loss.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

This information is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

Securities and advisory services offered through LPL Financial, a Registered Investment Advisor, Member FINRA/SIPC

5 Things to Review at Age 50 to Stay Retirement Ready

As you enter your 50’s, retirement is no longer a distant dream—it’s a fast-approaching reality. For couples like David and Lisa, both busy professionals juggling demanding careers, aging parents, and two kids in college, the pressure is real. Between tuition bills, thoughts of future weddings, and a desire to retire early (or at least have the option), they’ve started asking the big questions: Are we on track? Can we afford to retire when we want to? What happens if we can’t work as long as we thought?

If this sounds like you, you’re not alone. Your 50’s are a critical decade for aligning your wealth with your future goals. Here are five key areas to review now to make sure your retirement plan stays on course:

1. Supercharge Your Retirement Savings

Now’s the time to take full advantage of catch-up contributions. In 2025, individuals age 50 and older can make a catch-up contribution of $7,500 to their 401(k), bringing their total annual limit to $31,000.

For those ages 60 to 63, an additional special catch-up of $3,750 is available, allowing a maximum contribution of up to $34,750.

David and Lisa maxed out their workplace plans and reviewed whether Roth or traditional contributions made more sense based on their tax situation.

Also consider:

- Maxing out IRA’s (including backdoor Roth IRA’s if income limits apply)

- Health Savings Accounts (HSA’s) as a tax-advantaged way to save for future medical expenses

- Evaluating whether an in-service rollover to an IRA provides more investment flexibility

2. Evaluate Your Investment Allocation

The portfolio that got you here might not be the one to get you through retirement. You’re close enough to retirement that preserving wealth matters—but far enough away that you still need growth.

Make sure your investment strategy reflects your time horizon, risk tolerance, and future income needs. Lisa and David worked with their advisor to assess:

- Are we taking the right amount of risk?

- Are we properly diversified?

- How do our returns compare to what’s assumed in our financial plan?

3. Review Your Retirement Timeline and Income Plan

What if you want to retire at 60? Or take a step back at 58? It’s time to explore your options.

Your 50’s are the perfect time to start modeling different retirement ages and income strategies. At Gatewood, we walk clients through scenarios that answer:

- When can we afford to retire?

- What will our income sources be?

- Should we consider partial retirement or phased withdrawal strategies?

And don’t forget Social Security—understanding your optimal claiming strategy can make a significant difference over time.

4. Don’t Overlook Healthcare and Long-Term Care Planning

If you retire before age 65, how will you handle healthcare costs? This is one of the biggest surprises for early retirees. Lisa and David ran a cost analysis to see what COBRA, ACA plans, or a health sharing ministry might cost if they retired early.

Also consider:

- Reviewing employer benefits and whether they offer retiree health plans

- Evaluating long-term care insurance or alternative funding options

- Planning for Medicare expenses and gaps post-age 65

5. Revisit Your Estate and Family Planning

Your wealth isn’t just for retirement—it’s part of your legacy. In your 50’s, it’s time to update your estate documents, revisit beneficiaries, and plan for future family milestones.

Lisa and David:

- Updated their wills and trusts after their children turned 18

- Reviewed powers of attorney and healthcare directives

- Created a savings plan for future weddings or family support

This is also a great time to open up conversations with your kids about money, values, and your plans.

Bonus: Get a Professional Second Opinion

A lot can change in your 50’s—and it’s easy to overlook opportunities or risks. A financial planning team can help you:

- Spot gaps in your plan

- Stress-test your retirement strategy

- Align your investments, insurance, and taxes with your goals

David and Lisa left their meeting feeling confident—not because they had all the answers, but because they had a plan.

So, whether you’re thinking about retiring early, catching up on savings, or just want to make sure you’re on track, now is the time to pause, plan, and prepare.

Let’s make sure the next chapter of your life is everything you’ve worked for—and more.

Important Disclosures:

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

There is no assurance that the techniques and strategies discussed are suitable for all investors or will yield positive outcomes. The purchase of certain securities may be required to effect some of the strategies. Investing involves risks including possible loss of principal.

There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification and asset allocation do not protect against market risk.

The information provided here is general in nature. It is not intended, nor should it be construed, as legal or tax advice. To determine which strategies or investments may be suitable for you, consult the appropriate qualified professional prior to making a decision.

A plan participant leaving an employer typically has four options (and may engage in a combination of these options): 1. Leave the money in their former employer’s plan, if permitted; 2. Roll over the assets to their new employer’s plan, if one is available and

Living Well, Giving Well: Legacy Planning Insights

A Story of Reflection, Purpose, and Partnership

James and Evelyn, both in their early 70s, had spent the last few decades building a life they were proud of. They raised three children, enjoyed meaningful careers, and were now entering retirement with a sense of freedom—and a growing list of questions.

As they sipped coffee one morning overlooking their garden, their conversations increasingly turned to what came next—not just in terms of travel or hobbies, but how they wanted to be remembered. James had just received a letter about his required minimum distributions (RMD’s), and Evelyn had been reading about qualified charitable distributions (QCD’s). Both had been organizing old files and revisiting their estate plan.

“It’s not just about what we leave behind,” Evelyn said, “it’s about the impact we can make while we’re still here.”