At Gatewood Wealth Solutions, we believe your cash should do more than just sit in a savings account. Whether you need short-term income or are planning for a future large expense, there are smart, managed strategies designed to keep your money working while staying aligned with your financial goals. That’s where our Cash Flow Advisory Strategy and Lump Sum Advisory Strategy come in.

What Are These Strategies?

Both strategies are actively managed cash and cash-equivalent allocations designed with a goal to help clients capture higher short-term yields while maintaining liquidity and stability. However, they serve two distinct purposes:

- Cash Flow Strategy is for ongoing income needs, such as monthly withdrawals in retirement or other recurring distributions.

- Lump Sum Strategy is for specific future expenses, such as a home down payment, tax payments, or a major purchase 6 to 24 months out.

How Do They Work?

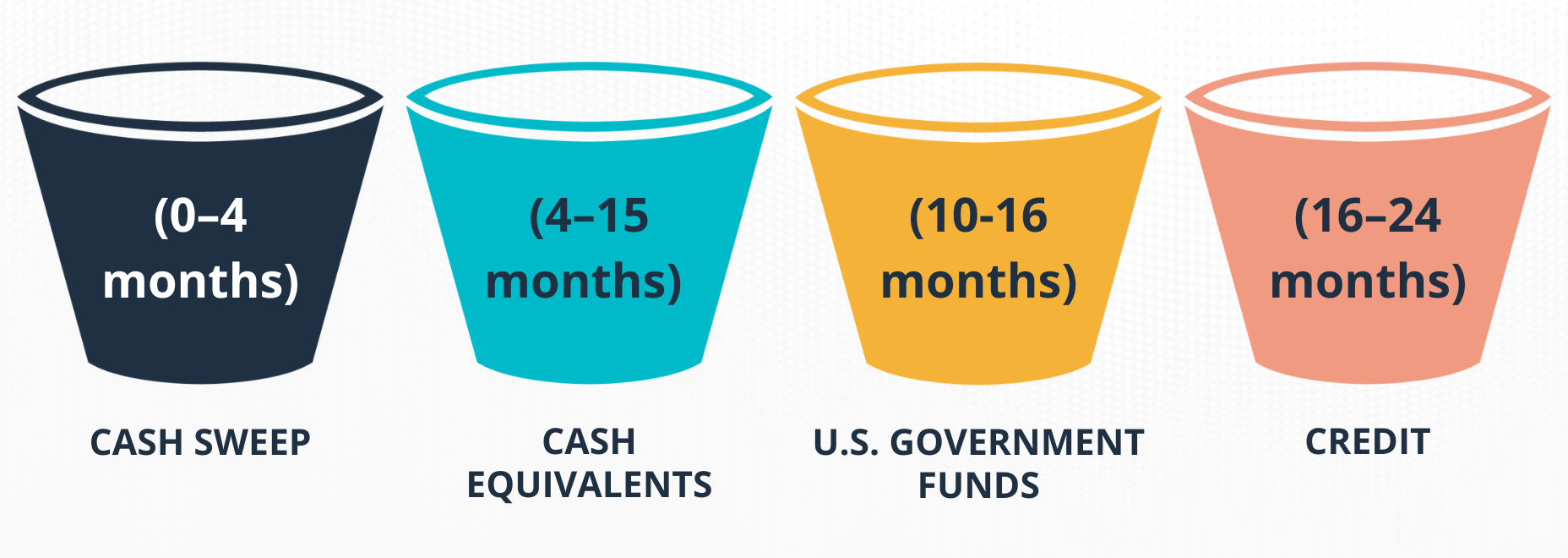

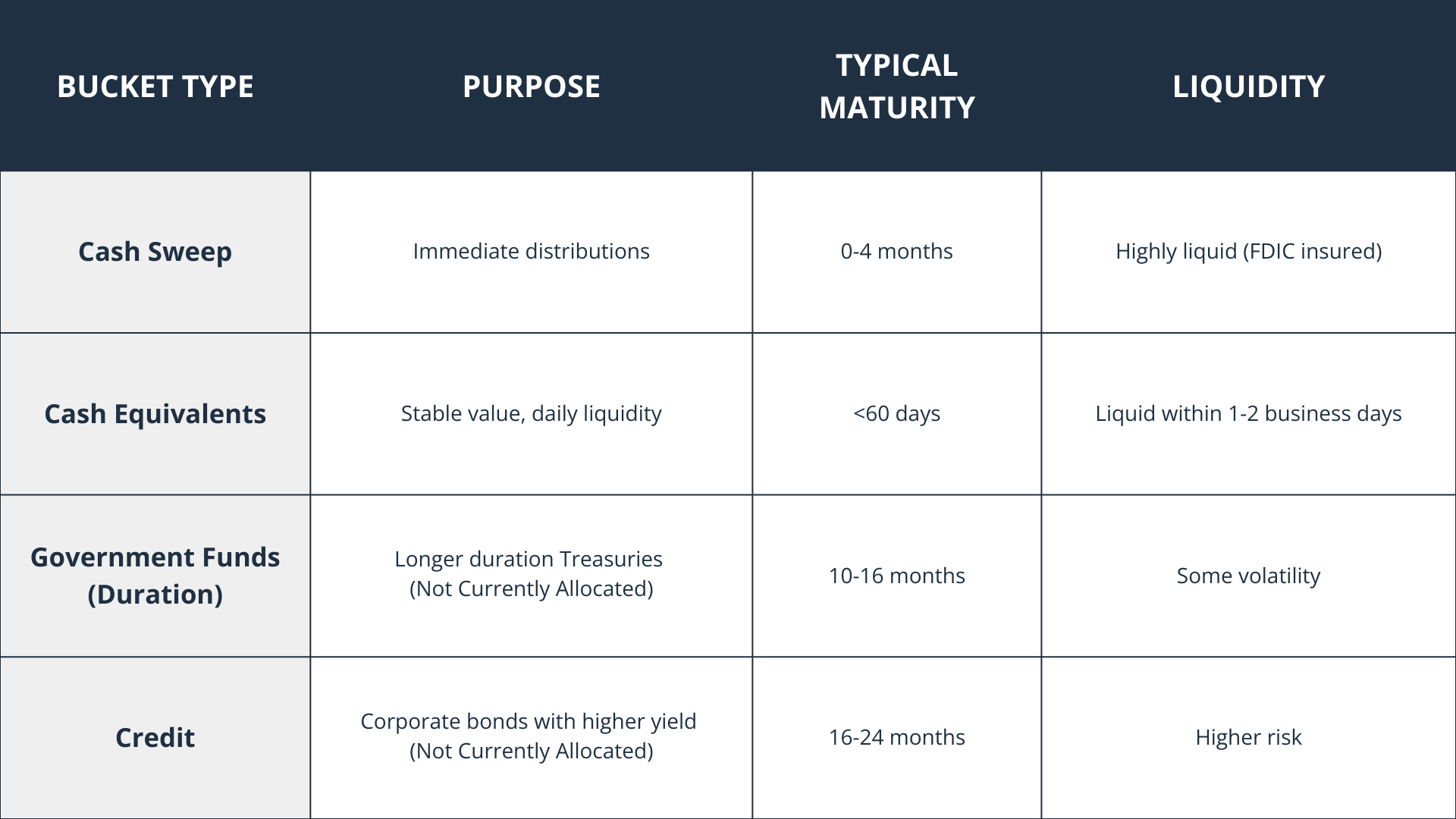

Each strategy is structured using a tiered bucket system, with allocations managed by our Investment Committee. The funds are invested in a mix of ultra-short-term, high-quality bond funds and cash equivalents, allowing you to earn a competitive yield while keeping the risk low.

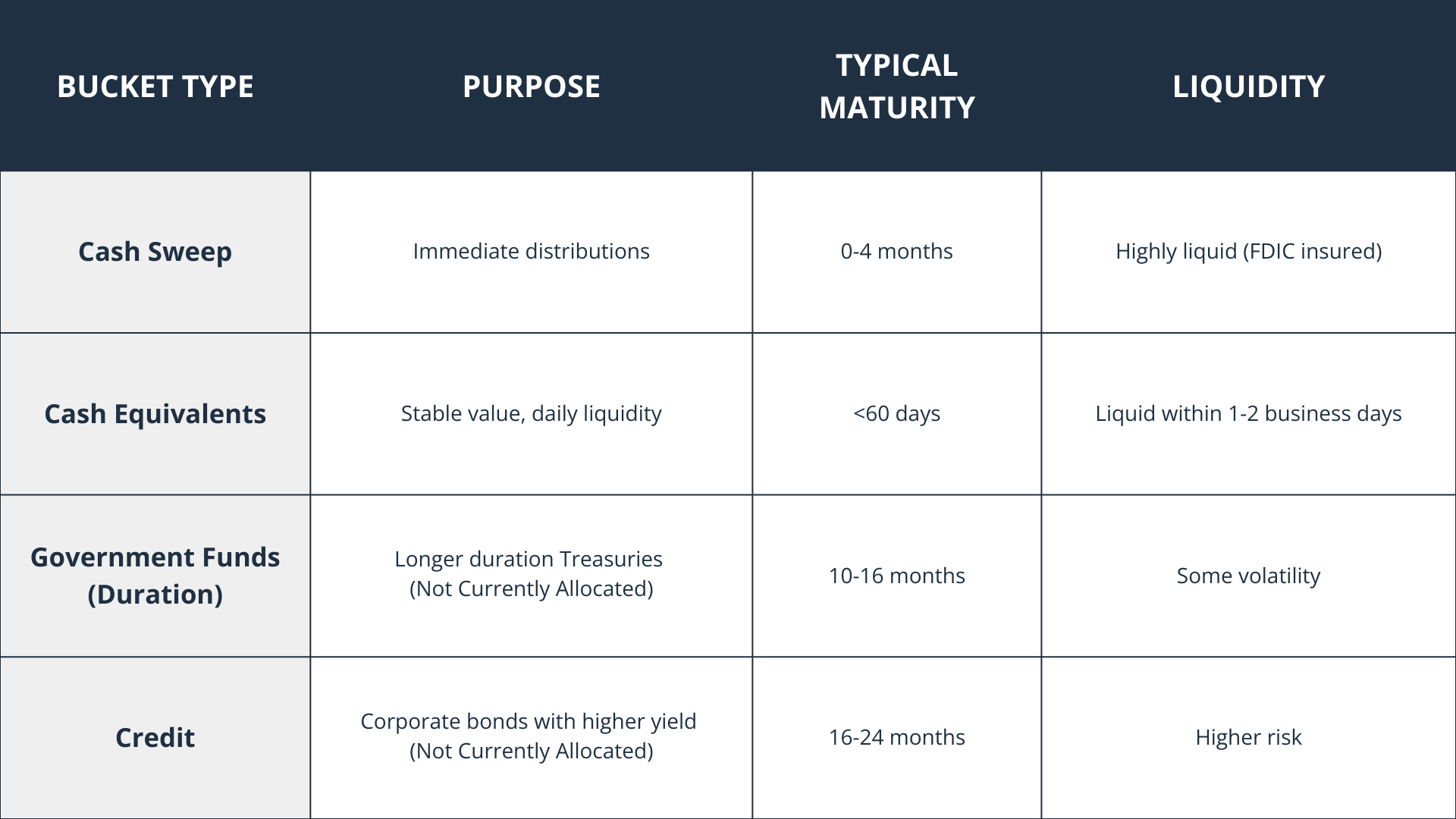

Both strategies use the same four investment buckets but are customized by time horizon and client-specific goals. Here is a breakdown of each bucket and its role within the strategies:

1. Cash Sweep (0–4 months)

- Purpose: Immediate liquidity

- Description: This bucket consists of FDIC-insured cash. It’s fully liquid and used for near-term distributions—typically covering 1 to 2 months of expenses in the Lump Sum Strategy and up to 4 months in the Cash Flow Strategy. This is your most accessible cash, designed to meet known, immediate needs.

- Why We Use It: It protects against the need to sell investments at an inopportune time and ensures quick access to funds.

2. Cash Equivalents (4–15 months)

- Purpose: Short-term stability with a yield advantage over traditional savings

- Description: This bucket is made up of high-quality, ultra-short-term bonds or money market funds with average maturities under 60 days. These investments aim to maintain a stable $1 value while earning a higher yield than FDIC-insured cash.

- Why We Use It: These instruments are low-risk and highly liquid, making them suitable for short-term needs while delivering higher interest income.

3. Government Duration (10–16 months)

- Purpose: Incremental return potential with modest volatility

- Description: This bucket contains U.S. government bonds with slightly longer maturities. These securities may have minor price fluctuations but offer a yield advantage when the interest rate outlook justifies extending duration.

- Why We Use It: When interest rates are expected to fall or stabilize, this bucket helps add return without taking on credit risk. We may hold this bucket selectively depending on the market environment.

4. Credit (16–24 months)

- Purpose: Higher return potential for mid-term needs

- Description: This bucket includes short-term corporate bonds. These offer higher yields than government securities but also carry credit risk. When credit spreads are attractive, this bucket adds value. When spreads are tight, as they are currently, we avoid this allocation.

- Why We Use It: When appropriately timed, it enhances returns without overextending risk. It is used only when the risk-reward tradeoff is favorable.

Here’s a simplified breakdown:

Making It Simple: A Helpful Analogy

To make the distinction even clearer, think of these two strategies like packing for a trip:

- The Cash Flow Strategy is your carry-on bag—it holds everything you need right away: monthly withdrawals, bills, and short-term expenses. It’s always close, easy to access, and organized to support your daily needs without touching your long-term investments.

- The Lump Sum Strategy is your checked luggage—it’s packed for something coming up later in the journey. Maybe it’s a major purchase, a home remodel, or another large one-time expense. You don’t need it today, but it needs to be ready when the time comes.

Both “bags” are thoughtfully packed to serve a specific purpose. By separating your short-term needs from your near-future plans, you avoid overloading your portfolio with cash—or worse, being forced to sell long-term investments at the wrong time.

When Is Each Strategy Appropriate?

- Use the Cash Flow Strategy if you:

- Are taking monthly or quarterly withdrawals

- Are in retirement and need predictable income

- Want to insulate your investment portfolio from market-driven withdrawals

- Use the Lump Sum Strategy if you:

- Have a known upcoming expense in 6–24 months

- Are saving for a home, wedding, remodel, or other large goal

- Don’t want to leave the money in a low-yield bank account but also don’t want the risk of the market

Cash Hub vs. Planning for the Future

The Cash Hub is part of our broader retirement income strategy. It represents a specific number of months’ worth of expenses we recommend keeping liquid to avoid selling long-term investments during downturns. For many retirees, we target 18 to 24 months of non-covered expenses in cash, creating a buffer for down markets.

The Lump Sum Strategy, on the other hand, is designed for one-time planned needs. Rather than letting those dollars sit idle in a checking account or risk losing value to inflation, we position the funds in a stable, managed solution.

Example: How a Client Might Use Both

Meet Sarah, age 62, recently retired. She has:

- $140,000 in cash from a recent bonus and stock option payout

- Monthly expenses of $10,000

- Social Security and a pension covering $6,000 per month

Her Plan:

- $96,000 goes to her Cash Flow Strategy (24 months of net cash needs: $10,000 – $6,000 = $4,000 × 24)

- $30,000 goes to her Lump Sum Strategy for a kitchen remodel in 18 months

- The rest stays in her investment portfolio for long-term growth potential

This allows Sarah to keep her distributions steady, avoid selling stocks in a downturn, and earn more on her near-term funds than she would at the bank.

Why Not Just Use a Savings Account or CD?

While savings accounts and CD’s offer less volatility, they fall short in three key areas:

- Low yields: Even high-yield savings accounts often return less than our managed strategies

- Inflexibility: CD’s lock your money for a set term, which may not align with your needs

- No strategy: Bank accounts are static. Our strategies are actively managed based on interest rates and your goals

That said, it’s important to note: unlike bank accounts, these funds must be sold before cash becomes available. However, the process is simple and only takes 1–2 business days to settle, and we handle the logistics for you.

Bottom Line: Purpose-Driven Cash Management

Your short-term cash shouldn’t be an afterthought. With thoughtful planning, strategic allocation, and active oversight, your money can stay accessible, and productive.

If you’re holding significant cash in the bank or unsure how to structure your liquidity, let’s talk about how these strategies can work for you.

Important Disclosures

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investing involves risk including loss of principal. No strategy assures success or protects against loss

Government bonds and Treasury bills are guaranteed by the US government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value.

CDs are FDIC insured to specific limits and offer a fixed rate of return if held to maturity, whereas investing in securities is subject to market risk including loss of principal.

An investment in the Money Market Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund.

This is a hypothetical example and is not representative of any specific situation. Your results will vary. The hypothetical rates of return used do not reflect the deduction of fees and charges inherent to investing