Both are skyrocketing – but they impact your investing views very differently

A roof over your head and gas in your tank cost more than ever. But prices for these essentials color your view of investing.

What do your nest egg, retirement planning and personal finances share with the overall American economy? Plenty, especially when it comes to the bite from energy and home prices.

Gasoline & Fuel Costs are Skyrocketing

In the past couple of years and especially in 2022, rising gasoline and heating and cooling costs gobbled up family income, although a red-hot housing market helped ease the impact to personal wealth (at least on paper). Nonetheless, Americans are feeling uncertain about their economic prospects.

Gas and fuel oil costs seriously affect our economic well-being, accounting for nearly 10% of the U.S. Consumer Price Index. And according to the latest consumer price index figures from the U.S. Bureau of Labor Statistics, energy and home costs continue to spearhead jumps in overall prices in 2022.

-

Energy is up over 30% in the past 12 months

-

Gasoline is up over 40% in the last 12 months

-

Fuel oil up a staggering 80%

And anyone who fills up their car knows that the national average for a gallon of gas keeps hitting all-time highs, (currently less than a nickel under $5/gallon) with many predicting more increases later this summer and into the fall.

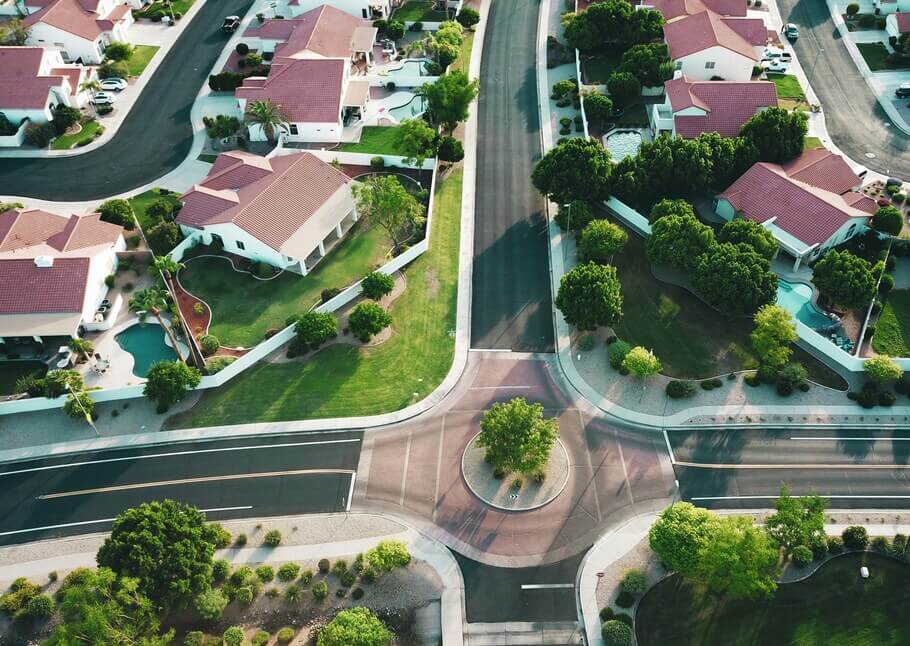

Housing is Bubble-Like

Meanwhile, the housing market is red-hot – almost bubble-like. This is good news for current home owners – although not so good news for prospective home owners or renters.

Consider this: the S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 20.6% annual gain in March, up from 20.0% in the previous month.

Further:

-

The 10-City Composite annual increase came in at 19.5%

-

The 20-City Composite posted a 21.2% year-over-year gain

Tampa, Phoenix, and Miami reported the highest year-over-year gains among the 20 cities in March. Tampa led the way with a 34.8% year-over-year price increase, followed by Phoenix with a 32.4% increase, and Miami with a 32.0% increase.

Seventeen of the 20 cities reported higher price increases in the year ending March 2022 versus the year ending February 2022.

Maybe rising mortgage rates will cool housing. Maybe not. A year ago, the benchmark 30-year fixed-rate mortgage was at 3.19%. Four weeks ago, the rate was 5.38%. For now, home purchases and prices remain strong.

Questions to Ask Before Investing The economy is hardly on fire, and skyrocketing energy and housing prices are two good reasons to question whether we are headed towards a recovery and better times or a recession and worse times.

Your optimism fuels your desire to invest and commit to investments – especially in our recent rollercoaster market.

-

How do you feel about the economy and your own financial prospects?

-

More confident than a year or two ago?

-

How’s your mindset affecting your spending and investing?

Before you send money toward Wall Street, ask yourself these key questions.

Important Disclosures

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investing involves risks including possible loss of principal.

The S&P CoreLogic Home Price Index tracks monthly changes in the value of residential real estate in 20 metropolitan regions across the U.S. The composite indexes and the regional indexes are seen by the markets as measuring changes in existing home prices and are based on single-family home re-sales.

All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

This article was prepared by FMeX.

LPL Tracking #1-05291827