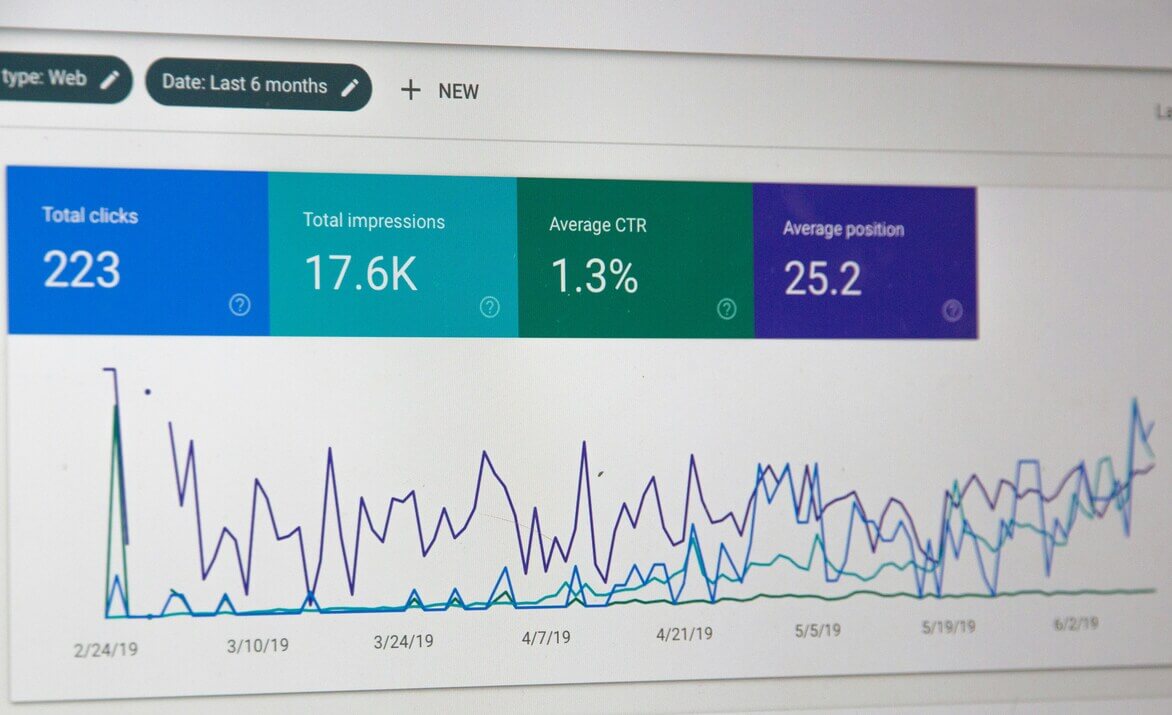

It is a concern for our clients that the market is potentially overpriced. In this post, we’ll cover this concern conceptually, while also revieweing key formulas and economic concepts. This can be a complex topic, but you are always more than welcome to call the lead advisors on our team at 314.924.5100 to get more clarification.

Market Potentially Overpriced

Looking at earnings ratios, we can see that the P/E rates are well above average. These P/E ratios can undoubtedly be stretched. If we look at this on a historical average, we see the market is overvalued, while interest rates remain low.

Valuing a Perpetuity

A perpetuity is an income payment that will last, in theory, forever. The concept of perpetuity helps us to understand how to discount an income stream permanently.

If you were to look at the formula coupon over the discount factor, it would equal the bond price. In other words, the coupon is the interest rate that is being paid. The discount factor is the interest rate that you’re trying to determine. For example, if you were to have a $1 coupon and a discount factor of five, you would pay $20. However, if the interest rate moves up, bond prices must go down.

Valuing a Stock as a Perpetuity

If you were to look at a preferred stock instead of a bond, preferred stocks would pay dividends. The preferred stock will pay you a certain amount as a dividend, while the valuation of preferred stock would stay the same.

The discount factor is something a bit different when referring to a stock. It’s called the equity risk premium: how much risk you’re taking plus the risk-free rate. Therefore, the equity risk premium is more significant than the corporate bond interest rate. We have consider the equity premium, plus the risk-free rate. The risk-free rate is what you get paid in cash, also known as the inflation rate.

Now, you may realize that dividends are not expected. Some stocks do not have a dividend, but most of the time, when you buy a stock, you expect that stock to grow. You want to increase that dividend that you’re going to expect in the numerator, which would make the stock price go up. However, you want the growth of the stock to happen over a long time. In simpler terms, the stock price is equal to the dividend plus the growth rate over the discount factor minus the company’s growth.

You pay a dividend out of earnings. Your retention rate is subtracted from the earnings, which equals the dividend rate. The payout ratio would be one minus the retention rate. Therefore, you can now justify the price to earnings that’s trading for it.

For example, let’s take the S&P 500 price equation below. We can assume what the ending year earnings are and what they’ll payout as a dividend in the numerator. For the denominator, you should have a good idea of the equity risk premium and the implied rate, because you’re discounting stocks. Also, we know what the risk-free rate is because the Fed is keeping that between 0-25 basis points. Lastly, you should know what the nominal Gross Domestic Product (GDP) would be, meaning that there’s an inflation factor plus the growth of GDP.

These assumptions we make in the equation — which we find using a matrix — matter immensely. The discount factor ranges from 1-10%, and the earnings growth rate ranges from 1-5%. Then, we look at different retention rates or payout ratios to see the current price of the market. What is it telling us, and what would it need to be to justify a price like that?

Again, if you have questions and want to speak to a lead advisor or even those who are not clients of our firm, please learn more about engaging with us by calling 314.924.5100.

GWS will keep everyone up-to-date on our Daily 3x3s and Weekly Market Insights. Tune in daily at 5 p.m. CT and Wednesdays at 3:30 p.m. CT.

For this week’s full market update, including investment themes updates and risks in 2021, be sure to check out the recording on our YouTube channel.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results.

All indices are unmanaged and may not be invested into directly. The economic forecasts outlined in this material may not develop as predicted, and there can be no guarantee that strategies promoted will be successful.

All investing involves risk, including the possible loss of principal. No strategy assures success or protects against loss.

Securities and advisory services are offered through LPL Financial, a registered investment advisor, Member FINRA/SIPC.