COVID-19

In New Jersey, the COVID-19 case count is beginning to increase again. However, if you look at Texas, you don’t see anything. If news stations or individuals discuss science, they should have a working theory on how science happens.

If you were to compare New Jersey and Texas, New Jersey is right on the dot. Remember the Sun Belt states? It was predicted cases would increase based on season changes by the end of March and April 2021. This is where people go into air-conditioned environments, making it a better environment for the Corona Virus to spread. Texas will likely have a bump in June. With that being said, we only need about 60 to 70% immunity, and as more people get the vaccine, the closer to exemption we become.

What is Inflation?

From our vantage point, inflation is when we see goods increasing in price, or another way to say it is the dollar is decreasing in value. Remember, it’s not the goods that are changing. It’s the currency. Therefore, we’re inflating the money supply, which is historically the definition for inflation. Rising costs are symptoms of inflation. I think people have pushed back on the idea of inflating the money supply because there are times whenever you don’t see goods go up if you measure it by price. From our experience, there has been a significant increase in the money supply over the last decade.

Inflation Equations

Here is an equation by Milton Friedman, who said inflation is always and everywhere a monetary phenomenon.

Money (M) is the water, velocity (V) is the pipes or how everything rotates, everything in the whole (Y) is the production of tangible goods, and the pressure (P) is the gauges in the pipes or the price of items.

There is a central pipe, the banking system, including the federal reserve and the treasury on how money gets into the system. The way that it gets through the economy is not just through one single pipe. You have lumber, home building, food, car manufacturing, semi-conductors, and many other ways to get through the economy.

When you increase the money supply, everyone has their different rank order goods, and they’re competing with each other. The areas that they have are where the highest demand is going to be. The areas that tend to get the flow are usually capital markets because most of your money is already going through things you need. Then, when you get a substantial increase, the majority goes into investing. So, once you have all your food, shelter, and clothing, additional money starts to flow in a capital market, and that’s why home prices and investments have gone up.

Moore’s Law

One thing that continues to keep prices down is this notion of Moore’s law: the amount of transistors you can put on a microchip has increased every 18 months. But the way that you understand that diminishing returns has to happen as you take the absurdity is you flip it.

Another way of understanding that would be that you’re making the transistor smaller and smaller. The smallest transistor would be a size of an atom, and the chip would be about Venice’s size. At some point, you’re going to run into problems. The diminishing returns of putting more transistors on that chip interest will slow down, which means those deflationary forces through technology start to let price inflation come back into this system.

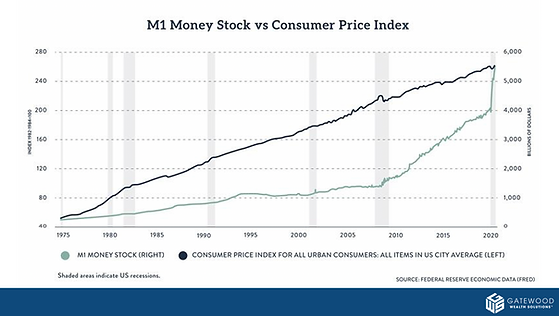

M1 Money Stock vs. Consumer Price Index (CPI)

Going back to 1975, the CPI has been climbing at the same slope. Money supply, all the way through 2008, was growing at a slower rate than inflation. The amount of money that was being created wasn’t causing the prices to go up less, but rather to go up faster. In 2008 we saw a rapid expansion in the money supply, but CPI stayed the same. Now the money supply is exceeding it, so it isn’t a one-for-one.

Asset Prices or Debt

One of the places that the rapid expansion has been going is asset prices or debt. In 1960, we had 53% of our Debt to Gross Domestic Product (GDP). We were holding 53% of our economy, our national income as debt. It went down in the 1980s to 34% because the government was inflating through the sixties and seventies. Then, by 2000 we were at 58%, moving up to 130% now. Our debt is growing at a lot faster rate than our economy, and it is our economy that pays it back.

Inflationary Outcomes

What are the ultimate outcomes whenever you inflate the money supply?

Stop Monetary Inflation

Interest rates increase above a point that velocity slows—market crash due to restructuring the economy towards consumer goods and away from capital goods.

Servicing the debt becomes impossible, and the liquidation of debt through default and restructuring—market crash does a sharp drop in money supply

Continue to Monetize the Debt with Eventual Price Inflation

A loss in the faith of the currency–hyperinflation

Weimar Republic, Venezuela, Zimbabwe, Continental

Greyback versus Green Back

Inflation Expectations

Interest rates are beginning to rise with inflation expectations, but equities are doing better than bonds for the year. The inflation expectations are now over 3% in the bond market.

It is undoubtedly true that if we look at how bonds have started the year out, this is one of the worst starts in some time for bonds. You have to remember that even though interest rates are going up, if you get a brand new bond, that might be good, but it’s the current bonds you hold that the price will go.

—-

Keep up to date on Gatewood Wealth Solutions through our daily 3x3s and our weekly market insights on our YouTube, LinkedIn, and Facebook accounts.

Disclosures:

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results.

All indices are unmanaged and may not be invested directly. The economic forecasts outlined in this material may not develop as predicted, and there can be no guarantee that the strategies promoted will be successful.

All investing involves risk, including the possible loss of principal. No strategy assures success or protects against loss.

Securities and advisory services are offered through LPL Financial, a registered investment advisor, Member FINRA/SIPC.