5 Questions to Find Out – Is a Roth IRA Conversion Right for You?

When considering a Roth IRA conversion, the decision often comes with questions and complexities. A Roth conversion involves transferring funds from a traditional IRA into a Roth IRA, paying taxes on the amount converted today, in exchange for tax-free growth potential and withdrawals in the future. Let’s explore when a Roth conversion makes sense, what to consider, and some real-life scenarios to help guide your decision-making process.

Five Key Questions to Ask Before a Roth Conversion

-

What is my current tax bracket, and how might it change in the future?

Converting to a Roth IRA involves paying taxes now, so understanding your current and future tax rates is critical.

-

Do I have the cash available to pay the taxes?

Using funds outside your IRA to pay the taxes is often a better strategy than withdrawing from the IRA itself.

-

What is my time horizon for needing these funds?

A longer time horizon provides more opportunity for tax-free growth, making a conversion more advantageous.

-

Will this conversion push me into a higher tax bracket?

Converting too much in one year can increase your taxable income significantly.

-

Am I planning to leave a legacy?

Roth IRAs offer tax-free inheritance benefits, making them a strategic option for wealth transfer.

When Does a Roth Conversion Make Sense?

-

During a Market Downturn

Converting during a market downturn means you pay taxes on a reduced account value. When the market recovers, those gains grow tax-free in the Roth IRA.

-

In Low-Income Years

If you anticipate your income will be lower for a specific period, converting in those years can minimize the tax burden.

-

Before Required Minimum Distributions (RMD’s) Begin

Converting before age 73 (when RMD’s start) can reduce your taxable income during retirement.

-

For Legacy Planning

Roth IRAs do not require RMD’s for the account owner, allowing growth potential tax-free for heirs.

-

To Hedge Against Future Tax Rate Increases

If you expect tax rates to rise in the future, paying taxes now at a lower rate may save money in the long term.

Benefits of a Roth IRA Conversion

-

Tax-Free Growth Potential and Withdrawals:

- Once funds are in a Roth IRA, they grow tax-free and can be withdrawn tax-free after age 59½ and meeting the five-year rule.

-

No RMD’s:

- Unlike traditional IRA’s, Roth IRA’s do not require account holders to take RMDs, allowing growth potential tax-free.

-

Legacy Benefits:

- Roth IRA’s can be inherited tax-free by your beneficiaries, providing a valuable wealth transfer tool.

When It Makes Sense to Stay with a Traditional IRA

-

If You Expect Lower Taxes in Retirement:

- If you anticipate being in a significantly lower tax bracket in retirement, paying taxes then may be more advantageous.

-

If You Don’t Have Funds to Pay Taxes:

- Using IRA funds to pay taxes can reduce the benefits of the conversion.

-

If the Conversion Pushes You into a High Tax Bracket:

- Large conversions can create unintended tax consequences.

Real-Life Examples of Roth Conversions

Example 1: Lower Tax Bracket Year

Sarah, 57, transitioned to part-time work and had a significantly lower income for two years. She used this window to convert $50,000 of her IRA to a Roth, paying taxes at a reduced rate. With over a decade before needing the funds, she now enjoys tax-free growth potential and confidence knowing her heirs will inherit the Roth tax-free.

Example 2: Market Downturn Conversion

David, 63, saw his IRA balance drop by 20% during a market downturn. He converted $100,000 to a Roth IRA, paying taxes on the reduced value. When the market recovered, the gains accrued tax-free, significantly increasing the after-tax value of his retirement savings.

A Thoughtful Approach to Roth Conversions

Roth conversions can be a powerful tool in your financial strategy but must be approached carefully. Your decision should factor in current and future taxes, cash flow, and long-term goals. While the benefits can be substantial, a Roth conversion isn’t right for everyone.

Before making a conversion, consult with your financial and tax advisors to evaluate your unique situation and ensure the strategy aligns with your broader financial plan.

Important Disclosures:

For additional guidance on Roth conversions and other wealth planning strategies, contact Gatewood Wealth Solutions. Our team is here to help you navigate your financial future with confidence.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investing involves risk including loss of principal. No strategy assures success or protects against loss.

This information is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor.

Traditional IRA account owners have considerations to make before performing a Roth IRA conversion. These primarily include income tax consequences on the converted amount in the year of conversion, withdrawal limitations from a Roth IRA, and income limitations for future contributions to a Roth IRA. In addition, if you are required to take a required minimum distribution (RMD) in the year you convert, you must do so before converting to a Roth IRA.

Securities and advisory services offered through LPL Financial, a Registered Investment Advisor, Member FINRA/SIPC

The Cash Strategy That Could Transform Your Wealth in 2025

What if the money sitting in your savings account—the cash you think isn’t “working hard enough”—is actually your most powerful wealth-building tool?

When Everything Changed for the Johnsons

Meet David and Sarah Johnson. Successful professionals. Smart investors. They’d been told by their previous advisor to “put every dollar to work” and minimize cash holdings. When the 2008 market crash hit, they watched their retirement accounts plummet just as David lost his job.

With no meaningful cash reserves, they faced an impossible choice: liquidate investments at their lowest point to pay bills, or rack up debt on a line of credit their advisor had recommended as a “cash alternative.”

They chose the line of credit. Big mistake.

By the time David found work eighteen months later, they’d accumulated $75,000 in debt at variable interest rates. Worse, they’d missed the entire market recovery because every spare dollar went to paying down that debt instead of buying investments at rock-bottom prices.

The Johnsons learned a hard lesson:

It’s not what you make on cash that matters, but what cash allows you to make on everything else.

The Gatewood Cash Philosophy: Savings vs. Investments

At Gatewood Wealth Solutions, we make a crucial distinction that most advisors ignore. Savings are inherently less risky, and the funds are liquid. Investments are 100% at risk 100% of the time. This isn’t just semantics. It’s the foundation of building enduring wealth with purpose.

Many advisors will tell you to “put your cash to work” in something “safe.”

Here’s the truth: there is no such thing as a safe investment. All investments carry the risk of loss. When someone says they want their cash to “make money,” they’re confusing the purpose of cash with the purpose of investments.

Cash serves two critical functions in wealth building:

- To avoid liquidating investments at the wrong time

- To seize opportunities

Notice both purposes matter most when investment values decline. That’s not coincidence—it’s strategy.

What This Means: The Mathematics of Opportunity

Let’s examine what happened to Jane, a hypothetical 65-year-old retiree with a $2 million IRA, planning to withdraw $140,000 annually (7% of her initial balance). ¹

Scenario 1: No Cash Strategy

Jane withdraws systematically from her S&P 500 investments regardless of market performance during the period 1973-1988.

Result at age 80: $1,442,897.

Scenario 2: Strategic Cash Reserve

Jane uses cash reserves during the four down market years, preserving her investments when values are depressed.

Result at age 80: $3,763,052.

The difference? A staggering $2.3 million.

Here’s what makes this remarkable: the investment performance was identical in both scenarios. The only difference was having $478,146 in cash to tap during down years.

Even if Jane earned absolutely nothing on that cash, her outcome was dramatically better.

Why This Matters: The Line of Credit Trap

Most advisors today recommend lines of credit as “cash alternatives.” They’ll say, “Why keep cash earning nothing when you can access credit when needed?”

This approach adds both cost and risk to your financial plan.

The Hidden Costs:

- Interest payments on borrowed funds

- Variable rates that can spike unexpectedly

- Loan payments that prevent you from buying investments when they’re cheapest

- Credit limits that can be reduced exactly when you need them most

The Real Risk: Lines of credit turn temporary market downturns into permanent wealth destruction. Instead of having cash to weather storms and capture opportunities, you’re paying interest and missing recoveries.

At Gatewood, we believe wealth is personal. Your cash needs are unique to your situation, your goals, and your confidence.

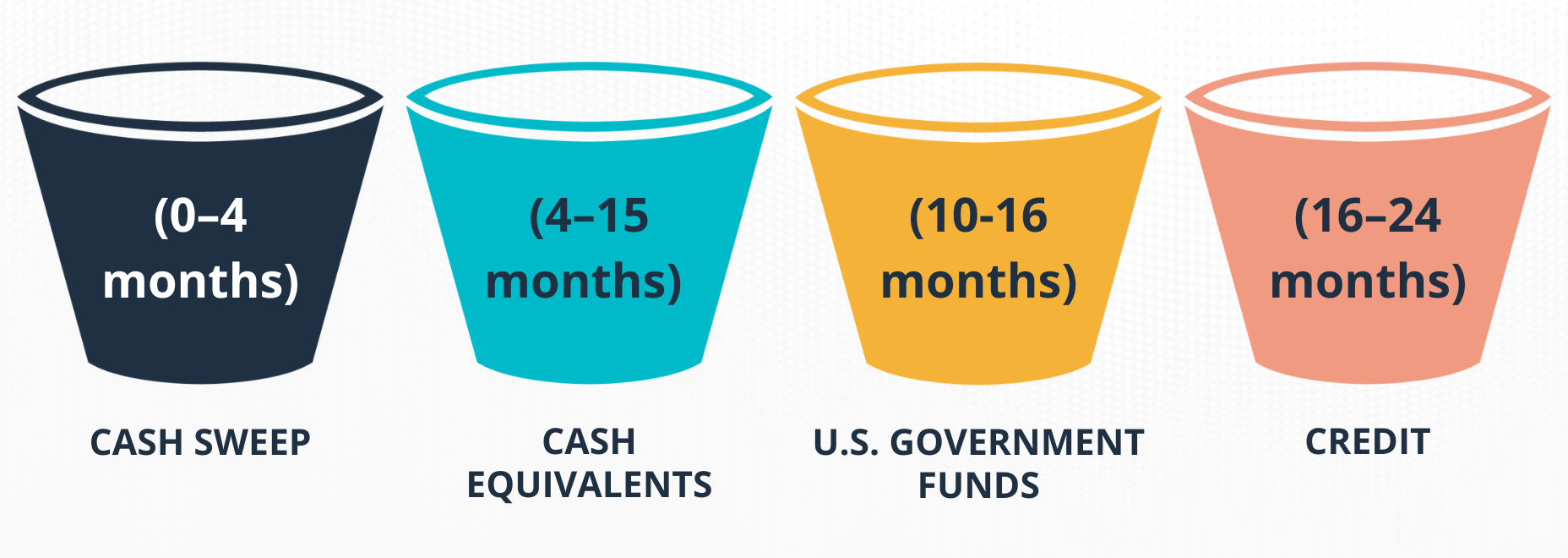

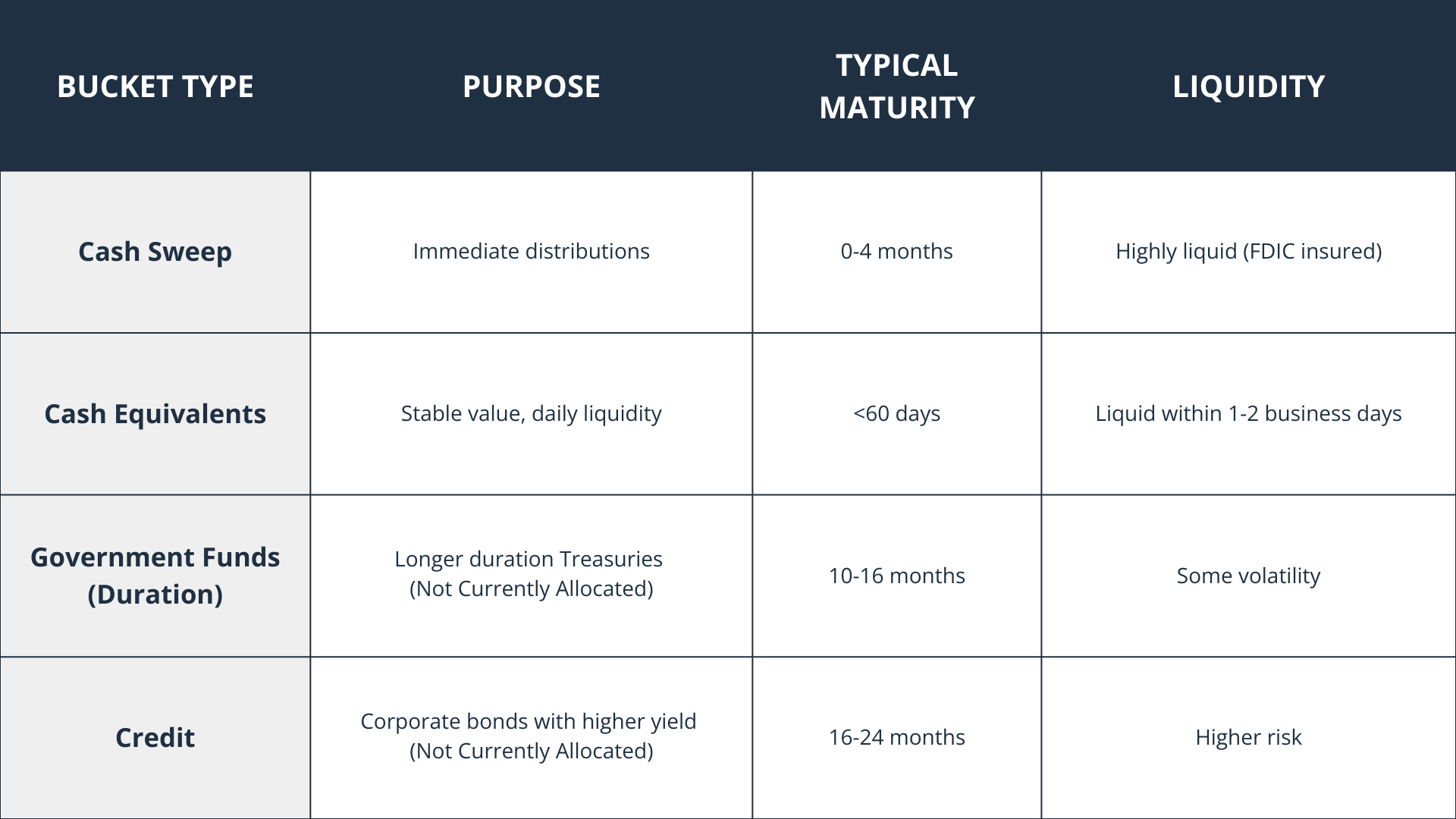

The Gatewood Cash Formula

Our process-driven approach calculates your optimal cash position based on your life stage:

Accumulation Phase:

3-6 months of expenses for emergencies. This protects your systematic investing strategy (dollar-cost averaging) from being derailed by life’s unexpected moments.

Approaching Retirement:

Gradual accumulation toward your 24-month target, ensuring you enter retirement with adequate liquidity.

Distribution Phase:

24 months of your income shortfall after guaranteed sources like Social Security and pensions. This creates a buffer that allows your investments to recover from market downturns.

An Analogy That Clicks

Think of cash like the foundation of a house.

You don’t build a foundation to be beautiful or to generate income. You build it to support everything else. The stronger your foundation, the taller and more ambitious your structure can be.

Cash works the same way in your financial plan. It’s not there to generate returns—it’s there to support higher returns in your investment portfolio by giving you the confidence to take appropriate risks and the flexibility to act when opportunities arise.

Would you rather have a beautiful foundation that crumbles under pressure, or a solid foundation that allows you to build wealth that endures?

When Lines of Credit Do Make Sense

To be clear, we’re not opposed to all forms of credit. Securities-backed lines of credit can serve a strategic purpose in specific, short-term situations where cash flow timing creates temporary gaps.

For example, if you’re buying a new home before your current one sells, a securities-backed line provides bridge financing without forcing you to liquidate investments or miss out on your dream property.

Similarly, if you’re expecting a substantial bonus, stock options vest, or you’re closing on the sale of a business within a few months, using credit to bridge that gap can make perfect sense. The key distinction is timing and certainty.

These are situations where you have reasonable confidence that cash will follow in a relatively short period—typically 3-6 months. What we caution against is using lines of credit as a permanent cash substitute or relying on them for unpredictable expenses where the repayment timeline is uncertain.

The difference between strategic short-term leverage and dangerous cash replacement is the difference between a useful tool and a wealth destroyer.

Other circumstances where securities-backed lines of credit might make sense include:

- Tax payment timing (when you know a refund is coming)

- Seasonal business cash flow needs with predictable revenue cycles

- Taking advantage of a time-sensitive investment opportunity when a planned asset sale is imminent

- Emergency situations where immediate access is needed and cash reserves are being replenished through planned distributions

The Gatewood Difference

While other advisors chase yield on every dollar, we focus on purpose. We keep your priorities the priority.

Our relationship-driven approach means we understand your unique situation, your concerns about market volatility, and your need for confidence in uncertain times. The true value of planning is the confidence it creates.

We’re not product-driven—we’re process-driven. We don’t sell you investments. We guide you through building enduring wealth with purpose so you can have confidence for life’s key moments.

With expertise and care, our team monitors your cash position throughout different market cycles, adjusting as opportunities arise or as your circumstances change.

What Happens Next

During strong markets, we deploy cash strategically at lower valuations. As markets reach new highs, we begin raising cash by taking profits in specific asset classes. During weak markets, we may redeploy cash at lower valuations or spend down reserves to give investments time to recover.

This isn’t market timing—it’s strategic cash management that puts you in control of your financial destiny.

Your Next Step

If you’re tired of advisors treating every dollar the same, if you want a wealth strategy built around your unique situation and goals, if you’re ready to discover how proper cash management can supercharge your investment returns, we should talk.

Don’t let another market cycle catch you unprepared. Don’t rely on debt to fund opportunities or weather storms.

Ready to discover what your cash can really do for your wealth?

Schedule a conversation with our team to learn how Gatewood’s cash philosophy can transform your financial confidence. Because at Gatewood Wealth Solutions, we understand that wealth with purpose starts with understanding what each dollar should accomplish.

Remember: It’s not what you make on cash that matters, but what cash allows you to make on everything else.

References

(1) Hypothetical example for illustrative purposes only. Beginning value $2,000,000 in IRA; S&P 500 historical return during 1973-1987, including dividends; $140,000 withdrawal each year: $0 withdrawal in years after a negative return except for required minimum distribution. These numbers do not reflect fees and charges associated with an actual investment. Historical S&P 500 returns from Bloomberg. The S & P 500 Index is a list of securities frequently used as a measure of U.S. Stock Market performance. Required minimum distributions from the IRA under Federal Tax Law. Source of diagrams from Northwestern Mutual’s brochure, “Down Markets Matter”, 67-0788 (0715).

(2) Investopedia – A required minimum distribution (RMD) is the amount that traditional, SEP or SIMPLE IRA owners and qualified plan participants must begin distributing from their retirement accounts by April 1 following the year they reach age 70.5. RMD amounts must then be distributed each subsequent year based on the current RMD distribution calculation amounts. http://www.investopedia.com/terms/r/requiredminimumdistribution.asp#ixzz4nzGcn0T4

(3) The primary purpose of permanent life insurance is to provide a death benefit. Using cash values to supplement your retirement income will reduce the benefit and may affect other aspects of your life insurance plan. Accessing the cash values through policy loans, surrenders of dividend values, or cash withdrawals will or could; reduce death benefit; necessitate greater outlay than anticipated; or result in an unexpected taxable event. Assumes a non-Modified Endowment Contract (MEC).

(4) Dollar-cost averaging (DCA) is an investment technique of buying a fixed dollar amount of a particular investment on a regular schedule, regardless of the share price. The investor purchases more shares when prices are low and fewer shares when prices are high. Dollar Cost Averaging (DCA) – Investopedia www.investopedia.com/terms/d/dollarcostaveraging.asp

(5) Higher returns are not guaranteed through this strategy. However, it is a sound strategy to help manage downside risk and can achieve improved outcomes as explained in the retirement distribution example in this report.

Important Disclosures:

¹This is a hypothetical example and is not representative of any specific investment. Your results may vary. (88-LPL)

Securities and advisory services are offered through LPL Financial, a registered investment advisor and broker-dealer, Member FINRA/SIPC.

Insurance products are offered through LPL or its licensed affiliates. Gatewood Wealth Solutions is not registered as a broker-dealer or investment advisor. Registered representatives of LPL offer products and services using Gatewood Wealth Solutions and may also be employees of Gatewood Wealth Solutions. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, Gatewood Wealth Solutions.

Securities and insurance offered through LPL or its affiliates are:

- Not Insured by FDIC or Any Other Government Agency

- Not Bank Guaranteed

- Not Bank Deposits or Obligations

- May Lose Value

A Smarter Glide Path for College Savings

Most 529 plans take a conservative approach to risk. What if being too cautious early on means leaving thousands of dollars on the table?

At Gatewood Wealth Solutions, we believe the key to smarter college savings is compounding earlier—when you have the time—and only dialing back risk when it truly matters. In this post, we walk through our custom 529 glide path and compare it to the most common industry average.

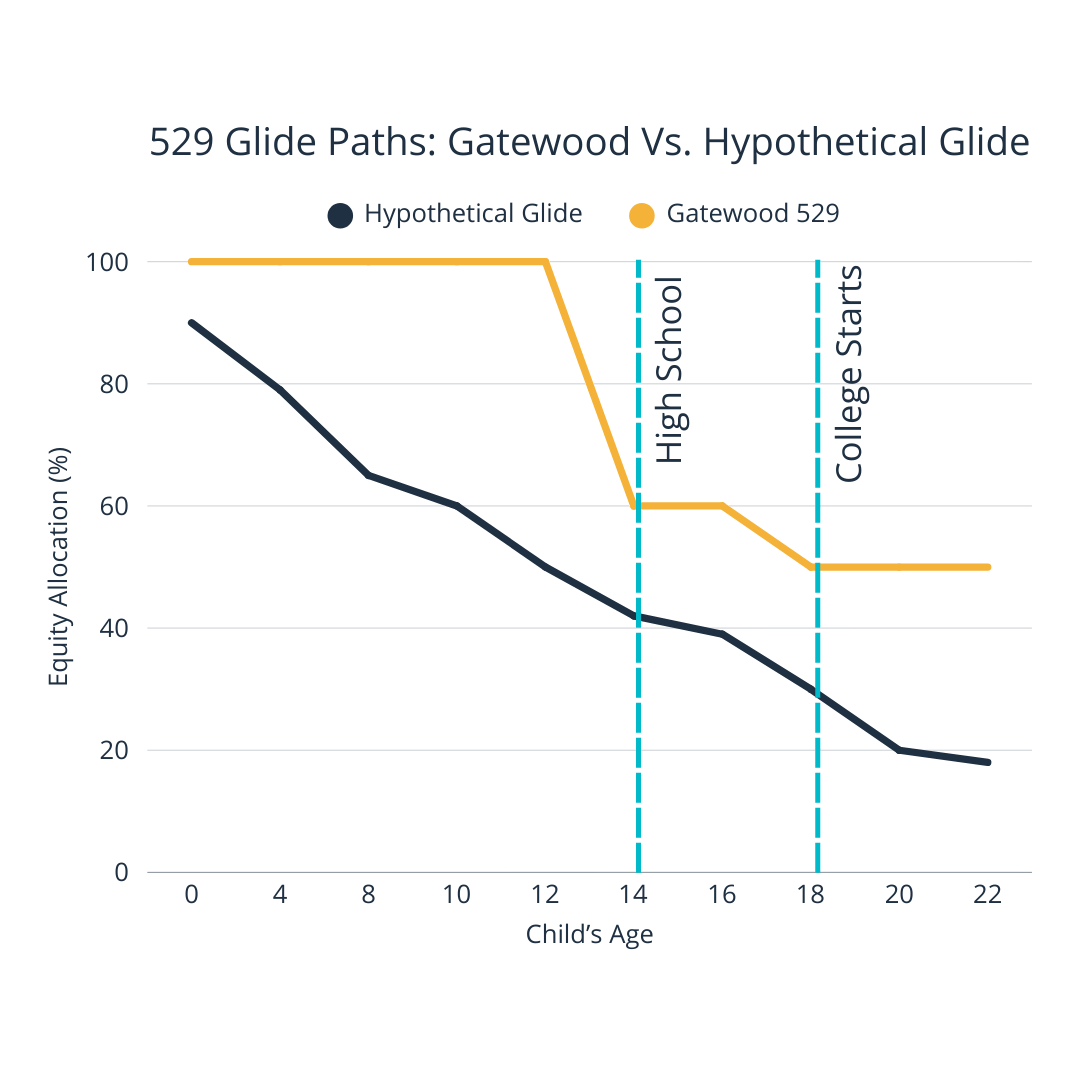

Why Glide Paths Matter in 529 Plans

Glide paths are automated investment changes. In 529s, most glide paths reduce equity (stocks) and increase fixed income (bonds/cash) as the beneficiary enters elementary school. It sounds sensible, but the problem is: these providers reduce risk far too early.

Most Gatewood clients don’t touch 529 money until the first year of college. Even then, withdrawals happen over four years. Many families don’t fully spend the accounts at all—preserving them for legacy planning. If the money is invested too conservatively for too long, it underperforms significantly.

That’s where the Gatewood Glide stands apart.

Our Glide Path

Gatewood’s 529 Glide:

- Starts at 100% equity

- Moves to 60% equity/40% bonds at high school entry (~age 14)

- Drops to 30% equity / 40% bonds / 30% cash at college entry (~age 18)

This gives investors the opportunity to benefit from long-term market growth while still adjusting tactically later if needed.

Glide Path Comparison: Equity Allocation by Milestone

| Plan | Starting Equity | Equity at HS Entry | Equity at College Entry | Avg Equity Allocation |

| Gatewood 529 | 100% | 60% | 30% | 85% |

| Hypothetical Glide 529 | 95% | 30% | 15% | 56% |

Equity Glide Paths

Why It Matters

We are a regulated industry, so publishing expected equity returns can be difficult. However, investors are aware of a consistent equity premium earned in the long run from taking equity risk over fixed income and cash.

Eighteen years is a long-term horizon. We believe that maintaining an average allocation above 80% equity during the growth years aims to lead to better results compared to the typical glide, which tends to average below 60% equity.

Finally, 529 plans are more than just tax shelters. They’re strategic long-term tools. By defaulting too conservative, traditional glide paths underserve many families. At Gatewood, we believe in giving your savings room to grow, with thoughtful transitions when the time is right.

Our 529 strategy reflects how clients really use their plans:

- Continued contributions during high school

- Maintain flexibility around college withdrawals

- Preserve asset for legacy planning

If you’re interested in building a 529 plan that aligns with your goals, we’re here to help.

Building a Better 529 Plan Strategy

Also read: Rethinking the 529: A Legacy Vehicle Hiding in Plain Sight

Explore how 529 plans can extend beyond college savings and support multi-generational wealth planning.

Important Disclosures

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investing involves risk including loss of principal. No strategy assures success or protects against loss.

This is a hypothetical example and is not representative of any specific situation. Your results will vary. The hypothetical rates of return used do not reflect the deduction of fees and charges inherent to investing.

Prior to investing in a 529 Plan investors should consider whether the investor’s or designated beneficiary’s home state offers any state tax or other state benefits such as financial aid, scholarship funds, and protection from creditors that are only available for investments in such state’s qualified tuition program. Withdrawals used for qualified expenses are federally tax free. Tax treatment at the state level may vary. Please consult with your tax advisor before investing.

The 10 Reasons People Choose Gatewood as Their Financial Advisor

The 10 Reasons Why People Hire a Gatewood Advisor

When considering a financial advisor, clients typically interview just one or two firms. At Gatewood Wealth Solutions, we recognize the importance of making a lasting first impression that aligns with our clients’ core values and expectations. Inspired by insights from financial expert Michael Kitces and Morningstar’s 2023 study “Why Do People Hire Their Financial Advisors?”¹ we’ve refined the top ten reasons our clients choose Gatewood:

Emotional Drivers

-

Trust & Integrity

Trust forms the foundation of every advisory relationship. At Gatewood, we prioritize transparency and fiduciary responsibility, aiming to ensure our clients feel secure knowing we always place their best interests first.

“The values-driven team of Gatewood Wealth Solutions is motivated, caring, highly competent and personally fueled by character and integrity.” — Dave M., Corporate Executive

-

Clear and Consistent Communication

We simplify complex financial concepts and maintain proactive communication. Our advisors listen deeply and seek to ensure clients always understand and feel heard throughout their financial journey.

-

Relief from Financial Anxiety

Managing finances alone can be overwhelming. Gatewood advisors provide confidence by taking the burden of financial complexity off clients’ shoulders, guiding them confidently toward their goals.

“Their unwavering support made a world of difference during such a challenging time. I am profoundly grateful for all they’ve done and continue to do for me.” — Carol S., Corporate Executive 09.20.23*

Financial Expertise

-

Personalized Investment Guidance

Gatewood offers customized investment advice meticulously aligned with our clients’ long-term objectives, so that decisions are based solely on clients’ best interests and not outside incentives.

“Gatewood Wealth Solutions gives me confidence that my retirement savings are being monitored and managed with MY best interest in mind.” — Gary B., Corporate Executive 09.27.23*

-

Specialized Problem-Solving

Our advisors are equipped to handle specific financial challenges such as tax optimization, retirement income planning, and estate management. We tailor each solution to address unique client circumstances effectively.

“Their planning services are comprehensive and consider all assets of our family, not just what they manage.” — Tim M., Partner/Attorney 09.22.23*

-

Proactive Strategic Planning

Life changes rapidly, and Gatewood advisors remain ahead of market cycles, income variations, and unexpected life events, proactively preparing clients to navigate and capitalize on these changes.

Situational Advantages

-

Personalized, Holistic Financial Plans

At Gatewood, financial planning extends beyond just numbers. We integrate our clients’ personal values, life stages, and aspirations into comprehensive strategies that align financial decisions with life goals.

“The Gatewood team developed an integrated financial and retirement plan that we refined together. I’m pleased to say we are well ahead on our plan!” — Phil P., Retired Corporate Executive 09.20.23*

-

Local Accessibility and Engagement

With our established presence in St. Louis, Gatewood clients benefit from direct access and face-to-face interactions. Our local roots and active community involvement offer reassurance and familiarity. For clients in the 30+ states outside of the St. Louis Metro Area, we frequently travel for in-person visits.

-

Tangible Quick Wins

We demonstrate value early by providing immediate, actionable insights and measurable results. Gatewood clients frequently experience beneficial outcomes quickly, reinforcing their decision to partner with us.

-

Real-Life Client Success Stories

Prospective clients appreciate authentic stories from those who’ve experienced our commitment firsthand. At Gatewood, we regularly share testimonials and case studies illustrating our dedication to client success, fostering confidence before the relationship even begins.

“As Pam and I navigate these retiring years, she and I both derive a rich sense of security knowing that John and the team at Gatewood Wealth Solutions will continue to surround and support her for as long as needed.” — Steve K., Retired Corporate Executive 09.27.23*

At Gatewood Wealth Solutions, our advisors may not address every potential motivator—but we passionately deliver on the ones that align most closely with our clients’ values: trust, clear communication, personalized strategies, and local, accessible expertise. These core areas define why our clients not only choose us initially but remain committed partners for life.

Sources:

¹Morningstar 2023, “Why Do People Hire Their Financial Advisors?” via Kitces

Important Disclosures:

*The statements provided are testimonials by clients of the financial professional as of 7/22/2025. The clients listed have not been paid or received any other compensation for making these statements. As a result, the client does not receive any material incentives or benefits for providing the testimonial. These views may not be representative of the views of other clients and are not indicative of future performance or success.

The Big Beautiful Bill: Tax Law Strategies for High Earners

Learn more about the history of the One Big Beautiful Bill Act →

A Moment of Change: Why the 2025 Tax Law Update Matters

In July 2025, Congress passed a sweeping set of tax and financial legislation known as the “One Big Beautiful Bill” (BBB). The bill brings several major updates relevant to high earners, business owners, and families managing multi-generational wealth. While the intent of the legislation is to create longer-term clarity, the changes present important planning opportunities—and potential pitfalls.

At Gatewood, we believe in building wealth with purpose. That includes guiding you through significant legislative shifts like these, helping you assess what matters most to your goals, and adjusting strategy with confidence.

What’s Changing: Key Provisions That Could Impact You

Income Tax Rates Made Permanent

Previously set to expire in 2025, the Tax Cuts and Jobs Act (TCJA) rates are now permanent. This means:

- The seven-bracket structure (10%, 12%, 22%, 24%, 32%, 35%, 37%) continues

- Bracket thresholds will remain inflation-adjusted

- Slight tweaks enhance benefits for lower-income households

Why it matters: With future rates more predictable, Roth conversions, capital gain harvesting, and income acceleration strategies can now be explored with greater confidence.

Higher Standard Deduction + Cap on Itemized Deduction Benefits

The standard deduction has been permanently increased to $32,000 (MFJ), $16,000 (Single), indexed for inflation.

However, a new cap limits the value of deductions for top earners:

- All itemized deductions (SALT, mortgage, charitable, etc.) are capped at $0.35 benefit per $1 deducted for those in the top bracket

- This replaces the prior Pease limitation

Planning Insight: Consider “bunching” deductions and using Donor Advised Funds to maximize limited itemized value.

Estate and Gift Tax Exemption Increased

The estate and gift tax exemption, previously set to revert to ~$5 million, has been increased to $15 million (indexed), now permanent.

Planning Consideration: High-net-worth families should revisit gifting plans, especially those using valuation discount strategies.

State and Local Tax (SALT) Deduction Expanded Temporarily

The SALT cap has been increased to $40,000 (phasing out for income > $500,000) through 2029. It returns to $10,000 in 2030.

Strategic Tip: Consider timing payments or leveraging non-grantor trusts to capture the deduction while available.

Charitable Giving Rules Shift

Non-itemizers can now deduct up to $2,000 (MFJ) annually. Itemizers will only receive a deduction for charitable contributions that exceed 0.5% of income.

Implication: Planning and timing of gifts, especially large charitable contributions, are now more important. Qualified Charitable Distributions (QCDs) and Donor Advised Funds remain essential tools.

Beyond the Headlines: Planning Impacts by Focus Area

Cash Flow and Debt Planning

- Car loan interest up to $10,000 is deductible (for U.S.-assembled cars, 2025–2028)

- Home equity loan interest remains non-deductible

Education and Family Planning

- New tax-preferred “Trump Accounts” allow a one-time $1,000 federal contribution per qualifying child born 2025–2029

- 529 plans expanded to cover more K-12 and credentialing costs

Retirement and Senior Considerations

- Seniors (65+) get an extra $6,000 standard deduction (2025–2028)

- HSA access and contributions may be expanded if employer coverage continues past age 65

Health and Disability Planning

- ABLE account enhancements made permanent, increasing flexibility for families with dependents who have disabilities

What to Do Next

These changes represent more than technical updates—they reshape how you plan. At Gatewood, our role is to help ensure that your strategy reflects these changes while keeping your long-term goals at the center.

Key Next Steps:

- Revisit your estate plan in light of the new exemption

- Evaluate Roth conversion opportunities before year-end

- Consider timing charitable and SALT-related deductions

- Explore how new education accounts or senior deductions might apply

Looking Ahead

Gatewood is here to help families navigate complexity with clarity and build wealth with purpose. If you have questions about how this legislation may affect your plan, schedule a conversation with our team today.

Important Disclosures:

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

This information is not intended to be a substitute for individualized tax advice. We suggest that you discuss your specific tax situation with a qualified tax advisor.

Traditional IRA account owners have considerations to make before performing a Roth IRA conversion. These primarily include income tax consequences on the converted amount in the year of conversion, withdrawal limitations from a Roth IRA, and income limitations for future contributions to a Roth IRA. In addition, if you are required to take a required minimum distribution (RMD) in the year you convert, you must do so before converting to a Roth IRA.

Prior to investing in a 529 Plan investors should consider whether the investor’s or designated beneficiary’s home state offers any state tax or other state benefits such as financial aid, scholarship funds, and protection from creditors that are only available for investments in such state’s qualified tuition program. Withdrawals used for qualified expenses are federally tax free. Tax treatment at the state level may vary. Please consult with your tax advisor before investing.

Rethinking the 529: A Legacy Vehicle Hiding in Plain Sight

A Quiet Shift with Big Implications

When most people hear “529 plan,” they immediately think “college savings.” And for good reason. These state-sponsored plans have long been the go-to solution for parents and grandparents who want to fund a child’s education while reaping tax benefits.

But a quiet revolution is underway.

Thanks to a series of legislative updates over the past several years—including the Tax Cuts and Jobs Act, both SECURE Acts, and most recently, the One Big Beautiful Bill—529 plans have become more attractive, more flexible, and more expansive than ever. These updates have broadened the definition of “qualified education expenses,” added rollover opportunities to Roth IRAs, and removed financial aid penalties for grandparent-owned accounts. In short: this once narrowly focused tool has evolved into one of the most powerful, tax-efficient investment vehicles available.

The Game-Changer: One Big Beautiful Bill

The One Big Beautiful Bill took things a step further—doubling down on flexibility and long-term planning power. Starting in 2026:

- The annual K–12 withdrawal limit increases to $20,000 per beneficiary, up from $10,000.

- Qualified expenses now include curricular materials, books, tutoring, dual-enrollment fees, standardized test costs, and even certain homeschooling expenses.

- Non-college paths are embraced—vocational training, licensing programs, and professional certifications now qualify, further aligning 529s with the evolving definition of education.

This expansion significantly increases the relevance of 529 plans for families focused on long-term legacy planning. These aren’t just college accounts—they’re a tool to prepare the next generation for any path.

A Multigenerational Strategy in the Making

Imagine this: instead of waiting to pass wealth to future generations through trusts or posthumous bequests, you begin gifting into a 529 plan today. Not just for one child—but for each grandchild or even great-grandchild. Over decades, these accounts provide tax-free growth potential, and can be repositioned for education, vocational training, or even retirement.

And because the account owner can change the beneficiary as needed, the legacy can be sustained for generations.

Final Thoughts

At Gatewood Wealth Solutions, we believe in building Wealth with Purpose. That often means taking a fresh look at overlooked tools—and right now, 529 plans are a hidden gem for legacy-minded families.

Let’s stop thinking of the 529 as a college-only account. It’s time to recognize it for what it really is: one of the most tax-efficient, flexible, and powerful long-term planning vehicles we have.

Related Reading:

A Smarter 529 Investment Strategy

Learn how Gatewood’s custom glide path keeps your education savings aligned with your timeline—not just a default formula.

Important Disclosures:

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investing involves risk including loss of principal. No strategy assures success or protects against loss.

Prior to investing in a 529 Plan investors should consider whether the investor’s or designated beneficiary’s home state offers any state tax or other state benefits such as financial aid, scholarship funds, and protection from creditors that are only available for investments in such state’s qualified tuition program. Withdrawals used for qualified expenses are federally tax free. Tax treatment at the state level may vary. Please consult with your tax advisor before investing.

The Financial Blind Spot: Why 85% of Your Employees Want Help—And Most Employers Aren’t Noticing

According to a 2025 study[1] highlighted by Inc., nearly 85% of employees believe their employer should help them navigate financial challenges. Let that sink in.

That’s not a “nice to have”—that’s a near-universal expectation.

And yet, in many workplaces, financial wellness is either ignored, underfunded, or mistaken for a once-a-year 401(k) meeting.

As someone who advises companies on retirement plans, I’ve seen this firsthand. And here’s the truth: the companies who acknowledge and respond to this growing expectation aren’t just helping their people—they’re strengthening their own business.

A Simple Metaphor: Financial Stress Is a Dashboard Warning Light

Imagine you’re driving a car and the oil light comes on. You ignore it—after all, the engine still runs. A few weeks later, you’re stalled on the highway with a major repair bill.

Employee financial stress works the same way.

It’s often invisible. But it’s real, it’s chronic, and it’s impacting performance, health, and retention. Financial pressure weighs heavily on decision-making, focus, and emotional health—especially when there’s no guidance or support.

The Science of Financial Stress at Work

Psychologists refer to this as cognitive load—when the brain is overloaded with mental “tabs,” it can’t focus. According to WebMD Health Services[3], financial stress is the #1 stressor across income levels, and 1 in 4 employees say it directly impacts their productivity.

Additional research from Morgan Stanley’s 2025 Workplace Financial Benefits Study[2] found:

- 84% of employees want help with personal financial planning

- 66% say financial stress affects their work or personal life

- 68% of employees would stay longer if their employer offered meaningful financial wellness support.

This is no longer just a benefits issue—it’s a talent strategy issue.

Why Most Employers Miss the Mark

Despite overwhelming data, many employers still believe financial guidance is too personal, too complicated, or already “covered” by the 401(k) plan.

But here’s the disconnect: most 401(k) plans offer basic education, not personalized guidance. And they often ignore broader financial issues—like budgeting, debt, or emergency savings—that dominate employee stress.

This is like handing someone a map but not teaching them how to read it.

Simple Ways Employers Can Step Into the Gap

You don’t have to overhaul your benefits package to make a difference. Here are practical, low-cost ways to respond to this need:

- Offer “Financial Office Hours” – Offer easy to access one-on-one meetings with a financial advisor (ideally one with no product agenda) where employees can ask basic questions—judgment-free.

- Survey Your Team – Ask: “What’s your biggest financial concern?” and “Would you like more support from the company?” It opens the door and shows empathy. You can modify future education initiatives around their answers.

- Add Financial Touchpoints to Existing Benefits – During open enrollment or onboarding, include simple guides on budgeting, emergency funds, and debt management. You could even provide a scheduling link to the financial advisor’s office hours calendar.

- Curate Trusted Tools – Recommend vetted budgeting apps, podcasts, or free online courses—employees often just need help knowing where to start.

- Normalize the Conversation – Create a culture where financial wellness isn’t taboo. When leadership talks about it, others feel safer engaging.

- Continue Onsite 401(k) Education Meetings – Keep offering in-person 401(k) sessions, but raise your expectations. Collaborate with providers to ensure the agenda and talking points address the real financial concerns of your team—not just investment basics. These sessions should help bridge the gap between retirement planning and everyday financial wellness. It should address common employee questions and give you time back in your day.

Final Thought: From Retirement Advisors to Financial Allies

As a retirement plan advisor, my role used to revolve around plan design, investment lineups, and compliance. But today, the companies we serve expect more—and rightly so.

By stepping into the financial wellness gap, we’re not just helping employees retire well. We’re helping them live better now.

And if 85% of your workforce wants this? The only real question is—what are we waiting for?

Sources:

[1] Inc. Magazine citing John Hancock’s 2025 Financial Stress Survey – 85% of employees believe their employer should support their financial well-being.

Source: Inc. (2025). The Next Frontier of Employer Support? Financial Wellness.

https://www.inc.com/2025/03/financial-wellness-workplace-employee-benefits.html

[2] Morgan Stanley Workplace Financial Benefits Study, 2025

84% want help with financial planning, 66% say stress affects work/life, 68% say they’d stay longer if supported.

Source: Morgan Stanley at Work. (2025). The State of the Modern Workplace.

https://www.morganstanley.com/articles/workplace-financial-benefits-2025

[3] WebMD Health Services (2024–2025 Report)

Financial stress is the top stressor and directly impacts productivity.

Source: WebMD Health Services. (2024). Employee Well-Being Trends Report.

https://www.webmdhealthservices.com/resources/2024-well-being-trends-report/

Important Disclosures:

This information was developed as a general guide to educate plan sponsors, but is not intended as authoritative guidance or tax or legal advice. Each plan has unique requirements, and you should consult your attorney or tax advisor for guidance on your specific situation. In no way does advisor assure that, by using the information provided, plan sponsor will be in compliance with ERISA regulations

When Dad Is Ready to Step Back: Succession Planning for Family Businesses

Picture this scenario: A successful business owner has spent decades building his company, and now his two adult sons are involved in the operation. One son is clearly positioned to take over as CEO, while the other plays a more supportive role. The father wants to be “fair” to both sons, but isn’t sure what that means in practice—should he split ownership equally?

How does he balance family relationships with business realities?

If you’re a family business owner, this hypothetical situation probably sounds familiar. You might be facing similar questions right now, or you know it’s a conversation you’ll need to have in the coming years. At Gatewood Wealth Solutions, we regularly work with families navigating these exact challenges, and this scenario illustrates why succession planning is about much more than just deciding who gets what—it’s about preserving both business success and family harmony.

The Challenge: When “Fair” Isn’t “Equal”

In our hypothetical family, the father initially thinks the solution is simple: split ownership equally between his two sons. After all, he loves them both equally, so equal ownership seems fair. But as we dig deeper with clients facing this situation, it becomes clear that “equal” might not actually be “fair.”

The son stepping into the CEO role would be carrying the day-to-day responsibility for the business, making tough decisions, and being accountable for results. The other son, while contributing to the business, wouldn’t be taking on the same level of responsibility or risk. Equal ownership could potentially create resentment on both sides—the CEO son feeling he’s doing more work for the same reward, and the other son feeling pressured to justify his ownership stake.

This dilemma highlights one of the most crucial questions in family business succession: How do you balance family relationships with business realities? As a Certified Exit Planning Advisor (CEPA), I’ve seen how this tension plays out in countless families, and there are proven strategies to address it.

The Questions That Matter Most

When Gatewood works with families in situations like this, we help them identify several critical questions that every family business should address:

About the transition itself:

- What does success look like for both the business and family relationships?

- How will the outgoing leader balance ongoing involvement with giving the next generation room to lead?

- What specific milestones or accomplishments need to happen before the transition feels complete?

About ownership and control:

- Should ownership be equal, or should it reflect each person’s involvement and contribution?

- How will major decisions be made if ownership is split?

- What happens if one owner wants liquidity in the future?

About the founder’s retirement:

- How will the founder fund his retirement lifestyle?

- Does he want to remain involved in an advisory capacity, or make a clean break?

- What legacy goals are tied to the business?

These aren’t just theoretical questions—they’re the foundation of every sound succession plan we develop at Gatewood.

The Hidden Landmines

Our team’s deep bench of experience has shown us that family business successions often fail not because of poor financial planning, but because of unaddressed emotional and structural issues. Here are the most common pitfalls we help families avoid:

- The Authority Trap: The new CEO expects to run the business with clear authority, but family members with equal ownership still want significant say in decisions. This creates operational paralysis and undermines leadership credibility.

- The Liquidity Time Bomb: If ownership is split equally but only one family member works in the business, the passive owner may eventually want to cash out. Without a funding plan, this can force distributions that strain cash flow or require the active owner to buy out siblings at potentially difficult times.

- The Vision Conflict: The founder built the business with his own style and risk tolerance. The next generation may want to modernize or grow more aggressively, creating conflicts about reinvestment versus distributions.

- The Emotional Undercurrent: Old family dynamics—who was the favorite, who was more responsible, who needed more support—can surface during succession planning and destabilize both business operations and family relationships.

At Gatewood, we’ve developed frameworks to help families identify and address these issues before they become problems.

A Better Approach: Structure Meets Heart

Let’s return to our hypothetical family and explore how Gatewood might advise them to structure their succession plan:

- Differentiated Ownership Structure: The son taking over as CEO would receive a larger ownership stake, reflecting his greater responsibility and risk. The other son would receive a meaningful but smaller stake, plus additional compensation for his ongoing contributions.

- Clear Governance: We’d help them establish a formal board structure with defined decision-making protocols, including which decisions require unanimous consent and which can be made by the CEO alone.

- Liquidity Planning: We’d create a structured buyout mechanism funded by life insurance and retained earnings, so if either son ever wanted to exit, there would be a clear, funded path that wouldn’t disrupt operations.

- Founder Transition: Dad would structure his retirement income through a combination of consulting fees for the first few years and ongoing distributions from his retained ownership stake.

This type of comprehensive planning is what we do every day at Gatewood—combining technical expertise with an understanding of family dynamics to create solutions that work for everyone involved.

The Roadmap Forward

If your family is facing a similar transition, here’s where Gatewood typically recommends starting:

- Get Professional Help Early: This isn’t just about legal documents—you need advisors who understand both the technical and emotional aspects of family business transitions. Our team’s diverse expertise allows us to address every aspect of succession planning.

- Have the Hard Conversations: Don’t avoid difficult topics hoping they’ll resolve themselves. Address expectations, fears, and concerns directly. We often facilitate these conversations to help families navigate sensitive territory.

- Plan for Multiple Scenarios: What if the chosen successor becomes disabled? What if family members have a serious disagreement? What if someone wants to sell their stake? Our exit planning process considers all these possibilities.

- Focus on Communication: Establish regular family business meetings separate from operational discussions. Create safe spaces for honest dialogue about both business and family concerns.

- Think Beyond Taxes: While tax efficiency is important, don’t let it drive decisions that create family discord or business dysfunction. Gatewood takes a holistic approach that considers all aspects of wealth transfer.

The Ultimate Goal

Imagine our hypothetical family one year after implementing their succession plan. The business is thriving, the brothers are working well together, and Dad is enjoying his newfound freedom while still feeling connected to the enterprise he built.

Their success wouldn’t come from finding the perfect legal structure or tax strategy—it would come from honest communication, careful planning, and a willingness to address both the business and emotional aspects of succession. This is exactly the type of outcome we help families pursue at Gatewood Wealth Solutions.

Remember, family business succession isn’t just about transferring ownership—it’s about preserving what matters most: the business that supports your family and the relationships that define it. When done thoughtfully, succession planning can actually strengthen both the enterprise and the family legacy for generations to come.

The key is starting the conversation before you need to. Don’t wait until retirement is imminent or health issues force the decision. The families who navigate succession most successfully are those who begin planning early, communicate openly, and get professional guidance to help them through the process.

Why Choose Gatewood?

At Gatewood Wealth Solutions, we understand that every family business is unique, but the challenges are remarkably similar. My background as a Certified Exit Planning Advisor, combined with our team’s deep bench of expertise, allows us to provide comprehensive solutions that address both the technical and emotional aspects of succession planning.

We don’t just create plans—we help families implement them in a way that honors their legacy. Our holistic approach considers your business operations, family dynamics, tax implications, and personal goals to create a succession strategy that works for everyone involved.

If you’re a family business owner facing succession planning questions, or if you know these conversations are on the horizon, the time to start planning is now. Your future self—and your family—will thank you for it.

About the Author

Jared Freese, CFP®, CLU®, CEPA, ChFC®, is a Wealth Advisor Manager for Gatewood Wealth Solutions, specializing in family business succession planning and wealth transfer strategies. He helps families navigate the complex intersection of business operations, family dynamics, and financial planning that aims to ensure successful transitions across generations.

Important Disclosures:

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

This is a hypothetical example and is not representative of any specific investment. Your results may vary.

How to Build a 401(k) Lineup with Passive and Active Fund Strategies

In designing a 401(k) lineup, empirical research favors passive index funds for core exposure, complemented by a few targeted active funds where managers have historically added value. Studies show that index funds generally outperform active peers in most asset classes (Morningstar, 2023)[1]. Meanwhile, certain market segments (international equity, fixed income, small-cap value, large-cap growth) exhibit inefficiencies that skilled active managers can exploit. The resulting hybrid strategy combines a passive core with selected active satellites to improve net outcomes.

Passive Style-Box Coverage

Passive core funds should cover all nine equity style boxes (large/mid/small crossed with value/blend/growth) at low cost. This broad coverage ensures participants receive market-like exposure without stock-picking risk. Passive funds have low fees, minimal turnover, and reduce behavioral risk.

-

- Passive core funds span the full style-box grid, giving exposure to value, blend, and growth stocks in each size tier.

-

- Low fees mean higher net returns: even small expense differences compound into large performance advantages.

-

- Research shows passive funds dominate core equity: over long horizons, most active large- and mid-cap funds underperform.

Rationale for Active International Equity

- Market Inefficiencies: Non-U.S. markets exhibit more complexity — including variable accounting standards, political risks, and currency volatility — which can create opportunities for skilled managers.

-

- Long-Term Evidence: Morningstar’s 2023 Active/Passive Barometer shows that approximately 40% of active international large-blend managers outperformed their average passive peers (Morningstar, 2023)[1] over the past 10 years. While not a majority, this is notably higher than the 10-year success rate for U.S. large-blend managers, which is closer to 10%. This relative improvement highlights that international equity markets may offer more opportunity for skilled active management due to greater inefficiencies and dispersion. (Source: Morningstar Active/Passive Barometer, 2023)

Rationale for Active Fixed Income

- Market Structure: The bond market is less efficient than equity markets. There are thousands of issuers and individual securities, most of which are not traded daily and have no centralized exchange. Bonds differ by coupon, maturity, credit rating, and call provisions — making analysis and pricing less transparent.

-

- Manager Flexibility: Active bond funds can shift credit exposure, shorten or lengthen duration, and overweight undervalued sectors (e.g., MBS, corporates) based on macro trends. Indexes cannot.

-

- Long-Term Evidence: Over the 10 years ending 2023, nearly 40% of active intermediate core bond funds beat their average passive peer (Morningstar, 2024). While not a majority, this rate is substantially higher than for active equity.

Rationale for Active Small-Cap Value

- Market Inefficiency: Small companies often lack analyst coverage and trade with wider spreads. Many are mispriced or have volatile fundamentals that require deeper research.

-

- Style Advantage: Value-oriented small caps can offer better entry points for active managers. Broad small-cap indexes tend to hold speculative or unprofitable firms — skilled managers can avoid these and target quality.

-

- Empirical Support: Morningstar’s long-term data (2023) shows that over a 10-year horizon, ~36% of active small-cap value funds outperformed — significantly higher than in large-cap. This provides a more favorable landscape for active strategies.

Rationale for Active Large-Cap Growth

- Concentration Risk: Growth indexes like the Russell 1000 Growth are highly concentrated in a few mega-cap tech names. As of mid-2024, over 50% of the index’s weight is in the top 10 holdings, creating a portfolio that behaves more like a concentrated fund than a diversified strategy.

-

- Cyclical Opportunity: In years when leadership broadens or top names falter, active managers can outperform. For example, during the 2022–2023 cycle, many active large-growth managers beat their benchmarks by reallocating away from overvalued mega-cap names.

-

- Risk Management Benefit: While long-term evidence of outperformance is weaker in this category, the case for active large-cap growth lies in mitigating concentration risk. Active managers may not consistently generate alpha, but they can reduce single-stock exposure and better manage downside volatility. This is particularly important given that large-cap growth is often one of the highest allocations among participants, driven by the familiarity and popularity of big-name tech stocks.

Cost and Fiduciary Considerations

- Fee Discipline: A small annual fee gap — such as between a 0.05% passive index fund and a 0.60% active alternative — can reduce terminal wealth by around 13% over 20 years due to compounding.

-

- Fiduciary Process: ERISA requires that fiduciaries act prudently and in participants’ best interests. “A fully passive lineup can meet this standard by offering broad diversification at low cost. However, offering evidence-backed active options in areas with higher inefficiencies can also be prudent—especially when it gives participants an opportunity to enhance returns or offset plan-related fees.

Conclusion

A 401(k) lineup built on passive index funds for full style-box coverage plus a targeted set of active funds in inefficient asset classes offers the best of both worlds: cost efficiency, fiduciary alignment, potential for excess return, and improved risk management.

By combining the reliability of passive investing with selective active management in four time tested categories — international equity, fixed income, small-cap value, and large-cap growth — sponsors can create a modern, research-backed lineup that supports participant success over time.

Are you reviewing your plan’s investment lineup? At Gatewood, we help plan sponsors apply fiduciary standards while building smart, efficient lineups that support long-term participant success.

Sources:

-

Morningstar. Active/Passive Barometer: U.S. Fund Landscape. July 2023.

https://www.morningstar.com/lp/active-passive-barometer -

S&P Dow Jones Indices. SPIVA® U.S. Scorecard – Year-End 2023.

https://www.spglobal.com/spdji/en/research-insights/spiva/ -

U.S. Department of Labor. Employee Retirement Income Security Act of 1974 (ERISA), Section 404(a)(1)(B).

https://www.dol.gov/agencies/ebsa/about-ebsa/our-activities/resource-center/publications/understanding-retirement-plan-fees-and-expenses -

Vanguard Research. The Case for Active Management in International Markets. 2022.

https://advisors.vanguard.com/insights/article/the-case-for-active-management-in-international-markets -

Morningstar. Why Indexing Works. Morningstar Research Article. 2023.

https://www.morningstar.com/articles/1132679/why-indexing-works -

Vanguard. Vanguard Large-Cap Value Index Fund (VVIAX) Prospectus and Fact Sheet. 2024.

https://investor.vanguard.com/investment-products/mutual-funds/profile/vvifax -

Morningstar Direct. Intermediate Core Bond Fund Category Performance. Accessed 2024.

-

FTSE Russell. Russell 1000 Growth Index Fact Sheet. 2024.

https://www.ftserussell.com/products/indices/russell-us

Important Disclosures:

This information was developed as a general guide to educate plan sponsors but is not intended as authoritative guidance or tax or legal advice. Each plan has unique requirements, and you should consult your attorney or tax advisor for guidance on your specific situation. In no way does advisor assure that, by using the information provided, plan sponsor will be in compliance with ERISA regulations..

Investing involves risk including loss of principal. No strategy assures success or protects against loss. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets

Bonds are subject to credit, market, and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The prices of small cap stocks are generally more volatile than large cap stocks.

The Case for Tariffs (Yes, Really): A Surprising Solution to the Deficit Debate

There’s a glaring contradiction in today’s economic discourse, and it clouds the investment outlook. The loudest voices warning about America’s unsustainable federal deficit are often the most reflexive critics of tariffs, an essential tool that could help address the crisis. They demand “fiscal responsibility” but fall silent when asked what they’d cut from the budget. Suggest entitlement reform, and they’ll tell you it’s political suicide. Propose higher income taxes, and they bristle at the economic drag. Ask how they’d raise $2.0 to $2.8 trillion annually to close the federal budget gap, and the conversation ends.

That’s why tariffs—unfashionable, imperfect, and deeply misunderstood—may be one of the only practical tools left that can meaningfully address the deficit until the country is ready for major changes to how the government collects revenue and spends.

D.O.G.E. Promised a Trillion-Dollar Fix. It Delivered a Rounding Error.

The Department of Government Efficiency (D.O.G.E.) was supposed to be the bold solution to government waste. Originally pitched as a vehicle for cutting $1 trillion in inefficiencies, the agency—backed by Elon Musk and restructured under President Trump—quickly revised expectations downward to $150 billion. D.O.G.E. operates as a consultant would, examining costs and structure and recommending changes to achieve efficiencies across various departments.

D.O.G.E. impact is a subject of some debate. As of mid-2025, D.O.G.E. has claimed between $150 billion and $ 90 billion in savings, although independent audits dispute much of that figure. More troubling, aggressive cuts to revenue-generating agencies like the IRS reduced government income. By some estimates, DOGE’s efforts may have cost taxpayers $135 billion through re-hires, overtime, legal settlements, and lost tax collections.

While well-intentioned and fundamentally a good idea, the shortfall was a strategic failure that exposed the limits of the “cut spending” approach. D.O.G.E. aimed to trim fat but ended up delivering a rounding error instead of transformational change.

Growth Alone Won’t Save Us

With a less-than-spectacular D.O.G.E. impact, and large Government spending cuts off the table — at least for now — the bipartisan default in Washington has long been to grow the economy and let increased tax receipts shrink the deficit as a percentage of GDP over time. It’s an appealing theory that consistently fails in practice. Despite periods of strong GDP growth, federal spending continues to outpace revenue by unprecedented margins.

While the growth strategy is politically palatable and will help over time, the U.S.’s current fiscal situation, with annual deficits of over $2 trillion, is dire. We don’t have the luxury of waiting for growth to solve a crisis that compounds daily. Growth matters, but it’s not enough. We need substantial revenue, and we need it soon.

Understanding Tariffs: A Tax, Not Inflation

Let’s address the elephant in the room: tariffs are, in fact, a tax. But they are emphatically not inflation.

Inflation is a monetary phenomenon—the expansion of the money supply that dilutes currency value and drives broad-based price increases. Tariffs don’t expand the money supply or devalue the dollar. They are a targeted consumption tax applied to imported goods, with three key differences from domestic taxes:

- Revenue generation: Unlike inflation, tariffs generate federal government revenue, potentially $300 billion annually

- Targeted impact: They affect specific imported goods rather than the entire economy. Imports are roughly 15% of the U.S.’s GDP today.

- Importer and Corporate absorption possibility: Who absorbs the cost increase from U.S. tariffs is an interesting and complex question, with the absorbing party differing by item and by importer. With energy costs roughly 10% lower than two years ago, many corporations have absorbed most of the tariff costs rather than passing them through

Despite persistent warnings from economists, tariffs have not triggered the runaway inflation they predicted.

The Hidden Costs of Corporate Absorption

However, when corporations absorb tariff costs, the economic impact doesn’t simply disappear—it gets redistributed. Companies facing compressed profit margins from tariff absorption experience a cascade of effects that ultimately flow back to the broader economy:

Reduced profit margins lead to lower corporate earnings, which translate to decreased stock valuations. This creates a diminished wealth effect as portfolio values decline, prompting consumers to reduce spending. Meanwhile, lower capital gains tax revenue partially offsets the government’s gains in tariff income.

This redistribution means that while tariffs may not be directly reflected in consumer prices, their costs still flow through the economy via financial markets and reduced economic activity.

The Regressive Reality of “Targeted” Impact

While tariffs don’t affect every sector equally, describing their impact as merely “targeted” obscures an important truth: if passed through, they disproportionately burden lower-income households. These families spend a higher percentage of their income on goods (versus services), have less flexibility to substitute away from imported products, and are more price-sensitive to increases in everyday items.

This regressive effect means that tariffs could function as a consumption tax that hits hardest those least able to absorb the cost—a significant trade-off that must be weighed against their revenue-generating potential. Kitchen table economics won 2024 for the Republicans, but it could be the reason they lose the 2026 midterm elections.

Why Income Tax Hikes Hit a Wall

One truism of taxes: Anything you tax, you get less of. That reflects human behavior and rational economic actors. Raising income taxes sounds straightforward until you encounter the Laffer Curve’s hard ceiling. Beyond a certain point, higher rates reduce total tax revenue by discouraging work, saving, and investment. Historical data suggests we may already be approaching that point, considering total income taxes collected rose when Trump dropped rates in his first administration.

The federal government’s share of GDP rarely exceeds 20%, regardless of marginal tax rates. Taxing productivity has diminishing returns and penalizes the very economic activity we need to encourage. Tariffs, conversely, are harder to avoid and don’t punish domestic output. For revenue generation with minimal collateral damage to productivity, tariffs offer a superior approach, though they come with their own distributional consequences.

Tariffs as Statecraft: Economic Leverage Without Bloodshed

One of tariffs’ most under appreciated benefits is their geopolitical utility. Unlike sanctions or military action, tariffs exert pressure with fewer human costs and less international conflict.

Consider Canada’s Digital Services Tax proposal earlier this year, which targeted U.S. tech firms. The Trump campaign’s swift threat of retaliatory tariffs prompted Canada to reverse course within days. No troops, no diplomatic standoff—just credible economic pressure accomplishing what traditional diplomacy might have taken months to achieve.

In an increasingly multipolar world where military intervention grows costlier and less popular, tariffs represent a powerful, non-violent tool of statecraft.

The Mainstream Economics Blind Spot

The loudest tariff opposition comes from economists who forecasted a Great Depression during COVID, predicted inflation was “transitory,” and missed nearly every major market rebound of the past five years. Now they’re warning of recession if tariffs increase.

Perhaps they’re right this time. But their track record suggests their models are shaped more by ideological assumptions than empirical evidence. As investors and fiduciaries, we must remain disciplined and objective, recognizing that markets rise under both Democratic and Republican administrations because innovation and capitalism transcend partisan politics.

A Nuanced Approach: Targeted Implementation

Smart tariff policy requires acknowledging both benefits and drawbacks. The mainstream economic consensus identifies legitimate concerns: tariffs can raise consumer prices, potentially trigger trade wars, and may reduce competitive pressure on domestic industries.

The solution isn’t to abandon tariffs but to implement them strategically:

Who are the most inelastic exporters?

What option do they have? Early returns on inflation and the “Liberation Day” April 2, 2025, tariffs reveal higher government revenues and little to no increased inflation or inflation expectations. This result goes against conventional economic groupthink and needs further exploration. One idea is that exporters where trade deficits are large and long running are “inelastic” and as a result have little recourse but to absorb the tariffs if they wish to continue their export volumes.

Target critical industries:

Focus on sectors vital to national security—steel, defense, critical minerals, and advanced manufacturing—rather than blanket applications that raise consumer costs across the board. Tariffs have an additional “incentive impact,” where importers may choose to build plants and manufacture in the U.S., thereby avoiding the tariff cost altogether. This is not a simple calculation for these importers as U.S. production costs could be higher, negating the profitability improvement from moving production to the U.S..

- Use as negotiation tools: Follow the US-China Phase One trade deal model, leveraging tariffs to secure better terms while avoiding long-term economic fallout.

- Maintain policy clarity: Rapid shifts create business uncertainty that kills investment. Clear, consistent policies allow markets to adapt and plan accordingly.

- Match unfair practices: When trading partners engage in dumping or subsidization, targeted tariffs can level the playing field without escalating broader tensions.

- Open new markets to U.S. exporters: One of the goals of recent tariff policy has been to open up agricultural markets to U.S. exporters, and this could have a beneficial impact on U.S. agricultural producers and exporters.

The Implementation Gap

However, a significant disconnect appears to exist between this strategic approach and current practice. The administration has largely deployed blanket tariffs across broad categories, including items that the U.S. cannot efficiently produce domestically, such as coffee, bananas, and numerous other products. This approach is a shock-and-awe approach to international trade, and if the intent was to draw everyone’s attention to this issue, the approach succeeded. Unfortunately, this approach creates exactly the problems that strategic implementation could avoid: higher consumer prices on necessities, economic inefficiency from protecting non-strategic industries, and diplomatic tensions without clear negotiating objectives.

This gap between theory and practice undermines many of the arguments in favor of tariffs. The current approach resembles less a surgical instrument and more a blunt tool, impacting the U.S. investment landscape as we saw in the April-May timeframe and making it harder to achieve the revenue and strategic benefits while minimizing economic disruption.

Trump 2.0: Tariffs as Economic Policy

In his first term, Trump deployed tariffs more surgically, targeting China, steel, and automotive sectors. In his second term, tariffs are expected to anchor his economic strategy alongside tax cuts, deregulation, and energy dominance.

The Trump approach may be unpredictable, but it’s not irrational. His focus on significantly altering the terms of U.S. trade across all trading partners can provide near-term economic growth. The mixed stock market performance that we have seen since April 2 creates a dynamic that appears to be high risk, high reward in terms of effective policy implementation. Tariffs can help the Trump administration achieve its objectives. Trump seeks a legacy of bringing industries back to the U.S., delivering on his promises of higher real wages to blue-collar workers, resulting in a booming economy. The question is how far he can take this fundamental restructuring of U.S. trade relations without incurring significant international and domestic opposition.,

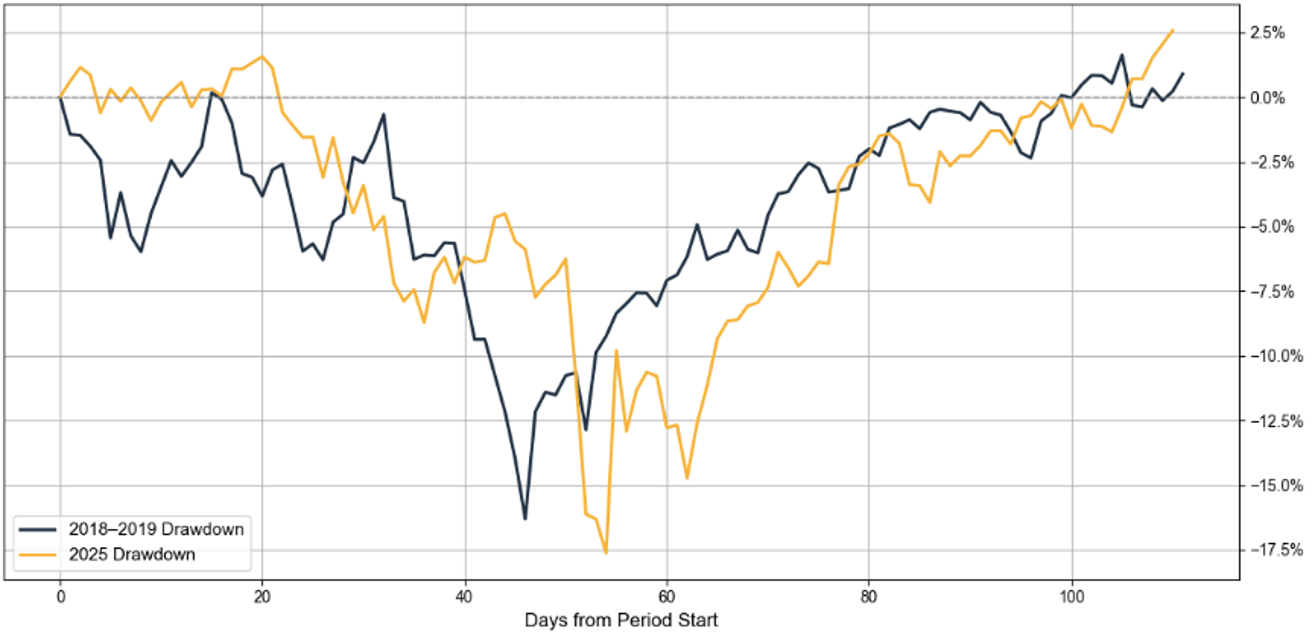

Markets Recover From Tariff Shocks

History offers a perspective on tariff-related market volatility. In April 2025, markets dropped 19% on tariff news—eerily similar to December 2018’s 19% decline over trade tensions. In both cases, markets recovered as investors recognized the temporary nature of the disruption. Both recoveries were swift once investors had better visibility into the impact and scope of the tariffs on industries and trading partners.

This pattern suggests markets can adapt to tariff policies more readily than economists predict, especially when those policies generate tangible economic benefits. The chart speaks for itself:

I am proud of the Gatewood Investment Committee and its successful navigation of the market correction this year. On the morning of April 7th, when the market was at its low point for 2025 (easy to see this in hindsight, hard at the time), our CEO said the following to our advisors at our Monday morning all-hands meeting:

“I would keep some powder dry. Since 1957, we’ve had 12 corrections in the S&P 500 greater than 20%. Assuming we’re in a bear market now, half of them were between 20-30%, three were between 30-40%, and another three were greater than 40%. If you have a lot of cash, don’t overcomplicate it. Invest half now, another quarter at a 30% drop, and go all-in, buying everything you can at a greater than 40% drop. You might only get one or two opportunities at that level in your lifetime.”

–Aaron Tuttle CFA® CFP® CLU® ChFC® | Partner | Chief Executive Officer

Since April 7th, the S&P 500 has risen by over +25%. Our clients are the beneficiaries of our continued commitment to long-term, methodical investing on their behalf. That’s the Gatewood way.

The Bottom Line: Tariffs May be the Only Tool We Have Left

We can’t cut our way out of this deficit at least for now, D.O.G.E. proved that. We can’t tax our way out through income taxes—the Laffer Curve won’t allow it. We can’t inflate our way out without destroying the currency. And while growth will certainly help, our fiscal situation requires exploration of all possible revenue sources.

That leaves tariffs as one of our most viable short-term options for meaningful deficit reduction until the country is ready for major changes to how the government collects revenue, what services it provides its citizens, and the cost of those services.

Tariffs have the potential to generate substantial revenue, though with significant distributional consequences. Tariffs create geopolitical leverage. Tariffs can strengthen strategic industries when properly targeted. The impact of tariffs may fall unequally on exporters, importers, nations, and consumers. They offer a possible path to start closing the deficit before it reaches crisis levels.

The key is honest acknowledgment of their costs and who absorbs these costs: the regressive burden on lower-income households if passed through, the hidden effects of corporate absorption flowing through financial markets, the impact on exporters and importers, and the critical importance of strategic rather than blanket implementation.

You don’t have to love tariffs to recognize their potential impact as a bridge solution until the country is ready for significant changes to how the government collects revenue and spends. At this point, they represent one of the only tools with a credible shot at improving our fiscal trajectory before time runs out, provided we implement them thoughtfully rather than as a blunt instrument.

The deficit is the fire. Tariffs are the hose. But we need to aim carefully, or we risk dousing the wrong things while the real problem continues to burn.

Curious About the Counterpoint?

Read Gatewood CEO Aaron Tuttle’s perspective on why tariffs might distract from the real work of fiscal reform.

Important Disclosures:

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

Investing involves risk including loss of principal. No strategy assures success or protects against loss.