Going to the (Stock) Market: Investing Tips for Mothers

Mothers are busy people, which means saving and investing for the future can often take the back burner to more urgent priorities. Not only that, but the stock market can seem risky. During the Great Recession, the value of the average retirement account dropped greatly, by about 25%.[1] Unfortunately, if you did not start investing early in life, you could have more ground to make up for later.² Below, we’ll discuss three key tips that can help mothers clarify and work toward their financial goals.

Make Your Goals As Specific As Possible

Creating goals can be tough—especially when retirement is decades in the future. But while you may not yet be able to calculate the precise amount of money you’ll need in 2050, setting specific and measurable goals can help guide your financial path. For example, if you’d prefer to retire early, you may want to pursue aggressive investments and save a significant amount of your pay.³

By writing down why you want to invest, what your financial goals are (for the short, medium, and long term), and what assets and resources you have available to work toward these goals, you’ll have a plan to help guide your path.

Consider Different Investment Accounts Available

Not all investing is created equal, even if you’re investing in the exact same assets in each account. Some investment accounts like a 401(k) or traditional individual retirement account (IRA) are pre-tax, where contributions reduce your taxable income now but are taxed upon withdrawal; others, like a Roth 401(k) or Roth IRA accept post-tax funds and offer tax-free growth in return.⁴ There are also Health Savings Accounts (HSAs), 529 college savings accounts, and Uniform Transfers to Minors (UTMA) accounts that generally allow you to purchase investments within them.

To determine which accounts you should prioritize over others, you may want to answer a few questions with a financial professional:

● When do you hope to retire?

● What’s your effective tax rate?

● How close are you to the next tax bracket?

● Do you expect to be in a higher tax bracket at retirement than you are now?

● Do you have a pension or another source of retirement income?

The answers to these questions, and more, may help you decide between accounts that are taxable, tax-deferred, and tax-advantaged. You don’t need to commit to one of these accounts for life; one year you may want to fund your Roth IRA, the next year you could focus on your traditional IRA or 401(k).

Know Your Risk Tolerance

Investing doesn’t just require the diligence to set aside funds regularly. It also requires knowing your tolerance level when it comes to downward-trending stocks. By ensuring that all your investments fit cleanly within your risk tolerance, you can help avoid the temptation to make sudden market moves that are driven by emotion rather than logic or analysis. Generally, the higher your risk tolerance and the longer your horizon, the more aggressively you can invest.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

Contributions to a traditional IRA may be tax deductible in the contribution year, with current income tax due at withdrawal. Withdrawals prior to age 59 ½ may result in a 10% IRS penalty tax in addition to current income tax.

The Roth IRA offers tax deferral on any earnings in the account. Withdrawals from the account may be tax free, as long as they are considered qualified. Limitations and restrictions may apply. Withdrawals prior to age 59 ½ or prior to the account being opened for 5 years, whichever is later, may result in a 10% IRS penalty tax. Future tax laws can change at any time and may impact the benefits of Roth IRAs. Their tax treatment may change.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

This article was prepared by WriterAccess.

Mastering Retirement Reserve Cash Management

At Gatewood Wealth Solutions, we’re not just about preparing for the best; we’re about being ready for the worst. Our approach to retirement income planning revolves around a core philosophy: keeping our clients “Bear Market Ready, but Bull Market Positioned.” In this blog post, we’ll delve into our robust methodology for cash management in retirement, highlighting the importance of cash reserves and strategic investment planning.

Understanding the Cash Target

Our firm has worked hard to develop an approach that allows us to pinpoint exactly where that “sweet spot” is, based on clients’ expenses, life stages, and our investment committee’s outlook on the market. Our financial planning and investment management teams work closely together to ensure no stone goes unturned in making this assessment.

The cornerstone of our approach is what we call the “Cash Target.” This is the amount we recommend our clients keep readily available in cash to weather market downturns without the need to sell off investments at unfavorable times. Determining this Cash Target involves a meticulous process that takes into account various factors such as annual expenses, income, market conditions, and life stages.

Steps to Calculate the Cash Target

1. Assess Annual Expenses: We start by evaluating our clients’ total annual expenses, including lifestyle costs, taxes, insurance, and other financial obligations.

2. Review Income: Next, we analyze the client’s income streams, ensuring we have a clear picture of their financial inflows.

3. Incorporate Market Outlook: Our Investment Committee routinely evaluates market conditions to adjust the Cash Target Timeframe. This is the recommended duration, in months, for which one should hold enough cash to cover total expenses, tailored to the current economic environment

4. Calculate the Cash Target: Using a specialized formula, we compute the precise number of months required to cover one’s total expense needs, subtracting regular income received. This Cash Target is based on the client’s expenses, income, and the designated Cash Target Timeframe.

5. Fund the Cash Hub Account: Once the Cash Target is determined, we allocate funds accordingly, so our clients have the necessary cash reserves in place.

Retirement Income Distribution Planning

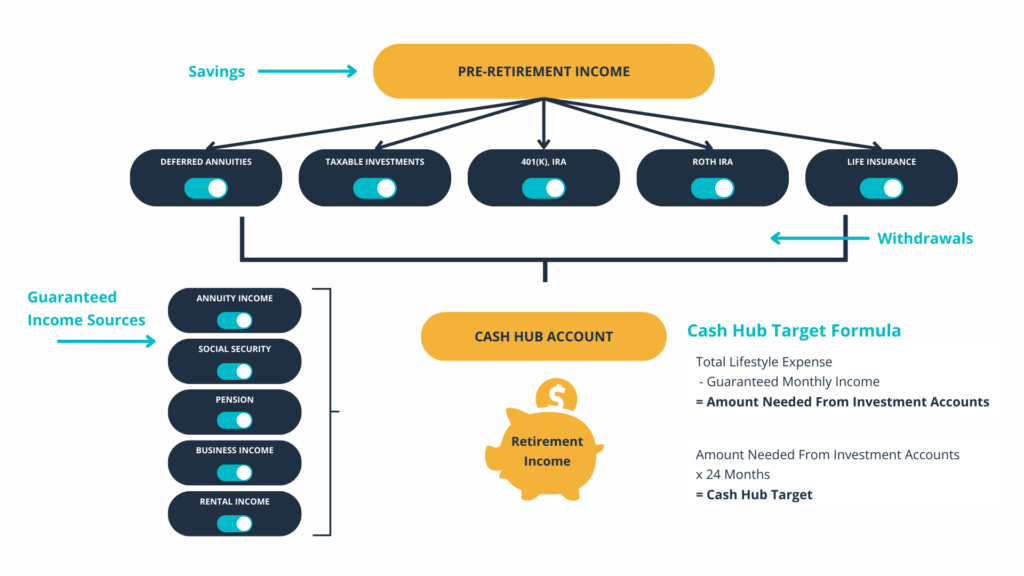

The cash hub account is just one small part of our overall distribution planning approach, which you can see below. Our planning team constantly turns these funnels on and off based on our clients’ specific financial situations and life goals. We can make sure we correctly put our clients’ money to work for them while maximizing their tax-saving strategies.

Cash – Invest or Keep?

Understanding the role of cash in retirement is crucial. While investments offer growth potential, cash provides stability and liquidity, acting as a safeguard against market volatility. By maintaining an adequate cash reserve, individuals can avoid the need to sell off investments during market downturns, thus preserving their long-term financial security.

Real Life Example

Consider Jane Smith, who illustrates the significant impact of having a cash reserve during retirement. By strategically tapping into her cash reserves during market downturns, Jane was able to preserve her IRA balance and substantially enhance her long-term financial outcome.

Life Stage Considerations

We tailor our cash management approach to different life stages, recognizing that the cash needs of individuals vary depending on whether they’re in the accumulation phase, distribution phase, or approaching retirement.

Adapting to Market Conditions

Our Investment Committee remains vigilant, adjusting the number of months for one’s Cash Target in retirement to market highs and downturns. This is crucial when clients rely on their investments for retirement income. In bearish markets, we will draw from cash reserves to avoid liquidating assets during unfavorable conditions, whereas in bullish markets, we rebuild cash reserves to the target.

Conclusion

At Gatewood Wealth Solutions, we believe in empowering our clients with robust retirement income planning strategies. By strategically managing cash reserves and investments, we aim to ensure financial stability and long-term prosperity for all our clients. If you’re ready to take control of your retirement finances, we’re here to guide you every step of the way.

Important Disclosures:

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

High Income, High Debt: 10 Ways High Earners Can Prevent a Credit Loss

A personal credit crisis is something many people fear, as it can lead to financial ruin and burden an individual with immense debt. Fortunately, steps can be taken to avoid such a crisis, even for high earners who may seem financially secure. When managed poorly, credit can invite various potential issues, including problems with enforceable legal judgments, fraud, overspending, and negative impacts on your credit score. Here are ten ways high earners can strategically manage their finances.

1. Budget and track expenditures

It’s essential to maintain a strict budget irrespective of the size of one’s income. Uncontrolled spending can lead to incurring a significant amount of debt, which in turn can trigger a credit crisis. High earners should always keep a detailed record of their expenditures to prevent overspending and stay within their budget.

2. Diversify income streams

While high earners may seem financially secure, relying on a single source of income can be risky. Diversifying income streams is an effective way to help address financial stability and mitigate a credit crisis by using credit when funds are scarce. If appropriate, consider passive income sources like real estate, stocks, or bonds.

3. Conduct regular financial audits

High earners must regularly audit their financial health to check uncontrolled spending, investment performances, and wealth accumulation. High earners must also periodically audit their credit reports to detect any errors or anomalies that could negatively affect their credit scores. In case of discrepancies, it’s crucial to initiate a dispute promptly to preserve a favorable credit status.

Another aspect of financial audits is monitoring interest rates, which impact the interest rate on credit cards, revolving lines of credit, and some loans that high-earners may carry. The higher the interest rate, the more the credit will cost over time.

4. Avoid unnecessary debts

Due to the vast credit card limits that high earners enjoy, using credit cards responsibly is essential. The higher the balance on a credit card, the more adverse the effect on a credit score.

High earners should avoid taking on unnecessary debts, which can lead to financial instability and potentially trigger a credit crisis. Avoid debts incurred through credit cards, unsecured loans, and high-risk investments.

5. Maintain an emergency fund

An emergency fund can be a safety net to cover unexpected expenses. Emergency funds provide a financial buffer that prevents the need to take on high-interest short-term debt, which could lead to a potential credit crisis.

6. Stay insured

Maintaining appropriate insurance policies to protect against unforeseen circumstances that may cause financial hardship is crucial. These include health insurance, disability insurance, liability insurance, property and casualty insurance, and long-term care insurance to protect assets against unforeseen legal judgments or collections.

7. Engage in Financial Education

High earners should continuously educate themselves about personal finance, investment strategies, tax laws, and other relevant topics to make informed financial decisions and prevent financial mishaps that could lead to a credit crisis.

8. Hire a financial professional

A financial professional can provide professional guidance on managing wealth and debt, tax planning, retirement planning, and other financial aspects. They will provide valuable advice and strategies to help high-earners work toward their goals while addressing credit issues.

9. Protect against fraud

Due to their wealth, high earners can be attractive targets for scammers. Therefore, preventing fraud by regularly checking credit reports, safeguarding personal information, and setting up fraud alerts on credit and bank accounts is crucial.

10. Save for retirement

High earnings do not guarantee a financially confident retirement. Therefore, it is essential that high-earners consistently save and invest for retirement, regardless of their current income level. Without financial confidence, high-earners may resort to credit use during retirement, which could lead to financial insecurity later in life.

Financial independence for high earners is about earning a high income and managing it responsibly. These preventive measures can help high earners manage their wealth and credit, maintain a positive credit score, and help mitigate a credit crisis.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

This article was prepared by Fresh Finance

Why Your Credit Score Matters in Retirement

Regardless of the stage of life, your credit score is an essential component of your financial health when you’re in retirement. A consistently strong credit score can pave the way for greater confidence, easy loan access, and lower interest rates. Many retirees overlook the importance of maintaining a suitable credit score after they stop working or that credit scores lose relevance in retirement. Yet, nothing could be further from the truth. Here’s a detailed look at why your credit score matters in retirement.

To Maintain Your Ability to Seek Credit

Retirement does not equate to financial inactivity. Even though you may no longer earn a regular paycheck, you may still engage in financial transactions requiring a credit check. For instance, if you plan to refinance your mortgage to a lower rate, lenders may consider your credit score part of the qualification process. If your score is low, you might be denied the mortgage or offered a higher interest rate mortgage.

To Find Housing

In addition, retirees often consider downsizing their homes, moving to senior living communities, or relocating to different states or countries. Any of these scenarios might necessitate applying for a new mortgage, a process that, once again, requires a solid credit score. Additionally, vacation home landlords often conduct credit checks before renting their property. A poor credit score can limit your options or cause you to lose out on your preferred vacation destination property.

Money for emergencies

Another reason your credit score matters in retirement is the possibility of unexpected expenses. Life is inherently unpredictable, and even in retirement, unforeseen costs can arise. These costs could be due to health complications, housing repairs, or helping a family member financially. In line with these circumstances, having good credit can make borrowing money more accessible.

New Opportunities

Retirees may also want to explore new ventures, like starting a business. Credit scores significantly impact the credit terms under which one can borrow capital to launch a business. An excellent credit score can make acquiring a loan less costly and more accessible. On the contrary, a low credit score could lead to onerous loan terms or a loan denial.

Suitable Insurance Rates

Furthermore, some insurance companies use credit-based insurance scores to determine risk factors and premiums for auto and homeowner’s insurance policies. A poor credit score might cause retirees to pay a higher premium or, worse still, reject their policy application outright.

Tip to Maintain Good Credit

A good credit score is essential to your overall financial health. Lenders, landlords, utility companies, and insurance companies use credit scores to evaluate your reliability. Here are some tips retirees can use to help maintain good credit.

Tip #1– Pay bills on time.

The first and most significant tip for maintaining good credit is ensuring your bills are paid on time. Delayed or missed payments can negatively affect your credit score.

Tip #2– Maintain low or no credit card balances.

The proverb “the less, the better” holds significance regarding credit card balances. Keeping your credit card balances low and not revolving is essential, and a lower percentage of credit use (below 30%) is positive. Maxing out your credit cards or maintaining high balances can negatively impact your credit.

Tip #3– Open new credit accounts only as needed.

While having a mix of credit types – such as credit cards, car loans, or mortgages – can help your credit score, it’s important not to open too many accounts in a short period.

Tip #4– Regularly check your credit reports.

Proactive credit report monitoring is vital, especially regarding credit scores. Regular credit report checks are instrumental in maintaining good credit. It helps to promptly identify any inaccuracies or fraud that could harm your credit.

Tip #5– Keep old credit accounts open.

The length of your credit history is another factor influencing your credit score. If you close an old credit account, you shorten your credit history, which could hurt your score.

Tip #6– Negotiate with creditors if necessary.

If you’ve missed payments and your credit score has taken a negative turn, contact your creditors and negotiate to remove the negative information.

Tip #7– Diversify your credit.

Having a diversity of credit types, such as a mix of installment loans, retail accounts, credit cards, and mortgage loans – can positively impact your credit score. Credit diversity demonstrates to potential creditors that you can responsibly handle different types of credit.

Tip #8– Seek professional help.

If you are overwhelmed with managing credit or have already slipped into a bad credit score, seeking professional help could be appropriate. Credit counseling agencies can provide invaluable assistance in rebuilding your credit score. Your financial professional can also be a source of help in providing recommendations based on your situation.

In conclusion, maintaining a suitable credit score is indispensable in your financial life, even throughout retirement. Retirees must focus on maintaining an excellent credit score to provide them with financial independence in their golden years.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

This article was prepared by Fresh Finance.

High-Net-Worth Retirement Planning: 6 Ideas That May Help You Get Your Finances in Order

Do you consider yourself a high-net-worth individual (HNWI)? Most people tend not to categorize themselves or see themselves as anything more than a spouse, parent, sibling, neighbor, boss, or business owner. However, society does classify people. HNWIs typically have at least $1 million in cash or assets that can be converted to cash easily, which could make planning for retirement more complex. Organizing your financial life can seem daunting at first, so here are 6 ideas to help you get started.

1. Goal setting and money management

People of significant means are often interested in wealth preservation and growing their savings and investments. They are also noticeably concerned with the social impact their money will have on the world. According to the Oxford Press, wealth managers have shifted their focus from specific investment vehicles and strategies to a more holistic investment approach and goal setting. With goals in place, cash flow projections with inflation adjustments will be easier to design.

Historically, inflation averages around 2.5% annually; however, recently, this average has deviated. A financial professional can help you adjust your long-term strategy to include a rise in future inflation and assist with planning how to save enough money to stretch 30+ years without getting sidetracked by expenses such as college tuitions or weddings. Thirty-four percent of U.S. HNWIs claim retirement savings as a top goal, while 26 percent cite preserving wealth for their children as their highest priority. The reality is that creating a comprehensive plan can be challenging and careful planning is critical.

2. Max out your retirement accounts

A 401(k) can be a powerful tool. If you have access to a plan through your employment, it may be beneficial to max out your 401(k) each year and take advantage of any match offered by your employer. The contributions are tax-deductible in the year that they are made. Any money left over can be put into an individual retirement account (IRA), health savings account (HAS), annuity, or another taxable account.

Some retirement accounts have required minimum distributions (RMDs) which, by law, you must withdraw once you attain age 73. In some cases, you may be able to delay RMDs until after you retire if you are still working at 73. Other complexities may arise if you inherit a retirement account, but consulting a financial professional can help you determine how to proceed depending on your relationship with the account holder, the type of account, and the decedent’s date of death.

The following accounts generally required minimum distributions after a certain age:

-

Traditional IRAs

-

SIMPLE IRAs

-

Inherited IRAs (typically, however, there are some exceptions)

-

Simplified Employee Pension IRAs (SEPs)

-

Qualified stock bonus plans

-

Qualified pension plans

-

Qualified profit-sharing plans, which include 401(k) plans

Section 403(b) and Section 457(b) plans

3. Stay up to date with tax law changes

-

Estate and gift tax changes – As of January 1, 2023, the federal gift/estate tax exemption increased to $12,920,000, while the federal annual exclusion amount increased to $17,000 per person per parent. So, in effect, any individual may receive up to $34,000 per couple per year. Any amount over the $34,000 threshold can be put toward the lifetime exemption amount. Utilizing this benefit now may be a good idea as come January 1, 2026, unless Congress decides otherwise, these high exemptions are scheduled to sunset and return to the previous Tax Cuts and Jobs Act amounts.

-

Modifications to charitable deductions – Currently, you are permitted to deduct 60% of adjusted gross income (AGI) for cash contributions held for over a year. For non-cash assets (property and long-term appreciated stocks), you generally deduct, at fair market value, up to 30% of your AGI for charitable contributions to an IRS-qualified 501 (c)(3) public charity if you select to itemize, which means forgoing the standard deduction. To account for inflation, the standard deduction is higher in 2023, up to $13,850 for individuals, $20,800 for head of household, and $27,700 for married couples who file joint returns. When you itemize, you should expect the sum of your itemized deductions to be greater than the standard deduction.

-

Home sale exclusion for primary residence (Statue 26 U.S. Code 121) – Exclusion of gain on the sale of principal residence allows an exclusion of $250,000 (for individuals) and a $500,000 (for married couples) on home sale gains. People who own a home as a primary residence for at least two of the five years immediately before selling their home can qualify for capital gains tax exclusion. There are many moving parts and rules to this exclusion, and getting help from a financial professional is highly encouraged.

-

The impact from Medicare surtax – Taxpayers that are above certain income thresholds of $125,000 (married and filing separately), $200,000 (single, head of household or qualifying widow or widower with dependent child), or $250,000 (married and filing jointly) may be subject to the Medicare surtax of an additional 0.9% tax rate. This can be a bit confusing. HelpAdvisor gives a good example; if you make $150,000 per year and are married and filing separately, you pay the standard 1.45% on the first $125,000 and 2.35% (1.45% + 0.9%) on the remaining $25,000.

-

Other expenses that qualify for deductions along with charitable donations include:

4. Confirm and communicate your charitable goals

o How are you involved in a charity? Are you just a donor, or do you sit on the board?

o Why do you support the charities that you do?

o What types of assets do you typically donate?

o Have you always donated, or do you plan to wait and donate after you die?

5. Create a withdrawal strategy

The question many retirees have is, “How do we deal with withdrawing our money when the time comes”? When it comes to your retirement, having a well-defined plan can help mitigate stress and frustration and potentially preserve wealth.

Some of the concepts you may want to explore include:

-

Focusing on the lower tax brackets first – Typically, the income of a high net-worth individual will dip after you stop working. Depending on your age and other requirements, you can consider withdrawing from your IRA and paying the taxes at the lowest marginal tax rate, especially in that window before social security benefits kick in. And if you can, delay taking social security benefits until the maximum age, maximizing the amount you will receive.

-

Review where your assets are located – Where are your stocks and bonds, for example, located? Are they in a tax shield IRA account where you may benefit because the bonds produce income taxed at ordinary income rates?

-

IRA Conversion (Traditional IRA -> Roth IRA) and Recharacterization (Roth IRA -> Traditional IRA) – A potentially helpful strategy, albeit complicated, involves converting assets from an IRA to a Roth IRA in what is called a Roth conversion. You pay taxes on any assets converted, and money is withdrawn later tax-free. This strategy could be beneficial if you suspect you may be in a higher tax bracket in the future. A recharacterization is converting assets from a Roth IRA to a traditional IRA. So, for example, you convert assets to a Roth account, and the market happens to drop after your conversion. You can recharacterize those assets back to a traditional IRA, removing the tax liability resulting from the conversion.

-

Don’t get bullied by the tax rates – You can’t predict the future of the tax rates and where you will be within them down the road. If taxes happen to go up, which they tend to do, then your tax-deferred money suddenly has less value than before since it gets taxed at a greater rate upon coming out of the account. Because this is possible, you should consult a financial professional and let them help you create a strategy that aligns with your financial goals.

6. Seek professional financial guidance

Managing your finances in an ever-changing world can be overwhelming, especially if you are someone with significant wealth. It would help if you had someone to guide you along your financial journey. Working with a financial professional can help you mitigate risk, consider options you might not have considered before, and stay aligned with your financial goals. Schedule a meeting with a financial professional and get the help you need to start your retirement planning journey today.

Important Disclosures:

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

Traditional IRA account owners should consider the tax ramifications, age and income restrictions in regards to executing a conversion from a Traditional IRA to a Roth IRA. The converted amount is generally subject to income taxation.

Contributions to a traditional IRA may be tax deductible in the contribution year, with current income tax due at withdrawal. Withdrawals prior to age 59 ½ may result in a 10% IRS penalty tax in addition to current income tax.

An annuity is a financial product sold by financial institutions that is designed to accept and grow funds from an individual and then, upon annuitization, pay out a stream of payments to the individual at a later point in time. Annuities are primarily used as a means of securing a steady cash flow for an individual during their retirement years.

This information is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

This article was prepared by LPL Marketing Solutions

Retirement Security Starts With Visualizing Your Future

Planning for your financial future and retirement looks much different now than in previous years. Some people must supplement their Social Security to have enough to maintain their desired lifestyle. This means financial planning is now a critical component of retirement. While having a financial professional on your side is vital to managing your financial future, so is visualizing what your future may include.

Visualizing Helps You Determine How Much You Need in Retirement

One of the most important reasons for visualizing your future is that it may help you understand how much money you might need to afford the retirement you want. Imagine what your retirement may look like for you. Might it include travel? Do you anticipate making significant purchases? Do you want to leave a large estate to family members? Consider what you want to have in the future and calculate how much money you may need to accomplish those desires.1

Visualizing Helps You Consider Aspects of Retirement That May Affect Your Financial Needs

Visualizing your retirement may help you determine what steps need to be taken and how your retirement may be affected by certain aspects of your future. You may decide working longer is the ideal way to get to the future you visualize. You may also find that your plans could involve downsizing or upsizing your living situation, which may lead to adjustments in your financial plan.2

Part of Your Visualization Needs To Consider a Few Inescapable Factors

Certain parts of the future, such as aging and retirement, are inescapable. To improve your visualization and planning, here are a few things that you might want to factor in:

-

You may live longer than expected: With advancements in technology and better health care, people are living much longer than the average life span used to be, so you may need to manage your financial plan in order to provide you with enough money to get you through the remainder of your life.

-

You may face major health care bills: For most people, getting older means more health concerns and higher medical bills. As medical costs continue to rise, this challenge is expected to get worse in the future.

-

Inflation: The cost of living may continue to increase as you age. In some cases, the inflation cost may be significantly higher than expected. During your visualization, you must account for the fact that prices might increase from now through your retirement and make sure you plan accordingly.

Planning for retirement involves trying to see into the future, so you may imagine how to cover your wants and needs. One of the easiest ways to start your plan is by visualizing what you want your financial future to look like. With the help of a financial professional, you might then come up with the necessary steps in your plan to help you get there.

Important Disclosures:

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

This article was prepared by WriterAccess.

Footnotes

1 How To Prepare For Retirement Through Visualization https://www.businessinsider.com/prepare-for-retirement-through-visualization-2011-4

2 Visualize your way to a better retirement https://www.cbsnews.com/news/visualize-your-way-to-a-better-retirement/

Retirement Re-Education: Back to School Time for Retirement Planning

Retirement planning is a constantly evolving process. Strategies that may have worked fine a few years ago may no longer be the optimal direction to continue. Your life may have taken unexpected turns, you may have different retirement goals you now wish to achieve, or you’ve realized your previous investments may not be working as well as anticipated to help you reach your financial goals.

Now is the time to consider a ‘retirement re-education’ by reviewing your retirement plan and overall strategies to see if they still align with your greater plans and goals.

Evaluating Your Current Plan

When sitting down to review your current retirement plan, you may want to:

-

Check your current investments: Markets have seen significant fluctuations throughout the years, so it is crucial to observe if your investments remain on track to get you toward your retirement goals. Make sure fund percentage balances are still appropriate and that your portfolio is well-diversified and in line with your current situation and future plans.

-

Check for contingencies: Ensure you have protection in place should the unexpected occur. This can start with insurance policies addressing long-term care, disability, and even death. You also want to ensure proper medical coverage to avoid being responsible for major medical expenses.

-

Ensure your retirement plan is tax-efficient: Seeking tax benefits will help you find ways to minimize taxes in your retirement portfolio. This focus can include placing taxable investments into tax-deferred accounts.

-

Evaluate changing family needs: If you have experienced recent adjustments in your family’s situation, consider how those changes can affect future finances and if any adjustments need to be made.1

Why You May Need to Revise Your Retirement Plan

Giving your retirement plan a once-over every couple of years is generally a good practice, but there may be situations when revising it sooner may be more urgent. Reasons to consider a revamp include:

-

Life event changes: If you have had significant life event changes, such as a new marriage, a divorce, a serious illness, the birth of a child, providing for step-children or grandchildren, or the death of a spouse, you may need to make significant changes to your retirement plan to realign with your new future goals.

-

Lifestyle changes: Moving to a new state, having significant changes in housing and related costs, or considerable health changes all may warrant a change in direction with your retirement goals.

-

Dramatic economic fluctuations: If domestic or global financial conditions have become unpredictable or there have been significant market fluctuations recently, it’s smart to review possible effects on your retirement investments. Economic situations that may prompt an urgent review include rising or falling interest rates, inflation, recessions, and significant Social Security changes.1

Important Disclosures:

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investing involves risks including possible loss of principal.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy. This article was prepared by WriterAccess.

Footnotes

1 5 Ways To Adjust Your Retirement Planning Annually, Forbes, https://www.forbes.com/sites/nextavenue/2020/03/05/5-ways-to-adjust-your-retirement-planning-annually/?sh=4110847f52af

Retirement Revolution: 3 Reasons to Rethink Your Retirement Plan

Retirement is a time that many of us look forward to our entire careers. It is the reward for a lifetime of work and the time to indulge in hobbies and enjoy much-needed vacations. While everyone looks forward to this seemingly-magical moment, if it is not the ideal time or plan, you may be in a poor financial position and unable to enjoy your retirement as you envisioned. Not sure if your retirement plan is still in line with your future life or financial goals? Below are a few reasons to give your current retirement plan a second look.

1. Your 401k Has Not Grown as Much as You Expected

Decades ago, pensions provided a significant income for retirees who had worked with a large corporation for a specified number of years. Over time, pensions have gone by the wayside, and employers have replaced this option with company matches for 401k contributions. Unfortunately, 401ks require employees to determine contributions. If they fail to consider possible market fluctuations with their funds, they may not be contributing enough to save for their retirement. Now that most pensions are a thing of the past and 401ks are the primary retirement vessel, almost half of American households are finding they will not be able to retire with enough savings to maintain their desired standard of living. If your accounts are not where you expected them to be, it may be ideal to increase your contributions or reconsider what you need for retirement.1

2. You Still Have a Lot of Debt

With the cost of living continuing to go up, your expenses in retirement will continue to rise as well. If you already have a significant amount of debt to pay down, that may make living on your retirement savings even more difficult. While some debt may be hard to avoid in retirement, significant debt, high-interest rates, or debt requiring large monthly payments may derail your retirement plans. If this is the case, you may need to push off retirement a few more years and work hard at paying down your debt to a more manageable level.2

3. You Don’t Have a Plan in Place for Major Expenses

While everyone hopes to avoid major expenses, they are, unfortunately, a part of life. Eventually, you may need to buy a new car, pay for a new roof, or upgrade your HVAC system. Ideally, you should tackle as many of these large expenses as you may anticipate before you retire so that they do not eat into your retirement savings. After you have taken care of what you know you will need to take care of, you should also put away more into your savings for possible large future expenses so that you won’t need to pull the money out of savings that you are relying on for monthly expenses.2

Important Disclosures

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial professional prior to investing.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

This article was prepared by WriterAccess.

Footnotes

2 10 Signs You Are Not Financially OK to Retire, Investopedia, https://www.investopedia.com/articles/personal-finance/021716/10-signs-you-are-not-ok-retire.asp

3 Ways Planning For Retirement is Like Planning For Summer Break

For kids, teens, and college students, summer break often represents freedom from schedules, responsibilities, and all those other drains on your time. Retirement actually can provide a similar level of freedom, but only if you’ve adequately prepared, planned, and saved. Below, we discuss three ways that planning ahead for your retirement can be like scheduling your summer.

Deciding What to Do

After spending decades at a 9-to-5, you may struggle to find ways to fill your time after retirement. Just like summer break, a couple of weeks of well-deserved decompression may turn into boredom.

It’s important to have a plan to transition into retirement. Whether this means having a list of vacation destinations, a hobby to turn to, or an organization to volunteer with, giving yourself some options can help you remain active and engaged instead of simply vegetating.

Deciding Where to Go

Many new retirees spend a lot of time traveling now that they no longer need to worry about coming back to a pile of work or rationing a limited number of vacation days. As you spend time traveling during your working years, take note of the destinations you’d like to return to.

Planning for retirement in general can look a lot like planning a vacation: you’ll need a budget, a destination, a timeline, and a Plan B. More than just longer vacations, retirement may also mean traveling to a new home – whether downsizing, moving closer to family, or even heading to a senior living community.

When considering next steps, especially if debating an interstate move, take into account factors like:

-

The way your state treats and taxes retirement income

-

Whether the setup of your home allows you to “age in place”

-

Access to amenities

-

Access to necessities (like grocery stores and hospitals)

-

Transportation options

-

Cost of living

By keeping these factors in mind, you’ll be able to find the best fit for your lifestyle now and in the future.

Deciding How to Pay For It

How do you afford your current lifestyle? What expenses do you expect to lose in retirement – and which ones might you gain?

Just like planning a vacation, planning how you’ll fund your retirement can be an intricate process with many moving parts. Having a financial professional at your side can help streamline matters.

Your financial professional will probably help you work backward to create your retirement financial plan. This planning can begin by evaluating how much your retirement lifestyle will cost, then figuring out how much income you’ll need to afford it. By looking at sources such as 401(k), IRA savings, a pension, Social Security, and taxable savings, your financial professional will scour all your potential areas of income and help you figure out the most tax-efficient way to fund your retirement.

Retirement planning can take time and effort – but just as you wouldn’t embark on the vacation of a lifetime without doing a bit of preliminary research, you also don’t want to leap into retirement without a plan.

Important Disclosures

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

This article was prepared by WriterAccess.

LPL Tracking # 1-05367403

Emergency Savings or Your Retirement Goals?

Deciding which one comes first so you know where to focus your efforts

When it comes to personal finance, there are a number of competing priorities that can make it difficult to determine where to focus your efforts. For many people, the choice between building emergency savings and working towards their retirement goals is one of the biggest dilemmas they face. So, which should you focus on first?

In order to answer this question, it’s important to understand what emergency savings and retirement goals are and why they are both important. Emergency savings refers to the amount of money you have set aside in a readily accessible account to cover unexpected expenses, such as a job loss, medical emergency, or major home repair. Retirement goals, on the other hand, are the plans you have in place to provide for yourself financially once you stop working.

Both emergency savings and retirement goals are important, but the order in which you focus on them will depend on your individual financial situation. If you have a stable income and few financial obligations, you may be able to focus more on your retirement goals, knowing that you have a safety net in place in the form of your emergency savings. However, if you have limited income and high debt, you may need to prioritize building up your emergency savings in order to protect yourself from financial shocks.

Emergency Savings First

Here are a few reasons why emergency savings should come first:

-

Peace of mind: Having a solid emergency fund in place can help you sleep better at night, knowing that you have a safety net in case of an unexpected expense.

-

Protects against debt: If you don’t have emergency savings, you may turn to credit cards or loans to cover unexpected expenses, which can quickly spiral into debt. Building up your emergency savings can help you avoid this trap.

-

Provides flexibility: With an emergency fund in place, you have more flexibility to make decisions about your financial future, such as taking on a new job or starting a new business.

Retirement Goals First

However, there are also some good reasons why focusing on your retirement goals first can make sense:

Time value of money: The earlier you start saving for retirement, the more time your money has to grow, which can make a big difference in the amount you have saved when you retire.

Compound interest: The power of compound interest means that the earlier you start saving, the less you have to save each month in order to work towards your goals.

Employer matching: If you participate in a 401(k) or other retirement plan at work, your employer may match a portion of your contributions. By maximizing this match, you can significantly increase your retirement savings.

Emergency Savings vs. Retirement Goals

So, which should come first? Ultimately, the answer will depend on your individual financial situation and goals. In any case, it’s important to find a balance between the two. You don’t want to neglect your emergency savings and end up in debt when an unexpected expense arises, but you also don’t want to neglect your retirement savings and end up struggling to make ends meet in your later years. A good rule of thumb is to aim to have three to six months of living expenses in your emergency fund, and then start contributing to your retirement goals as soon as you can.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

This article was prepared by FMeX.

Spring Has Sprung: Time to Refresh Your Retirement Plan

Spring can be a fantastic time to refresh your retirement plan and savings habits. With 2023 bringing increased limits for 401(k)s, individual retirement accounts (IRAs), Health Savings Accounts (HSAs), and other tax-advantaged accounts, it’s worth taking a closer look at your retirement savings. Below, we discuss three ways to refresh your retirement plan this spring.

Maintain Consistent Savings

With inflation taking a bite out of just about everyone’s paychecks, it can sometimes be tempting to decrease the amount you’re contributing to retirement just to gain a bit of breathing room. However, maintaining a consistent rate of savings even through lean times can go a long way toward securing your financial future. When it comes to saving for retirement, time is on your side—and the more you can contribute at a younger age, the more time this money will have to grow.

If your savings rate has been at the same level for more than a few years, it may be time to revisit this contribution. You may discover that you can afford to set aside a little more; in other cases, it may make sense to switch from a tax-deferred account to a post-tax account like a Roth 401(k) or Roth IRA.

Review Your Asset Allocation

When it comes to investing for retirement through an employer plan, the options available to you may sometimes seem overwhelming. Far beyond mere “stocks vs. bonds,” employees are asked to choose from accounts ranging from growth to stability, domestic to international, and tech to blue chips. For some plans, the default option is to put contributions into a money market account rather than investing them in the stock market.

Does your asset allocation appropriately reflect your risk tolerance and investment timeline? It can be tough to know.

Fortunately, you don’t have to do it alone. A financial professional can work with you on your strategies and goals, making adjustments where necessary to keep you on the right path. Don’t wait until you get closer to retirement to realize you haven’t been investing as efficiently as you would have liked.

One last thing that is important to keep an eye on involves the disposition of your assets once you’ve passed away.

Many financial accounts like 401(k)s, IRAs, and even some bank accounts may require you to name a beneficiary. And for life insurance policies, the beneficiary is key—this is the person to whom the benefits pass, regardless what a marriage decree or executed will may say to the contrary.

If you’ve gotten married or divorced, had children recently, or if it’s been more than a year since you evaluated your beneficiary designations, it’s important to revisit each of your financial accounts to ensure your beneficiary designations continue to reflect your wishes. In many cases, a surviving family member has discovered too late that their loved one named an ex-spouse or estranged family member as their beneficiary, leaving those who depend on them in the lurch.

Important Disclosures

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

The Roth IRA offers tax deferral on any earnings in the account. Withdrawals from the account may be tax free, as long as they are considered qualified. Limitations and restrictions may apply. Withdrawals prior to age 59 ½ or prior to the account being opened for 5 years, whichever is later, may result in a 10% IRS penalty tax. Future tax laws can change at any time and may impact the benefits of Roth IRAs. Their tax treatment may change.

An investment in the Money Market Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund.

Asset allocation does not ensure a profit or protect against a loss.

This article was prepared by WriterAccess.

LPL Tracking # 1-05355828

A Retirement Countdown Checklist: 5 Steps to Consider Before Retirement

Whether you’re hoping to retire soon or are just beginning to explore the idea of stepping back from your job, you’re probably wondering how to make it happen. Will you have enough money? How will you spend your time? What will you do for health insurance? Here, you’ll find a useful countdown of the five biggest steps to developing a solid retirement plan.

5. Assess Your Retirement Goals

What does retirement look like for you? Do you plan to or want to continue working part-time? Will you travel? Do you want to sell your home and hit the road in an RV? At what age will you claim Social Security? When will you qualify for Medicare?

Everyone’s retirement goals are different, which means your financial plan for retirement will also be different.

4. Decide How to Draw Down Savings

Depending on whether your assets are held in a pre-tax account, a post-tax account, or a taxable account, your savings drawdown strategy can vary widely. Your age can also dictate when, how, and how much you withdraw from your retirement accounts. For example, if you plan to retire before age 59.5, you may want to first begin withdrawing funds from a taxable account to provide flexibility until you’re able to take penalty-free withdrawals from a 401(k) or a traditional IRA.

3. Enlist a Financial Professional

If you don’t yet have a dedicated financial professional, now may be the time to assess your retirement readiness and work to optimize your income and assets as you enter retirement. You don’t want to find yourself in a position where your retirement needs exceed your income or assets and you’re forced to scale down—or even go back to work—after you’ve already been enjoying retirement for a few years.

2. Survey Potential Large Expenses

Beginning your retirement with multiple large, unexpected expenses can send even the most carefully planned budgets off track. Before you retire, consider some of the biggest expenses that are likely to come your way.

● Will your home need new windows or a new roof soon?

● Are your major appliances—washer and dryer, dishwasher, refrigerator, HVAC—getting older?

● How much longer do you expect your vehicle to last?

● Is your health plan switching to a high-deductible one?

By planning for large expenses before you retire, you can work to ensure these costs won’t catch you by surprise.

1. Begin Planning Your Estate

Whenever you’re making a big financial shift or embarking on a new phase of your life, it’s important to revisit and assess your estate plan. If you pass away without a valid will or other estate plan, your heirs could find themselves embroiled in a messy, expensive court battle to reclaim and divide your assets.

In some cases, you may only need a will to dispose of your assets in the way you’d like. Other situations may call for an irrevocable trust or some other multifaceted approach to managing your estate. Talking to an attorney and your financial professional can give you a better idea of the options available to you and where each different path may lead.

Important Disclosures

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) and options may be appropriate for you, consult your financial professional prior to investing or withdrawing.

This information is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

This article was prepared by WriterAccess.

LPL Tracking # 1-05337697.

What Veterans Should Know About Retirement Planning

Veterans’ retirement benefits are among some of the most generous out there, in large part due to the risks and sacrifices that come from military service. But navigating this array of benefits may seem complicated. What should veterans know about their military retirement plans?

When are Veterans Eligible for Retirement?

Veterans who are injured in the service may be eligible for retirement benefits within five years of sustaining a disability. Others may be eligible after accruing 25 years of service or at age 50 after accruing 20 years of service. Other retirement eligibility dates may apply to those whose agencies are being reorganized, those who have been laid off through a reduction in force (RIF), or those who have transferred to a new employer. For veterans, there’s rarely a one-size-fits-all answer to “when can I retire?” It’s a good idea to talk through your retirement plans with an OPM employee to make sure you’re on track.

Veteran Retirement Benefits

Some of the retirement benefits that are available to veterans include:

These benefits are in addition to any other retirement benefits that a veteran may have accrued, like an individual retirement account (IRA), Health Savings Account (HSA), or other savings plans. The amount you may receive depends on factors like your length of service, your age at retirement, the amount you’ve contributed to your Thrift Savings Plan or other 401(k)-like plan, and your average earnings over your career. In general, the higher your regular pay, the greater your pension payment.

Preparing for Retirement

During the year or two before your retirement, it may make sense to prepare to make the retirement process as streamlined as possible. Some key steps include:

-

Confirming your retirement eligibility

-

Choosing a retirement date

-

Getting information about your available retirement benefits

-

Reviewing your official personnel folder (OPF) or equivalent folder to ensure that your records include all eligible service

-

Choosing eligible beneficiaries (like a spouse or children)

-

Checking your health benefits records

If there are errors or omissions in any of these records, it’s important to correct them as quickly as possible. Otherwise, you may not be able to receive all the retirement benefits to which you’re entitled.

Important Disclosures

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual.

All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

LPL Tracking # 1-05186914

Sources

Treat Yourself to These 5 Retirement Saving Tricks

Your retirement is the reward after years of hard work and saving. You might dream of traveling, want to invest in a vacation home, or want to take up a new hobby. For an enjoyable retirement, saving is critical. Take charge of your retirement and work toward your goals with the help of these few tips and tricks.

1. Take Advantage of a Company 401(k) Match

When a company provides a matching contribution for your retirement savings, it is like getting free money to invest. This strategy may help your portfolio grow larger. Find out the amount of your 401(k) contribution that your company matches, and make sure you contribute that much to your 410(k). This strategy is like getting an extra company bonus each year.1

2. Start Early

No matter your age, you may save for retirement. The longer your money is invested, the greater chance you may have that your savings grows. Make your savings allocations a part of your monthly budget, like any other bill. Take advantage of payroll contributions if you have a company 401(k). If you set up an automatic savings process, you put money away with each paycheck without thinking about it.2

3. Fully Fund a Health Savings Account

Healthcare costs continue to rise yearly, and you may face significant health expenses as you age. Consider contributing money to a health savings account to prepare for these costs. When you contribute to a health savings account, it is tax deductible. You may withdraw the money tax-free as needed to pay for qualified medical expenses. In 2022, you may contribute up to $7,300 annually for a family and $3,650 for an individual. While a health savings account is a way to prepare for medical costs, it is also a way to help save for retirement. Once you hit 65, you may use the funds in the account to pay for anything, not just healthcare expenses.1

4. Find the Perfect Place to Retire

When saving for retirement, it is essential to know your goals for retirement and where you plan to retire. If you are considering moving for retirement, you might find a state that may help your money go further. Many states are good for retirees. Some have great weather, some top-notch health care services, and others do not impose a state tax. Not paying state tax on your retirement funds may make retirement easier.1

5. Look for Tax Advantages at 50

Taxes may get a little easier for you once you are at the age of 50. As you get nearer to retirement, you may take advantage of the increased limits for retirement contributions. This additional amount may help boost your retirement savings while taking advantage of the tax breaks that retirement plans offer. After age 50, contributions to a traditional individual retirement account (IRA) or a Roth IRA may increase from $6,000 to $7,0003, and you may contribute an additional $6,500 to your employer-sponsored plan.1

Get your retirement savings on track by utilizing these tips.

Important Disclosures

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

Contributions to a traditional IRA may be tax deductible in the contribution year, with current income tax due at withdrawal. Withdrawals prior to age 59 ½ may result in a 10% IRS penalty tax in addition to current income tax.

The Roth IRA offers tax deferral on any earnings in the account. Withdrawals from the account may be tax free, as long as they are considered qualified. Limitations and restrictions may apply. Withdrawals prior to age 59 ½ or prior to the account being opened for 5 years, whichever is later, may result in a 10% IRS penalty tax. Future tax laws can change at any time and may impact the benefits of Roth IRAs. Their tax treatment may change.

All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

This article was prepared by WriterAccess.

LPL Tracking #1-05313109.

Footnotes

1 8 Essential Tips for Retirement Saving, Investopedia, https://www.investopedia.com/articles/investing/111714/8-essential-tips-retirement-saving.asp

2 How to Win at Retirement Savings, The New York Times, https://www.nytimes.com/guides/business/saving-money-for-retirement

3 Retirement Plans FAQs Regarding IRAs, Internal Revenue Service, https://www.irs.gov/retirement-plans/retirement-plans-faqs-regarding-iras

Short-Term Goals vs. Retirement Savings

Too many focus on immediate needs versus saving for retirement

American workers find it difficult to save for retirement because their distant financial needs tend to take a backseat to more immediate economic concerns, even if they have their day-to-day finances under control or are financially literate, according to a study by the Center for Retirement Research at Boston College.

In the issue titled: “Are Americans of All Ages and Income Levels Shortsighted About Their Finances?” researchers Steven A. Sass and Jorge D. Ramos-Mercado analyzed the results of a FINRA Investor Education Foundation survey to determine how Americans balance the need for long-term saving with their current financial concerns. The survey sample included 9,473 households in which the main respondent was between the ages of 25 and 60.

The Study

To examine the question of whether the financial assessments of workers at all income levels are shortsighted, the study created three age groups (25-34, 35-50, and 50-60) and divided each age group into terciles (three groups) based on household income, adjusted for household size.

The study looked at the respondents’ answers to questions about how satisfied they are with their personal financial condition, and about the extent to which they are able to meet specific day-to-day and distant financial needs.

The indicators used for day-to-day problems were “difficulty covering expenses,” “heavy debt burdens,” “unemployment,” and “inability to access $2,000;” while the indicators used for distant problems were “no retirement plan,” “no life insurance,” “no medical insurance,” “mortgage underwater,” “not saving for college,” and “concern about repaying student loans.”

Financial Problems Varied More by Income

Not surprisingly, the analysis showed that the incidence of financial problems varied much more by income than it did by age, as deficiencies were much more prevalent in lower- than in higher-income households.

For example, the findings indicated that 80% of households in the bottom income tercile, but only 33% of households in the top income tercile, reported that they were have difficulties covering expenses.

However, the results also showed that among respondents of all income levels and age groups, having problems with day-to-day expenses was associated with large statistically significant reductions in financial satisfaction, whereas the relationship between financial satisfaction and distant problems was much more muted. Among the distant problems, only not saving for college and not having medical insurance were associated with statistically significant reductions in satisfaction in all three age groups.

The findings further indicated that the relationships between financial assessments and specific deficiencies varied much less by income than they did by age, with people of different ages having different concerns.

For example, the inability to access $2,000 and the inability to repay college loans were associated with much larger reductions in satisfaction at younger ages, whereas having heavy debt burdens and an underwater mortgage were associated with greater reductions in satisfaction at middle and older ages.

Financial Planning Matters

The major exception to this pattern was in the area of retirement planning: the results indicated that there was no relationship between having no retirement plan and financial satisfaction among workers in any age group, and that having no retirement plan was associated with a statistically significant reduction in financial satisfaction among respondents in the top income tercile only.

Sass and Ramos-Mercado concluded that Americans of all ages and income levels appear to be shortsighted about their finances. The authors therefore recommended that steps be taken to make it easy and automatic for households to save enough to secure a basic level of financial well-being in retirement.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial professional prior to investing. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and cannot be invested into directly. All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

This article was prepared by RSW Publishing.

LPL Tracking # 1-05056219

401(K): The Preferred Vehicle for Retirement Savings

A 401(k) retirement savings plan is one of the most desirable fringe benefits a small business can offer. For a business owner, it can help strengthen a company’s position when competing for top talent. It can also be structured to help retain employees once they are hired. For employees, a company-sponsored 401(k) plan offers an excellent way to build a retirement nest egg through tax-deferred savings.

In Brief

A 401(k) plan allows each employee to set aside part of his or her salary, subject to certain limitations, in a separate account to grow on a tax-deferred basis. Participants have the flexibility to choose from among a variety of funding options offered by the plan. Employers may contribute to employee accounts by matching a percentage of their employees’ contributions. Withdrawals usually occur at retirement—when plan participants are more likely to be in a lower income tax bracket.

Possible Advantages

The benefits of a 401(k) plan are numerous and may include some, or all, of the following:

Pre-Tax Contributions Employee contributions are typically made on a pre-tax basis, subject to certain limitations. By lowering their taxable salary or wages, plan participants are able to lower their income tax for each year they participate.

Employer Matching Contributions Some employers match contributions up to a certain percentage. For instance, with a 50% match, an employer would contribute $0.50 for every $1.00 an employee contributes. The advantage of matching contributions generally depends on the level of the match and the employer’s vesting requirements.

“Vesting” refers to an employee’s right to the funds in his or her account. An employee’s contributions, and the earnings on those contributions, are fully vested from his or her start in the plan. An employer’s matching contributions vest according to a schedule that usually depends on the employee’s length of service. Thus, an employer can arrange the vesting schedule to reward and retain employees by fully vesting plan participants after, say, five years.

Variety of Funding Options Plan participants may select from a variety of funding options. Most plans also allow employees to change their funding choices periodically to reflect their individual needs and goals.

Tax-Deferred Earnings Earnings on any contributions accumulate on a tax-deferred basis. This includes earnings on matching contributions made by employers.

After-Tax Contributions Many plans also allow employees to make after-tax contributions, subject to certain limitations. While these contributions do not lower the current year’s income tax, as do pre-tax contributions, they accumulate earnings on a tax-deferred basis.

Restrictions

As with all retirement plans, 401(k) plans have certain limitations:

Limits for Highly Compensated Employees (HCEs) The contributions of HCEs may be limited if lower paid employees do not contribute a sufficient amount. Every year, plan administrators must perform certain “top-heavy” tests to determine the maximum amount HCEs may contribute.

Taxation at Withdrawal Plan participants are subject to income taxes for pre-tax contributions when they withdraw the funds. However, after-tax contributions are not subject to further taxation when withdrawn.

Early Withdrawal Penalty Withdrawals prior to age 59½ may occur only under certain circumstances and, when allowed, may be subject to a 10% early withdrawal penalty.

A 401(k) plan offers advantages for both employer and employees. For business owners, it can help attract and retain desirable employees. For employees, a 401(k) plan, when combined with income from other sources, such as Social Security, a pension, and personal savings, can help them work towards their retirement objectives. It’s no wonder that, for many, 401(k) plans have become the preferred vehicle for retirement savings.

Important Disclosures

This material was created for educational and informational purposes only and is not intended as ERISA or investment advice. If you are seeking investment advice specific to your needs, such advice services must be obtained on your own separate from this educational material.

Investing involves risks including possible loss of principal.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

This article was prepared by Liberty Publishing, Inc.

How to Manage Savings for Retirement

Whether you dream of a travel-filled retirement or would prefer to relax and enjoy spending more time at home, you are probably wondering what you might consider to make your golden years as stress-free as possible.

For those who spent the last several decades in a wealth-accumulation mode, withdrawing savings may trigger anxieties about the future. Some of the choices you may make during the earliest years of retirement may significantly alter the speed with which you spend down your retirement savings.

Moving to a State with No (or Low) Income Taxes

Nine states do not have any income tax on personal income: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming. Although New Hampshire does not tax wage income, it does charge a 5% state tax on dividend payments and interest income received by individuals.1

Retiring and establishing residence in one of these states with no personal income tax can save the significant amount of state income tax levied in other states for every 401(k) or individual retirement account (IRA) withdrawal you may take. For example, California, Hawaii, and New Jersey have the highest tax rates for those in the top income brackets.

California’s personal income tax rates start at 1% and go up to 13.3% for income above $599,012. Hawaii’s personal income tax rates start at 1.4% go up to 11% for income above $200,000. New Jersey’s personal income tax rates start at 1.4% go up to 10.75%.2

There are certainly trade-offs to this approach, as low-income-tax states may have significant sales taxes, higher property taxes, or may offer fewer public services than those found in states with higher taxes. Nevertheless, state income tax rates are worth investigating for those looking to preserve their retirement savings.

In some cases, it may make sense to plan a move to a no-tax state to establish residency in the year before you begin taking any required minimum distributions (RMDs). Use this strategy correctly, and you have to pay only federal income taxes on these RMDs.

For most states, spending more than 183 days (half a year) in that state during a single year makes a person a resident of that state. 3

Deciding When to Take Social Security Benefits

Another important factor in preserving your retirement savings involves when to take Social Security benefits. The earlier you claim, the less you receive per month. Waiting until age 70 to request Social Security benefits increases the monthly payment.

But while it may seem sensible to put off Social Security so that your total benefit is as large as possible, this approach has other considerations. Taking Social Security earlier may reduce the amount you need to withdraw from retirement accounts, helping these funds continue to grow until your RMDs begin at age 72 (70 ½ if you reached 70 ½ before January 1, 2020). If you have health problems that could shorten your life, taking early Social Security payments may also make sense.

A financial professional may help you consider different scenarios to get ideas of when it makes sense for you to claim Social Security.

Considering Guaranteed Income Products

Social Security benefits are one form of guaranteed income. But because these benefits cap out at $4,194 in 2022 (for the highest earners who delay claiming until they are 70 years old), the benefits may not be enough to support a previously high-income household.4

Guaranteed income products such as annuities have the potential to provide a monthly source of extra income to help maintain an acceptable lifestyle during retirement.

Important Disclosures

This material was created for educational and informational purposes only and is not intended as ERISA, tax or investment advice. If you are seeking investment advice specific to your needs, such advice services must be obtained on your own separate from this educational material.

We suggest that you discuss your specific tax issues with a qualified tax advisor.

Contributions to a traditional IRA may be tax deductible in the contribution year, with current income tax due at withdrawal. Withdrawals prior to age 59 ½ may result in a 10% IRS penalty tax in addition to current income tax.

Fixed and Variable annuities are suitable for long-term investing, such as retirement investing. Gains from tax-deferred investments are taxable as ordinary income upon withdrawal. Guarantees are based on the claims paying ability of the issuing company. Withdrawals made prior to age 59 ½ are subject to a 10% IRS penalty tax and surrender charges may apply. Variable annuities are subject to market risk and may lose value.