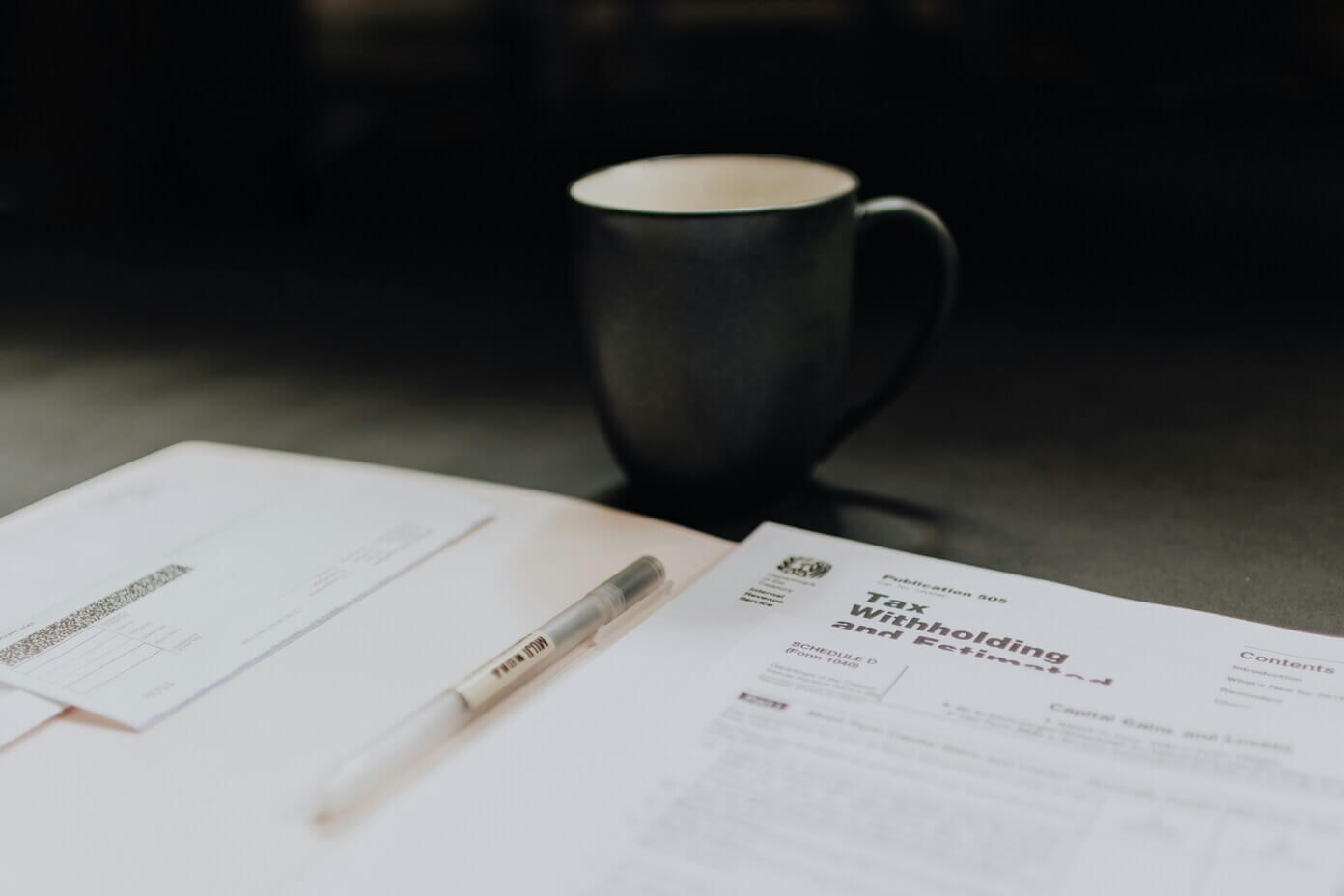

Tax planning can be advantageous when done during the year and well in advance of year’s end. Opportunities exist for you to mitigate tax liability, which may leave more income for you and/or your family.

Generally, people put off tax planning because paying income taxes is an obligation. So, this “negative” view can cause frustration. It is often simpler to say, “Let’s see how everything shakes out between January 1 and April 15.” However, after December 31, all you can do is deal with your tax liability. On the other hand, if you take care of the tax planning now, you may save more on April 15.

Considering doing a trial tax return based on your projected personal income and deductions. Afterward, you can adjust your W-4 Form accordingly.

If you expect to have income that is not subject to withholding, review your required quarterly estimated tax payments. If you fail to have enough tax withheld or make sufficient estimated tax payments by the end of the year, you may be subject to penalties and interest. Adjust your W-4 or estimated payments to make up any shortfall.

It may be beneficial to keep an eye on what is happening in Congress. Tax reform is an ongoing process, and there may be more changes ahead.

If you can control when you receive income or take deductions, consider deferring income into next year if you expect to be in a lower tax bracket. Likewise, accelerate your deductions if you expect to be in a higher tax bracket this year as opposed to next. If you expect a tax change for the upcoming year, you may want to revisit this issue.

Watch out for the alternative minimum tax (AMT) if you expect to have any large tax items this year such as depreciation deductions, tax-exempt interest, or charitable contributions. To avoid the AMT, consider strategies such as re-positioning assets or delaying charitable contributions.

However, if you are subject to the AMT, consider accelerating next year’s income into this year if your regular tax bracket would be higher than the AMT rate. If your itemized deductions increase the likelihood of triggering the AMT and do not generate significant tax savings, consider postponing deductions into next year if you are subject to the AMT this year.

By considering the above tips and establishing the most suitable strategies for your situation, you may optimize your opportunities and mitigate your liability. Consult a tax professional for more information according to your unique circumstances.

Important Disclosures

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

This article was prepared by Liberty Publishing, Inc.